Coinbase Global (COIN) is a leading U.S.-based cryptocurrency exchange. Coinbase offers secure trading, investing, and custody services for over 240 digital assets, including Bitcoin (BTCUSD) and Ethereum (ETHUSD), with institutional products like Coinbase Prime and tools for developers via its API ecosystem.

Founded in 2012 by Brian Armstrong and Fred Ehrsam, the company operates in over 100 countries globally.

About Coinbase Stock

As of late October, Coinbase reflects a volatile yet strong performance. The stock has fallen about 2% over the past five days but is up 1.4% over the last month, mirroring fluctuations in Bitcoin prices. Over six months, COIN is up roughly 66%, and its year-to-date (YTD) gain stands near 31%, far ahead of the S&P 500’s ($SPX) 15% rise in the same period. Over the past 52 weeks, Coinbase has surged about 63%, significantly outperforming the S&P 500’s 16% advance.

Its movements closely track crypto cycles, showing strong resilience but heightened volatility.

Coinbase Misses Estimates

Coinbase Global Inc. reported Q2 2025 results on July 31, missing Wall Street estimates as challenging crypto market conditions weighed on trading activity. The company posted revenue of $1.5 billion, up 3.3% year-over-year but 5.7% below consensus estimates of $1.59 billion. Earnings per share came in at $0.12, sharply underperforming expectations of $1.51. The miss reflected weaker trading volumes and a 39% sequential decline in transaction revenue, although subscription and services revenue offered partial support to topline growth.

Financially, Coinbase’s GAAP net income surged to $1.43 billion, driven by large unrealized gains from strategic and crypto investment portfolios totaling $1.86 billion. Excluding these, adjusted net income was $33 million, highlighting underlying weakness in operating performance. Adjusted EBITDA reached $512 million, down from $596 million a year prior, as operating expenses increased due to a $307 million data breach charge. Despite this, Coinbase maintained strong liquidity with $9.3 billion in total USD resources and a $1.8 billion crypto portfolio.

For Q3, Coinbase guided for transaction revenue around $360 million and subscription and services revenue between $665 million and $745 million, indicating low single-digit sequential growth. Management reiterated its focus on product diversification, derivatives trading, and stablecoin payment solutions to counter trading revenue cyclicality.

Additionally, Coinbase has scheduled its third-quarter results for Oct. 30.

Coinbase Acquires Echo

Coinbase has announced the acquisition of crypto-investing platform Echo in a deal valued at approximately $375 million, paid through a combination of cash and stock. This marks the exchange’s eighth acquisition in 2025, reflecting its aggressive expansion under the favorable regulatory climate fostered by President Donald Trump’s administration.

The move builds on Coinbase’s earlier acquisition of LiquiFi and extends its ambition to become a comprehensive solution for funding and growth of blockchain ventures. Echo, founded by crypto veteran Jordan Fish (known as “Cobie”), has helped projects raise over $200 million across nearly 300 deals since its 2024 launch.

Echo’s “Sonar” platform allows startups to conduct both private and public token sales, democratizing access to on-chain fundraising. By acquiring Echo, Coinbase aims to integrate community-driven investment tools, enabling its users to participate early in blockchain funding opportunities traditionally reserved for venture firms.

The deal also complements Coinbase’s strategy to expand into tokenized securities and real-world assets, enhancing its Base network infrastructure. According to the company, the acquisition will help establish transparent, globally accessible capital markets while offering new opportunities for both institutional and retail investors on its platform.

Should You Buy COIN Stock?

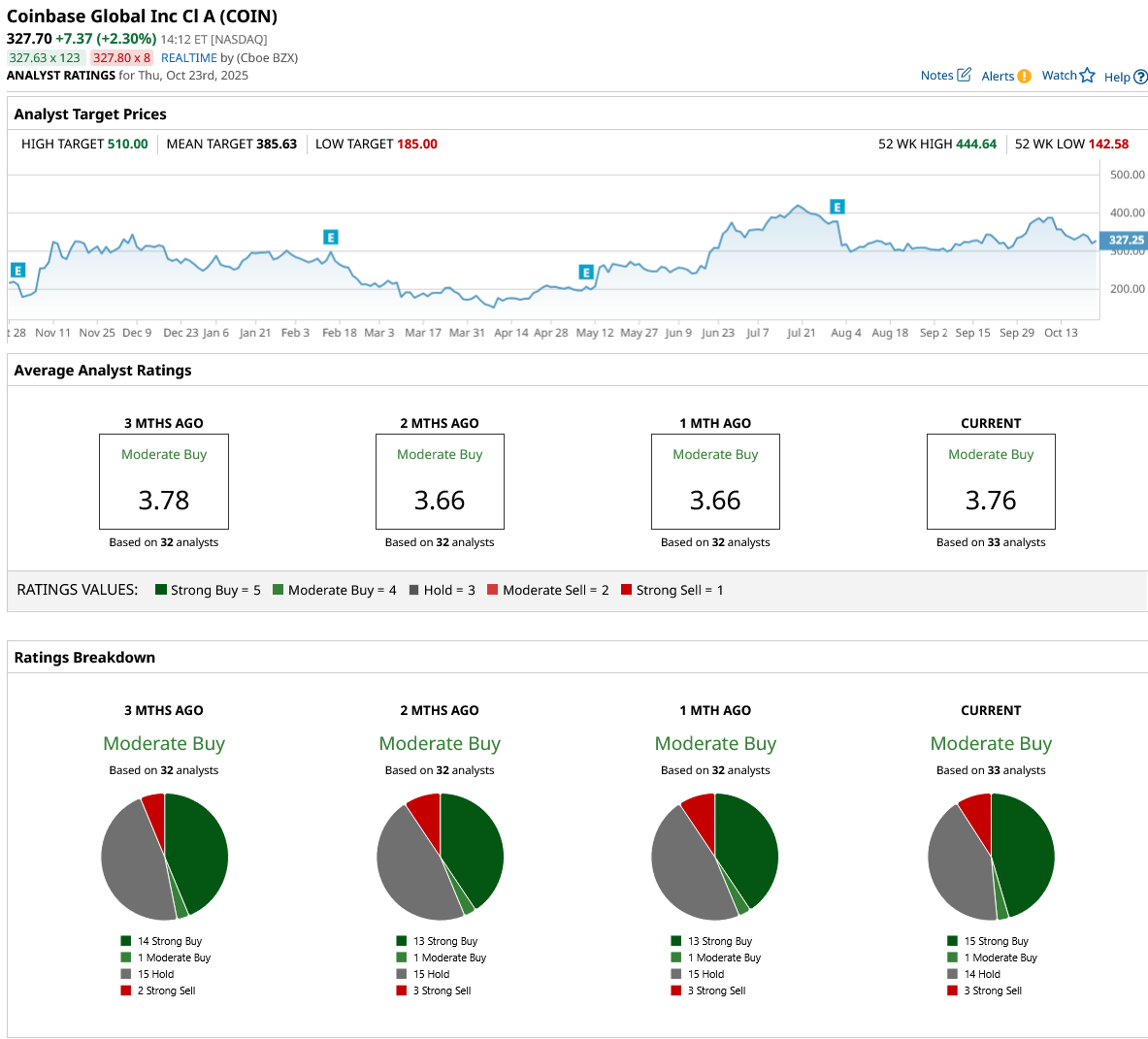

Amid the crypto boost, analysts are weighing favorably on the exchange platform with a consensus “Moderate Buy” rating and a mean price target of $385.63, reflecting an upside potential of 21% from the market rate.

The stock has been evaluated by 33 analysts, receiving 15 “Strong Buy” ratings, one “Moderate Buy” rating, 14 “Hold” ratings, and three “Strong Sell” ratings.