/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

When the discussion is about AI, none can steal the limelight from Nvidia (NVDA). After competitor AMD (AMD) grabbed headlines for its seminal partnership with OpenAI to deploy 6 gigawatts of the former's GPUs, the Nvidia share price came under pressure. However, Nvidia CEO Jensen Huang has turned the narrative towards his company again after he stated in a recent interview with CNBC's Squawk Box that “This year, particularly the last six months, demand of computing has gone up substantially.”

Specifically about Nvidia, Huang presented a positive picture for the company's Blackwell chips, stating that “Demand for Blackwell is really, really high. I think we’re at the beginning of a new buildout, beginning of a new industrial revolution.”

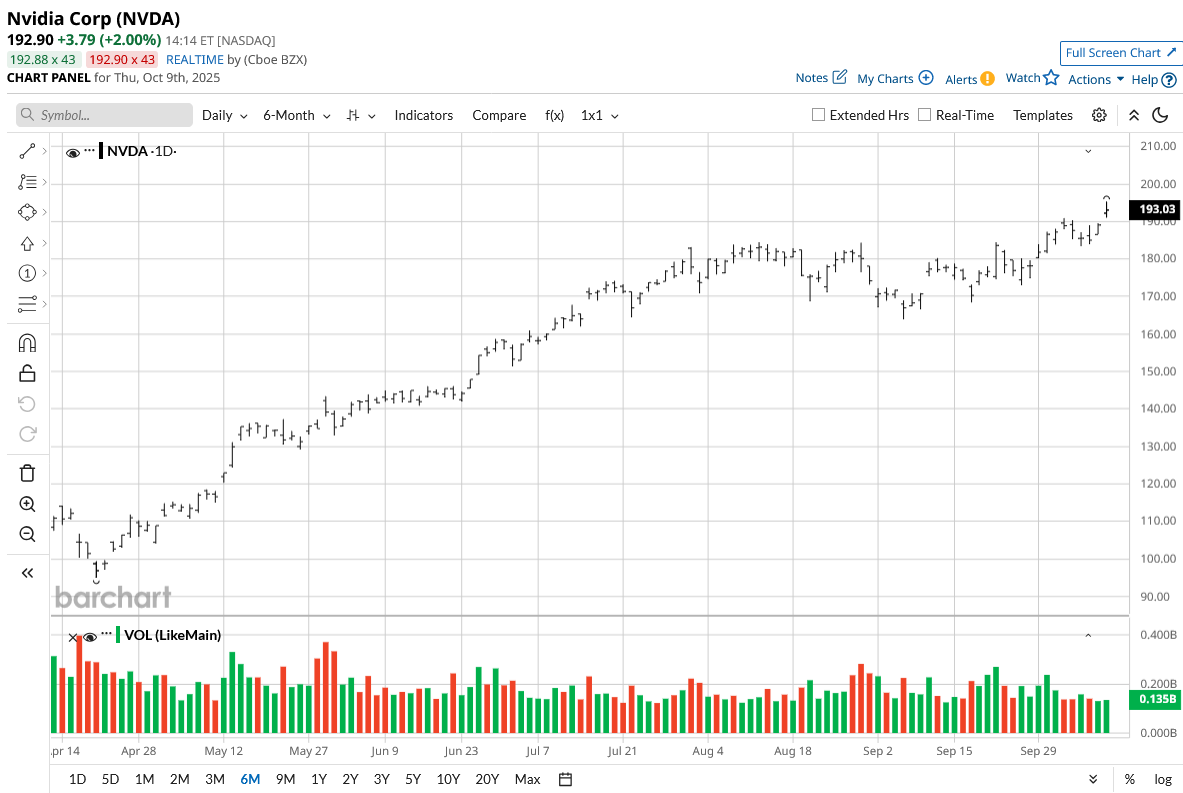

This sent the shares of Nvidia up by 2.2% yesterday and another 2% today, with the stock now up 43.5% on a year-to-date (YTD) basis, as the company inches closer to a market cap of $4.5 trillion. However, investors shouldn't shy away from NVDA stock, as the run-up is far from over. Why? Here are some possible reasons.

Financial Supremacy Complements AI Supremacy

For years, Nvidia's share price has wandered in the wilderness of penny stock levels. In fact, since its listing in 1999 and up until 2020, NVDA stock seldom crossed the level of $10. However, patience bore its fruits, and over the past five years, the NVDA stock has caught fire with a remarkable rally of 1,274.4%. In that same period, Nvidia has grown its revenue and earnings at scarcely believable CAGRs of 66.11% and 91.21%, respectively.

In recent times as well, the performance has been equally robust, as the company's quarterly earnings have outperformed Street expectations consecutively for more than two years. Unsurprisingly, that was the case in the most recent quarter as well.

Nvidia had another strong quarter, and it’s hard not to notice just how much the data center business is carrying the company, but that is not a slight on the company, as the demand for data center GPUs remains robust and growing at a healthy tick. Revenue came in at $46.7 billion, up 56% from a year ago, and EPS hit $1.05, beating the $1.01 consensus while jumping 54% compared to last year. The data center unit alone pulled in $41.1 billion—up 5% from the previous quarter and 56% higher than the same quarter a year back.

Cash flow is holding up, too. Operating cash reached $15.4 billion, compared with $14.5 billion last year, and the balance sheet looks solid: no short-term debt and $56.8 billion in cash give Nvidia plenty of flexibility. For now, it seems more than ready to handle near-term obligations without any stress.

Looking ahead, management is expecting revenue of around $54 billion next quarter, slightly above analysts’ $53.14 billion estimates. Sure, the stock is expensive—the forward P/E, P/S, and P/CF are 43.90, 34.46, and 60.52, well above sector norms of 25.78, 3.57, and 20.13—but the forward PEG sits at 1.34, still below the 1.83 sector median. So while investors are paying a premium, the growth story still makes the valuation somewhat defensible.

What Makes Nvidia Special?

Nvidia towers over everybody in the GPU space, with a market share of more than 90%, making it almost a monopoly. But why do companies prefer Nvidia's GPUs over its competitors?

Companies usually pick Nvidia’s GPUs over others for pretty obvious reasons. They got an early start on GPUs built for AI and high-performance computing, which gave them a clear edge. Moreover, they’ve built a strong developer ecosystem, offer a range of products, and lead the pack in AI data centers, so most companies naturally stick with them.

A big reason it’s difficult to switch away from Nvidia is CUDA, its proprietary software platform. Once a company invests in it, moving to another provider isn’t easy. Nvidia’s GPUs are fast, energy-efficient, and scale well for AI training and inference, beating both CPUs and competitor chips. The way their hardware and software fit together—with high chip-to-chip bandwidth—gives them a versatility and integration that rivals like AMD just don’t match.

They also rule the data center GPU market, with around 90% share. Continuous innovation, like the Grace Hopper Superchip, plus partnerships with cloud providers, keeps customers loyal. When you put all that together—the hardware, the software, the ecosystem—it’s easy to see why Nvidia GPUs are the default choice for companies running AI or other compute-heavy workloads.

Nvidia has also strengthened its position through partnerships with major cloud providers like AWS, Azure, and Google Cloud. By putting GPUs directly into these platforms, companies don’t need to spend big on hardware upfront, which makes high-performance computing a lot more accessible. That convenience alone has encouraged adoption across different industries, and it keeps Nvidia right at the top of the market.

Additionally, the company continues to innovate, and it plays a crucial role in its market dominance. Nvidia pours a lot into R&D and keeps bringing out new GPUs that are faster, more energy-efficient, and loaded with AI-specific features like Tensor Cores and GPU Boost. For customers, this means hardware that scales with complex AI workloads and stays relevant longer, which makes switching to competitors a real hassle.

Finally, Nvidia provides plenty of support and training for developers and enterprises. Between forums, certification programs, and dedicated support, the company helps users actually get the most out of its technology. This mix of hardware, software, and support keeps people coming back, encourages ongoing innovation, and strengthens the ecosystem in ways that competitors can’t easily match.

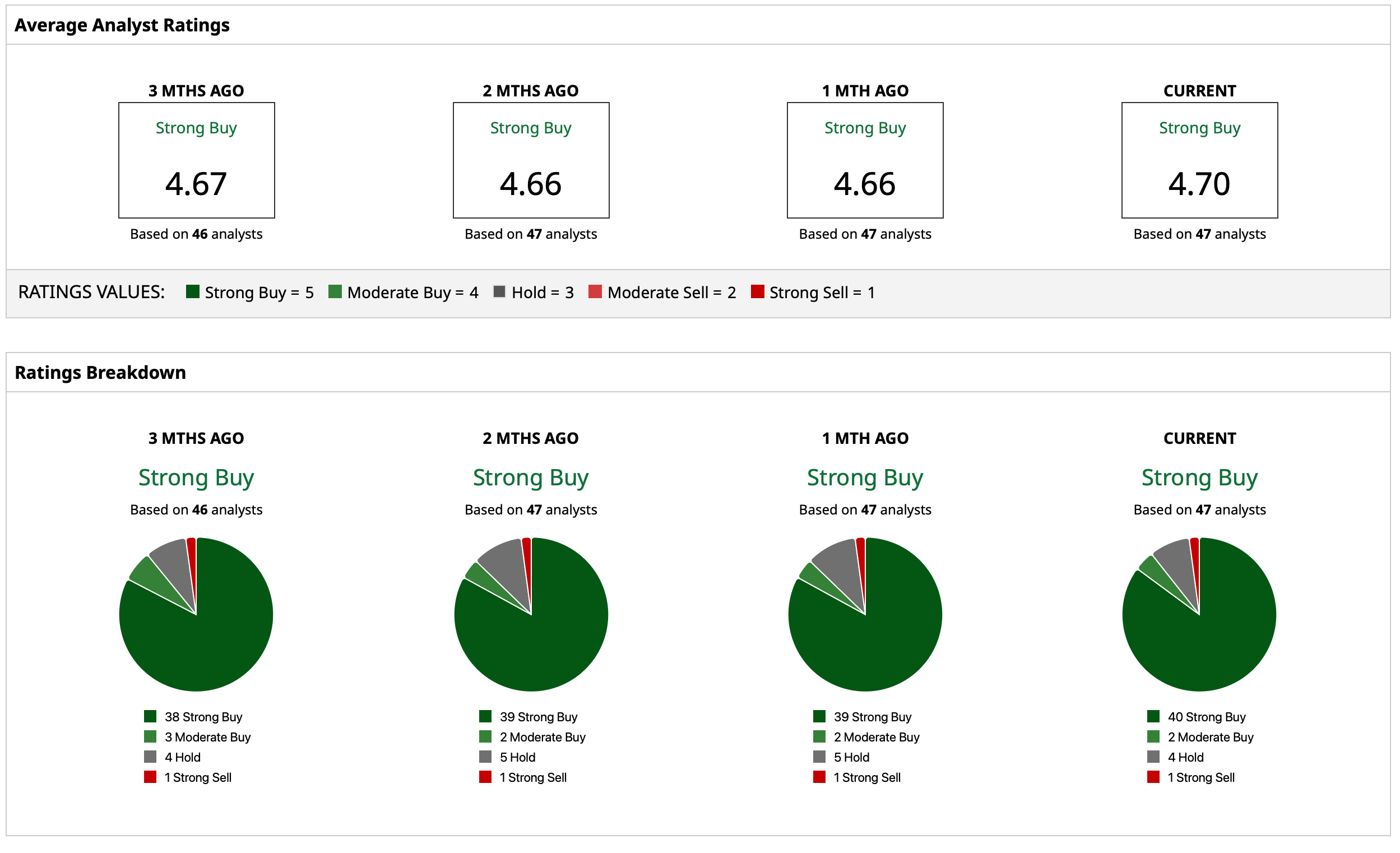

Analyst Opinion

Taking all of this into account, analysts have deemed the NVDA stock a consensus “Strong Buy,” with a mean target price of $217.14. This denotes an upside potential of about 12.6% from current levels. Out of 47 analysts covering the stock, 40 have a “Strong Buy” rating, two have a “Moderate Buy” rating, four have a “Hold” rating, and one has a “Strong Sell” rating.