/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) stock has been on a solid run and with good reason. Over the past 12 months, shares of the semiconductor and software giant have surged by 154%, driven by strong demand for the company’s artificial intelligence (AI) semiconductors.

While AVGO stock has gained significantly in value, the momentum in its business and stock does not appear to be losing steam. If anything, it’s accelerating, with Broadcom recently adding a fourth major AI customer to its roster. This development could give its financials a significant boost and continue to support its share price.

AI Demand Keeps Broadcom’s Growth Engine Running

Broadcom’s recent quarterly performances show significant AI-driven demand powering its financials. In its fiscal third quarter, the company delivered record revenue of $16 billion, up 22% year-over-year. This shows acceleration from the 20% growth registered in Q2. Adjusted EBITDA climbed to $10.7 billion, a 30% jump compared to the prior year. These figures reflect solid operational performance and also point to a demand pipeline that continues to swell. Broadcom’s consolidated backlog reached $110 billion, underscoring how AI and cloud infrastructure have become long-term growth drivers.

Within its semiconductor division, Broadcom recorded $9.2 billion in revenue, a 26% increase from last year. The bulk of this came from AI-related sales, which surged 63% to $5.2 billion. Notably, AI sales had already grown 46% in the prior quarter, meaning the company is seeing acceleration in the AI segment. Q3 also marked AVGO’s tenth straight quarter of double-digit growth for its AI business.

Broadcom Stock: The XPU Advantage and a New Customer Win

A key growth catalyst for Broadcom has been its XPU product line, custom accelerators designed for AI workloads, which now accounts for 65% of its AI revenue. Demand for custom solutions has proven to be sticky, with the top three customers deepening their reliance on Broadcom’s expertise. Moreover, the company has now secured a fourth AI customer, a milestone that will significantly boost its revenue. This new relationship already includes over $10 billion in committed orders for AI racks powered by Broadcom’s XPUs, with shipments expected to ramp up in 2026.

The combination of stronger demand from existing customers and the addition of a new one has shifted Broadcom’s outlook. Management now sees fiscal 2026 shaping up to be significantly strong. With AI infrastructure spending accelerating globally, Broadcom is poised to capitalize on the demand for AI semiconductors.

VMware Integration Strengthens the Software Side

While semiconductors grab headlines, Broadcom’s infrastructure software business is also performing well, primarily driven by the VMware acquisition. In Q3, this division delivered $6.7 billion in revenue, up 17% year-over-year.

The shift from traditional licenses to VMware Cloud Foundation (VCF) subscriptions is proving highly lucrative, producing steady double-digit growth in recurring revenue. Broadcom reported more than $8.4 billion in total contract value during the quarter, underscoring the stickiness of its software model.

AVGO’s Valuation: Premium, But Backed by Growth?

One concern for investors is valuation. AVGO currently trades at a forward price-earnings ratio of 55.82x, which looks lofty at first glance. However, Wall Street expects earnings to rise sharply —projecting EPS growth of 47.7% in fiscal 2025 and another 30.1% in 2026. Considering those growth projections, AVGO’s premium multiple looks justified.

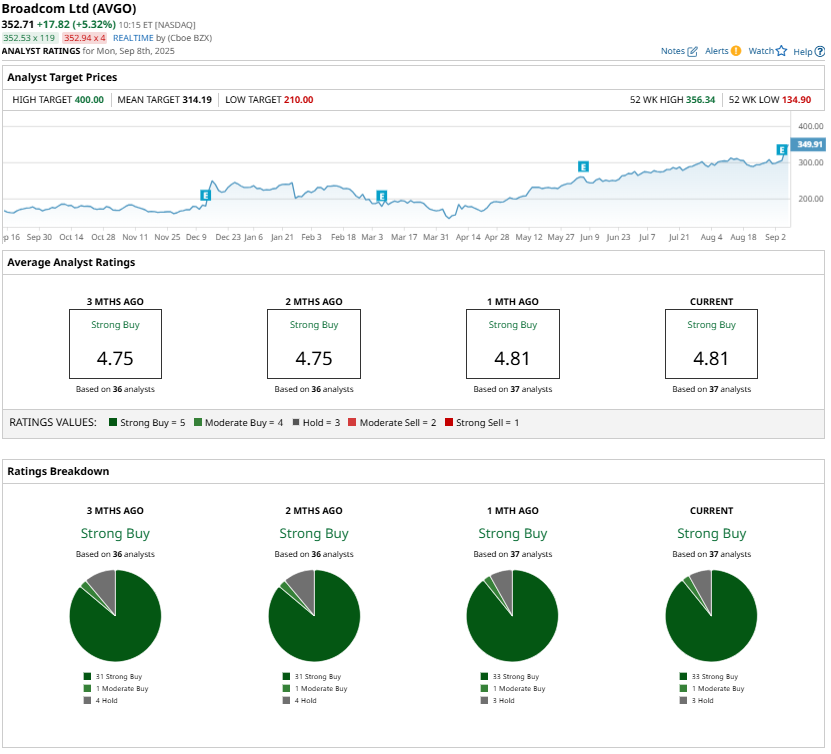

Wall Street’s Take: Strong Buy

Analysts remain bullish on Broadcom. The consensus rating sits at “Strong Buy,” supported by expectations for robust demand for its custom AI accelerators. The Street’s highest price target is $400, implying that there’s room for further upside.

The Bottom Line on Broadcom Stock

With strong financial results, a growing backlog, and the addition of a fourth major AI customer, Broadcom’s stock is likely to sustain its upward trajectory. The VMware integration further strengthens Broadcom’s diversified revenue base, providing balance alongside its semiconductor gains. While valuation remains on the higher end, strong earnings growth projections and continued AI tailwinds suggest that a premium may be warranted.