/Alphabet%20Inc_%20and%20Google%20logos%20by%20IgorGolovinov%20via%20Shutterstock.jpg)

Alphabet (GOOG) (GOOGL) stock is sliding this morning after a slight YouTube miss and aggressive capex guidance overshadowed the company’s overall better-than-expected financials for its fiscal Q4.

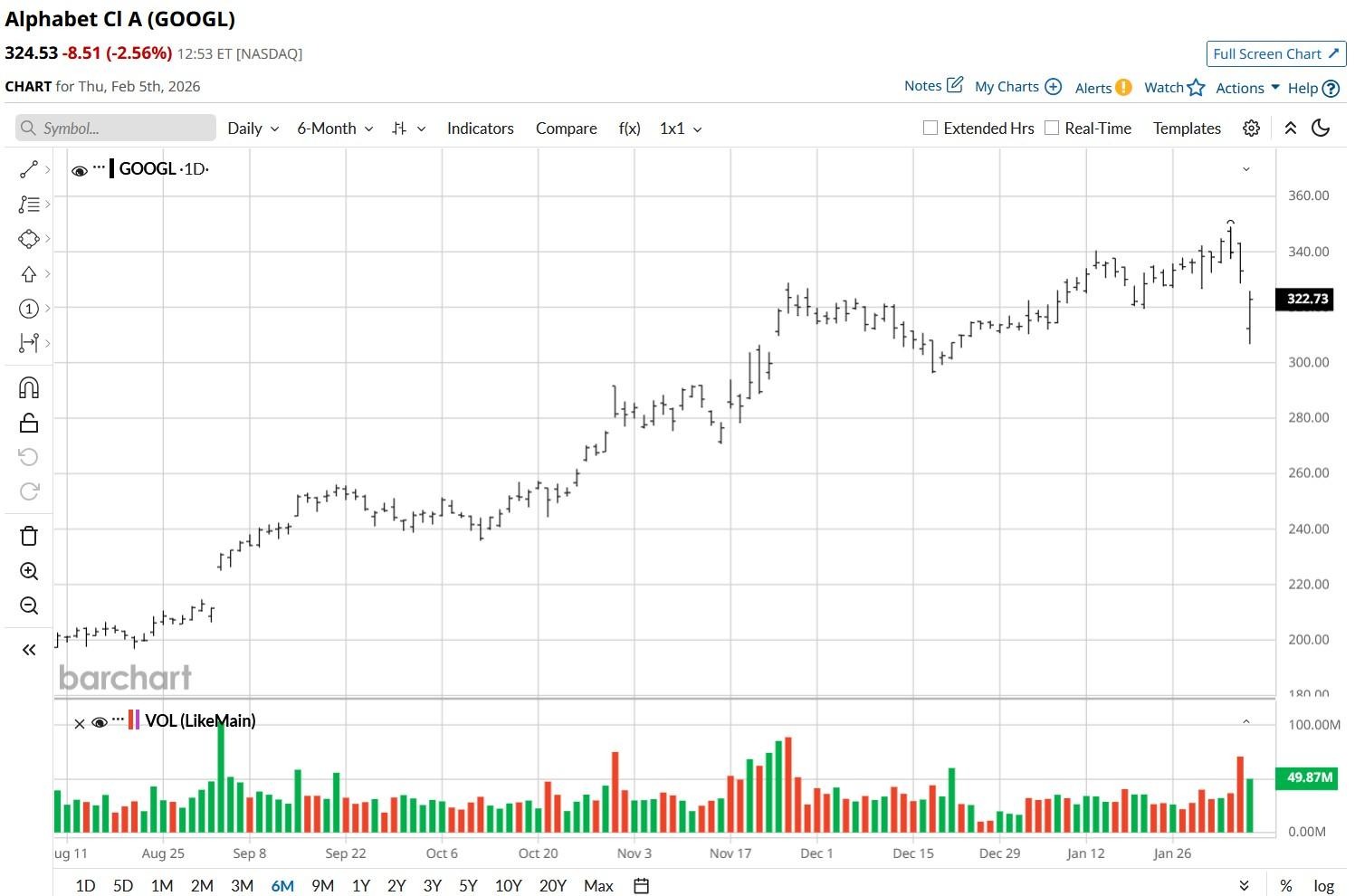

The post-earnings dip made GOOGL slip below its 50-day moving average (MA) today, signaling that downward momentum may sustain in the near term.

Despite the recent decline, however, Google shares remain up more than 100% versus their 52-week low.

Why Capex Guidance Doesn’t Warrant Selling Google Stock

In its earnings release, Alphabet said its capital expenditures could soar to nearly $185 billion this year — more than double what it spent in 2025. At first glance, this headline number sure looks concerning, but a closer look reveals the company is actually spending into strength, which warrants sticking with GOOGL stock.

Google Cloud brought in $17.7 billion in the fourth quarter, up a remarkable 48%, reinforcing that Alphabet isn’t just building data centers blindly, it’s responding to a massive $240 billion backlog.

As Sundar Pichai, the company’s chief executive, has noted previously, “The risk of under-investing is far greater than the risk of over-investing in AI infrastructure.”

Citi Reiterates GOOGL Shares as Top Pick for 2026

In a post-earnings interview with CNBC, Ron Josey, a senior Citi analyst, urged long-term investors to look past the knee-jerk reaction, reiterating Google shares as one of his top picks for 2026.

According to him, Alphabet is the only tech titan with a vertically integrated artificial intelligence (AI) stack — from in-house TPU chips to the world’s most dominant consumer platforms.

While the market fears the cost of artificial intelligence, Google is already seeing a 78% reduction in Gemini serving costs, Josey revealed.

A 0.26% dividend yield and billions authorized for share repurchase make the AI stock even more attractive as a long-term holding.

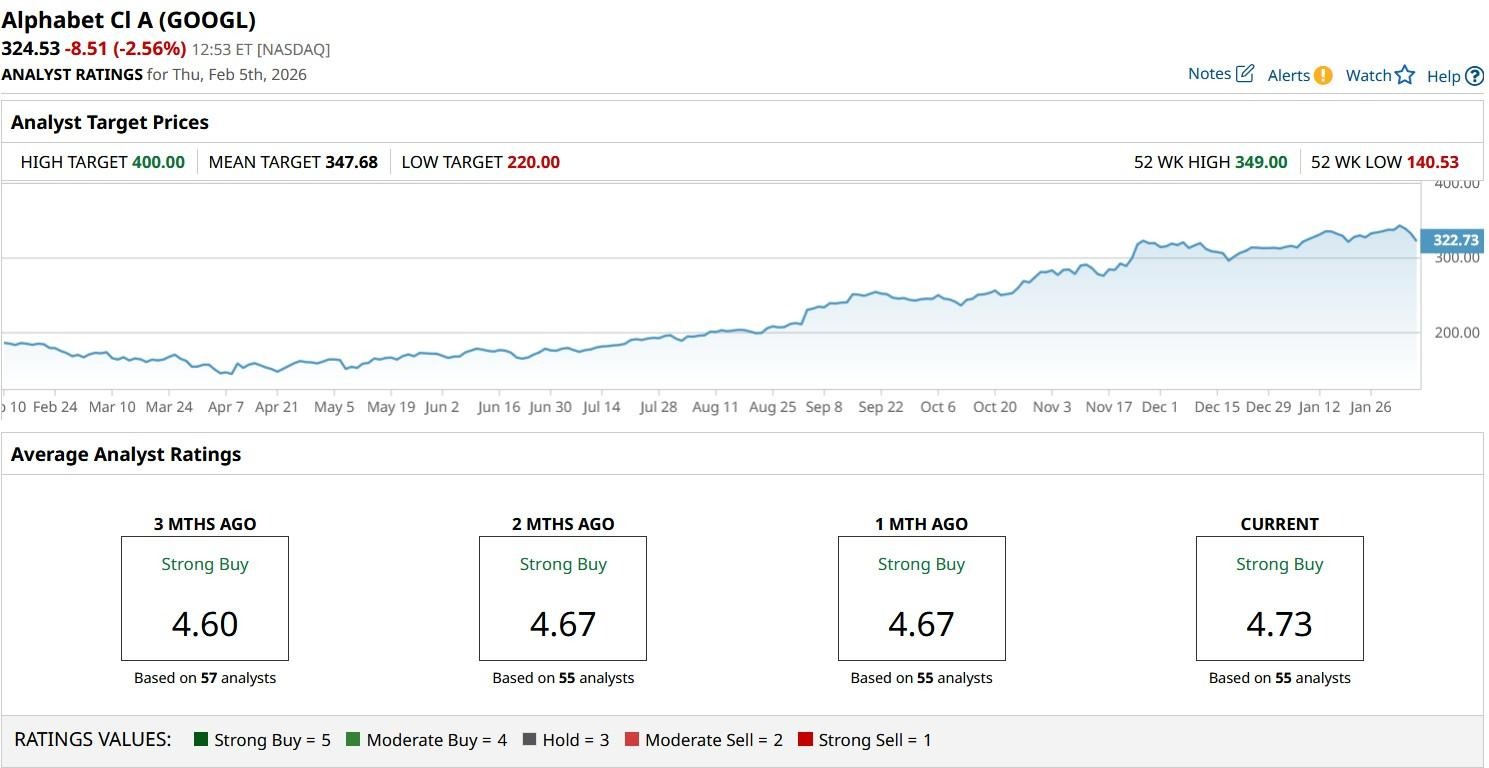

How Wall Street Recommends Playing Alphabet

Other Wall Street analysts also agree with Citi’s bullish view on Alphabet, especially since it remains decisively above its 100-day MA, indicating the broader uptrend is still intact.

According to Barchart, the consensus rating on GOOGL shares sits at a “Strong Buy” currently, with price targets as high as $400 signaling potential upside of nearly 25% from here.