Diversification into a new segment is often tricky to digest. While it opens up a company to new growth avenues, it can also significantly dent existing financial strength if it goes awry. It can take years to recover. CleanSpark (CLSK) is doing something similar with its plans to pivot into AI infrastructure. The question for investors is: Is the business strong enough to pull off such a pivot?

The company has said it will shift from being a pure-play Bitcoin (BTCUSD) miner to an AI infrastructure provider. For this purpose, it brought on Jeffrey Thomas as the senior vice president of AI data centers, who has formerly worked on setting up data centers around the world. This experience will be vital, and one way to judge his performance would be to see how quickly he can secure future contracts for this venture.

CLSK’s new venture makes sense. The company already has power infrastructure and mining sites, so the barrier to entry into the data center business is lower. The process is still complex, and one should not expect an immediate financial reward. In fact, without securing reasonable contracts, it will be very difficult to stay competitive. There is a transition risk as the company burns capital and exposes itself to a whole new regulatory risk as well.

About CleanSpark Stock

CleanSpark is a Bitcoin mining company that owns its own infrastructure for this purpose rather than renting mining equipment. It is headquartered in Henderson, Nevada.

CLSK stock is up 87% year-to-date (YTD), outpacing the Nasdaq Composite’s ($NASX) 19.13% by almost 4x. Currently, the stock is trading at an approximate 24% discount to its 3-year high of $24.72. Looking at the 5-year price trend, the stock currently trades at a massive 56% discount to a high of $40.39 touched back in January 2021.

Valuation metrics for CLSK inspire a lot of confidence, as the stock is currently trading below the sector median along several parameters. The company’s forward GAAP price-to-earnings (P/E) ratio of 13.15x is 61% below the sector median. Even on a trailing twelve-month (TTM) basis, the GAAP P/E ratio of 20.79x offers a 34% discount to a median of 31.36x. Further, CLSK’s forward price-to-book (P/B) multiple of 3.08x is 33% lower compared to a median of 4.58x, suggesting significant undervaluation of the stock. Hence, there is evident potential for further upside from current levels.

An aspect investors should not ignore is that AI data center and infrastructure companies command a high multiple these days. If this venture turns out successful, CLSK could see a re-rating. While long-term investors wait for the financial impact to appear on the company’s financial statements, short-term traders could lock in profits with the potential re-rating.

CleanSpark Beats Earnings Consensus

CLSK announced its third-quarter earnings on Aug. 7. Although the quarterly revenues of $198.6 million were 94% higher compared to the same period last year, they missed the consensus forecasts very marginally by $1.7 million. However, amid reaching a milestone of 50 exahashes per second (EH/s), the GAAP EPS of $0.78 comfortably beat the consensus by $0.28. The adjusted EBITDA numbers witnessed a massive turnaround during the three months, as they stood close to $378 million compared to -$58 million in the previous quarter.

Given a friendly regulatory environment along with a growing market, the company is committed to capturing a greater share of the global hash rate by adding another 10 exahash. For the last quarter, the consensus estimates for revenues stand north of $237 million, while the GAAP EPS is forecasted to be between $0.31 and $0.38. This is relative to an EPS of -$0.29 during the final quarter in 2024. On the earnings call, the management was asked about the company’s flexibility in pursuing alternative uses for its assets. It said the opportunities will be pursued if superior returns are available, and in just over two months, that comment has been put into action.

What Do Analysts Expect for CLSK Stock

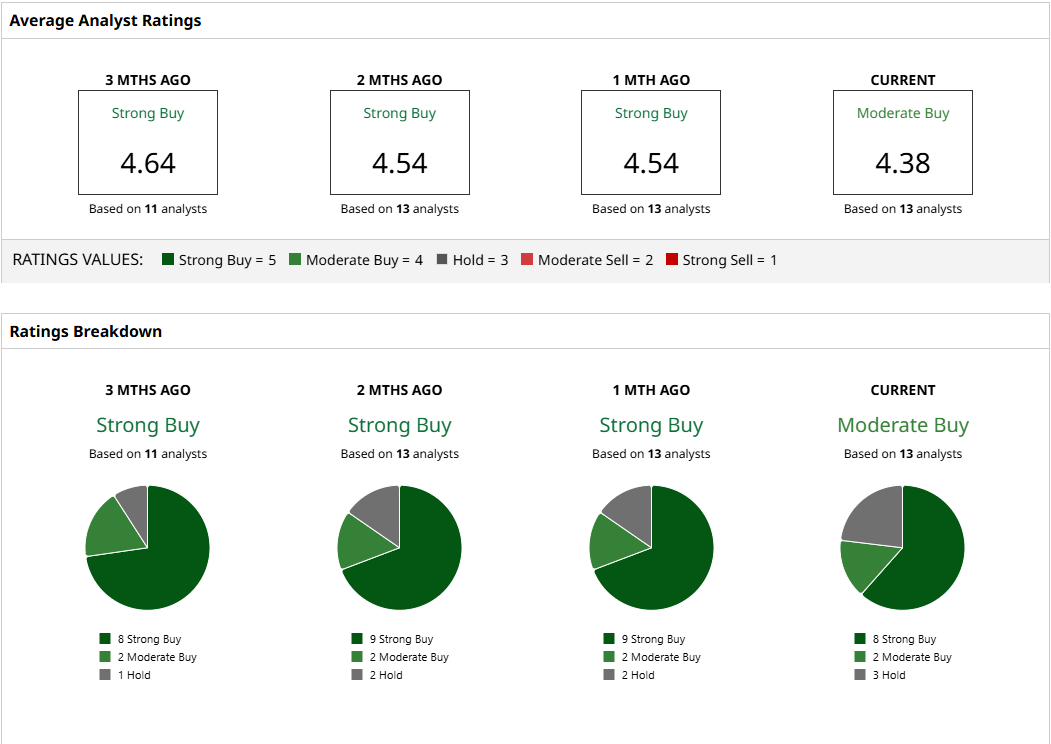

Of the 13 analysts that cover CLSK stock, eight have a “Strong Buy” rating, with no “Sell” or “Strong Sell” ratings from any analyst. H.C. Wainwright was the latest to join the list of analysts bullish on the stock with a “Buy” rating. With the data center pivot, this optimism is likely to stay strong unless evidence emerges that the company is unable to execute.

Analysts have a mean target price of $22.34 on the stock, offering 32% upside from current levels. The highest target price of $30 would net investors a 74% profit.