Life has come full circle for Chinese stocks in general and Alibaba (BABA) in particular. After China's brutal tech crackdown in 2020 and 2021, several analysts characterized Chinese stocks as “uninvestible.” The label wasn’t entirely unwarranted, as China targeted emerging sectors, such as edtech companies, and policy uncertainty made it challenging to value Chinese companies.

Alibaba was perhaps the face of the crackdown, as the company’s co-founder, Jack Ma, was seen to be getting too big for his boots after he criticized Chinese regulators heading into the IPO of the company's subsidiary Ant Financial in 2020. As things turned out, China cancelled that IPO, which was set to become the largest Chinese listing ever. Importantly, Ma wasn’t seen in public for weeks, and while he has since emerged back in public life, it is a more chastened version.

Meanwhile, BABA stock, which briefly fell below its 2014 IPO price last year, has since rebounded and done so in style. Far from being “uninvestable,” there is a literal fear of missing out (FOMO) trade in Alibaba as BABA stock has more than doubled in 2025. Incidentally, Cathie Wood—who sold Chinese shares in 2021 amid the tech crackdown and warned of a “valuation reset”—also jumped back into BABA stock again.

Why Is BABA Stock Rising?

Both macro and company-specific factors have backed the rally in BABA stock. On the macro level, China’s stimulus measures helped buoy sentiments towards Chinese stocks. President Xi Jinping’s meeting with Chinese entrepreneurs earlier this year, where, among others, Ma was in the audience, was another key event, as it signaled that, amid the slowdown, the country is now backing up its private sector. Finally, the artificial intelligence (AI) trade, which was largely limited to U.S. Big Tech companies, made its way into China after DeepSeek stunned markets with its low-cost model earlier this year.

Alibaba Is a Play on China's AI Story

Alibaba has also impressed with its AI strategy. In the June quarter, Cloud Intelligence Group, which houses the company’s cloud and AI businesses, saw a 26% rise in revenues. Alibaba said that AI-related revenue accounted for a fifth of revenues from external customers in its cloud business while emphasizing that the business has grown in triple digits for eight consecutive quarters.

Alibaba is also working on AI chips and recently onboarded China Unicom as its first major external customer. Notably, Nvidia (NVDA) CEO Jensen Huang has long been warning that U.S. chip export controls would spur innovation in China, and his words seem prophetic as China pivots to domestic chips, which could shun the Santa Clara-based company from the world’s second-biggest market for AI chips.

Alibaba is getting even more ambitious in its AI plans, and last month, CEO Eddie Wu talked about raising the capex towards building AI infrastructure, which it had previously set at $53 billion over the next 3 years, without specifying its quantum. BABA is going global with AI and will open data centers in the Netherlands, Brazil, and France, and it has plans to add more countries, including Mexico, Japan, and South Korea, to the list.

The company also launched new AI models while announcing a partnership with Nvidia, wherein it will integrate Nvidia’s robotics software and physical AI development tools into its cloud platform.

BABA Stock Forecast: A “FOMO” Trade?

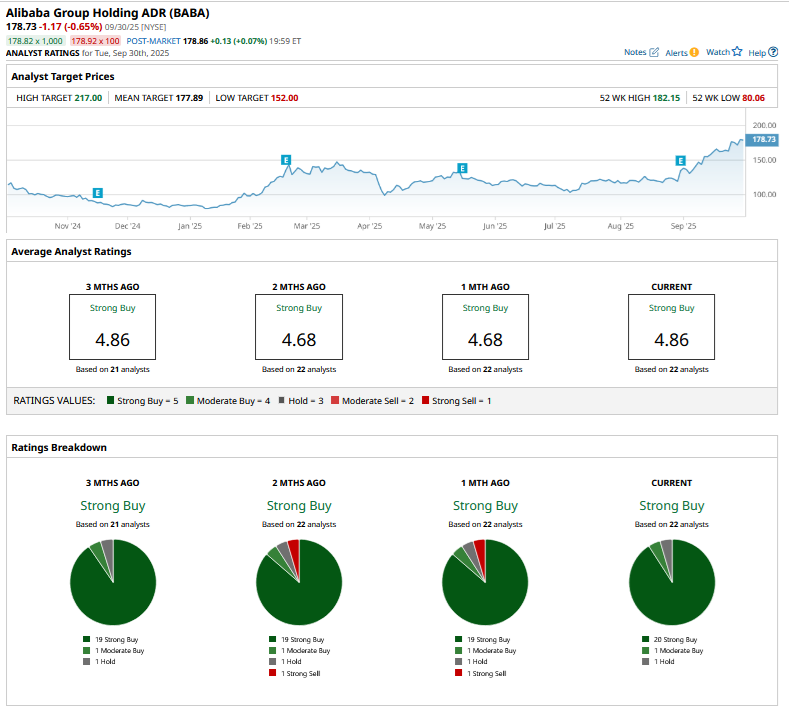

Analysts have been on a target price-raising spree over the last month, and Morgan Stanley, Jefferies, Morningstar, Baird, Susquehanna, Barclays, and Benchmark raised the stock’s target price in September.

Great Hill Capital’s Thomas Hayes termed BABA stock the “cheapest” AI play globally. There indeed is some merit in that assertion, as while Alibaba’s valuation multiples have expanded, its forward price-to-earnings (P/E) multiple of 24.4x is much cheaper than U.S.-based AI plays, including its closest peer, Amazon (AMZN).

That said, the valuations should be seen in perspective, and BABA has always traded at a discount to Amazon, and if anything, the current gap is the narrowest we have ever seen, as while Alibaba’s valuation multiples have expanded, they have compressed for Amazon, which is the worst-performing “Magnificent 7” stock this year.

Meanwhile, while the FOMO trade in BABA rolls on, some are advising caution, with Tiger Securities downgrading the stock from a “Buy” to “Hold” on valuation concerns.

Should You Buy Alibaba Stock?

I have been bullish on BABA stock for quite some time now, especially given its tepid valuations, as not long ago it was a single-digit P/E stock—a rarity in tech names. I still like Alibaba as the company makes progress in AI. Notably, Alibaba’s current valuation multiple appears elevated given the short-term earnings impact from the losses in its instant e-commerce business. It is, however, a fast-growth business whose monthly active users approached 300 million in August.

Alibaba’s focus on AI and instant commerce would drive the next leg of growth, while a resumption of the planned listing of its business units would help unlock shareholder value. Overall, I continue to stay invested in Alibaba, as while its valuations are no longer mouthwatering, they are still nowhere near a bubble zone despite the apparent FOMO trade.