Activist investors have a knack for shaking things up, pushing companies to rethink strategy, streamline operations, and unlock hidden value for shareholders. And now, beverage powerhouse Keurig Dr Pepper (KD) is in the spotlight after reports surfaced that Starboard Value, a well-known activist fund, has quietly taken a stake in the company. The news comes just months after the beverage giant’s controversial plan to acquire Dutch beverage firm JDE Peet’s (JDEPY) in August, a move that rattled investors.

Adding to the unease, the company also announced its intention to split into two publicly traded companies, Beverage Co. and Global Coffee Co. The market didn’t take that news well, with shares nosediving. Since then, Starboard has reportedly been building its position and holding private discussions with KDP’s management and board, focusing on improving execution and restoring investor confidence. So, with an influential activist now circling the soda and coffee giant, should investors also scoop up KDP shares?

About Keurig Dr Pepper Stock

Born in 2018 from the merger of coffee innovator Keurig Green Mountain and soda icon Dr Pepper Snapple Group, Massachusetts-based Keurig Dr Pepper blends two beverage worlds under one roof. Today, KDP isn’t just about soft drinks or coffee, it’s the umbrella for over 125 owned, licensed, and partner brands spanning sodas, juices, teas, single-serve brewers, and more. The company is home to brands like Dr Pepper, 7UP, Snapple, Mott’s, and Canada Dry, as well as coffee staples like Keurig, Green Mountain, and Donut Shop.

However, shares of this beverage giant have been grabbing headlines this year, but not for reasons that excite investors. The spotlight turned intense after the company announced its $18.4 billion acquisition of JDE Peet’s and revealed plans to split into two publicly traded companies on Aug. 25, triggering an immediate 11.5% selloff in KDP shares.

The breakup would create Global Coffee Co., merging KDP’s and JDE’s coffee businesses, and Beverage Co., which would house soft drink icons like Dr Pepper and Snapple. While the strategy is designed to sharpen focus and unlock long-term value, many investors worry that KDP is overpaying with a 33% premium for JDE Peet’s, potentially straining its balance sheet and introducing near-term financial pressure.

Beyond the price tag, the market is weighing the execution risks of such a large deal and the split, as well as uncertainties around leadership continuity and operational efficiency. Currently valued at a market capitalization of roughly $36.3 billion, KDP shares are stuck deep in read. The stock is down about 27.2% over the past year and has shed almost 17% in 2025.

By comparison, the broader S&P 500 index ($SPX) is up 13.4% over the past 52 weeks and 13% in 2025. On a brighter note, following reports that Starboard Value is building a stake in KDP, the stock has seen a modest rebound, climbing about 5.4% over the past five days.

Keurig Dr Pepper also keeps investors happy with quarterly dividends. On Oct. 10, it paid $0.23 per share, putting its forward annualized dividend at $0.92 per share, which translates to an attractive 3.45% yield, a nice perk for investors looking for steady income.

Keurig Dr Pepper’s Q2 Earnings Snapshot

On July 24, the beverage company dropped its fiscal 2025 second-quarter earnings report, which blew past Wall Street’s top-line expectations. Revenue for the quarter came in at $4.16 billion, representing 6.1% year-over-year (YOY) growth and slightly ahead of Wall Street’s forecast figure of $4.14 billion. The company’s adjusted EPS of $0.49 reflected about 11.1% annual growth and closely aligned with the consensus bottom-line estimate.

Management highlighted that the quarter’s results were driven by continued momentum in U.S. Refreshment Beverages and International operations, while U.S. Coffee showed early signs of stabilization. The U.S. Refreshment Beverages segment shone, delivering net sales of $2.7 billion, up 10.5% YOY, thanks to a 9.5% boost from volume and mix and a 1% lift from pricing.

Growth was supported by market share gains in carbonated soft drinks, energy drinks, and sports hydration, as well as the strategic acquisition of GHOST. Meanwhile, U.S. Coffee net sales dipped slightly to $948 million, with flat overall results reflecting K-Cup pricing adjustments to offset inflation, tempered by declines in pod and brewer shipments.

International segment net sales were $555 million, down 1.8% YOY. On the cash flow front, operating cash flow reached $431 million, while free cash flow totaled $325 million. Looking ahead, KDP’s management reaffirmed its fiscal 2025 outlook, targeting mid-single-digit constant currency net sales growth and high-single-digit adjusted EPS growth.

How Are Analysts Viewing Keurig Dr Pepper Stock?

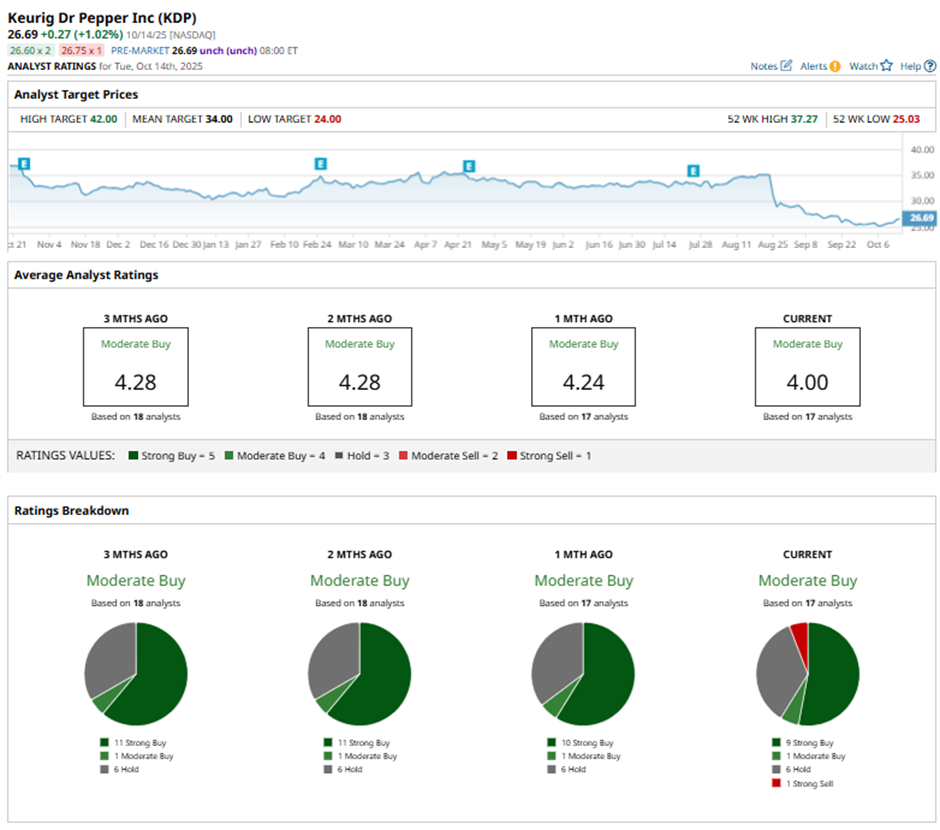

Overall, Wall Street remains cautiously optimistic on Keurig Dr Pepper, with the stock carrying a consensus “Moderate Buy” rating. Of the 17 analysts offering recommendations, a majority of nine analysts are giving it a solid “Strong Buy,” one suggests a “Moderate Buy,” six issue “Hold,” and the remaining one offers a “Strong Sell.”

Analysts see room for growth. The average analyst price target of $34 implies potential upside of 27.4% from current levels, while the Street-high target of $42 suggests that the stock can rally as much as 57.4% from here, making the soda-and-coffee giant a stock to watch.