Arm Holdings Plc (NASDAQ:ARM) is actively exploring a significant strategic shift towards developing “full-end solutions” and chiplets, potentially moving beyond its traditional intellectual property (IP) licensing model.

Check out the stock price of Arm over here.

What Happened: This revelation came during the company’s first quarter 2026 earnings call, where CEO Rene Haas indicated the move is driven by the “insatiable compute demands of AI” and customer requests for more integrated solutions.

Haas stated, “We are continuing to explore the possibility of moving beyond our current platform into additional compute to subsystems, chiplets and potentially full-end solutions.”

He elaborated that the company is “looking now at the viability of moving beyond the current platform to additional subsystems, chiplets or possibly full solutions,” emphasizing that Arm possesses the internal expertise needed to “design, implement and have a chiplet, for example, manufacturing.”

This signals a potential foray into areas currently dominated by its partners and customers, including major players like Nvidia Corp. (NASDAQ:NVDA).

The strategic exploration is closely tied to Arm’s surging presence in the AI landscape. The company reported that its Neoverse data center chips are expected to capture “nearly 50%” market share among top hyperscalers this year, a dramatic leap from “sub 20%” just a year ago.

This growth is fueled by adoption in critical AI infrastructure, including Nvidia Grace Blackwell, Amazon.com Inc.‘s (NASDAQ:AMZN) AWS Graviton, Alphabet Inc.‘s (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Axion, and Microsoft Corp.‘s (NASDAQ:MSFT) Cobalt.

The integration of Arm designs into high-performance AI systems, such as Nvidia’s Grace Blackwell, which is “25x more energy efficient than the previous x86-based system,” underscores Arm’s growing influence.

Why It Matters: While a direct entry into chip manufacturing could create new competitive dynamics with its existing clientele, Arm’s confidence stems from its unique position as the “only compute platform built to deliver AI performance across the full spectrum of power and performance from milliwatts to megawatts.”

The company also highlighted the success of its Compute Subsystems (CSS) platforms, which are already delivering “double the royalty of Armv9” and exceeding expectations, providing a blueprint for more integrated offerings.

Arm missed the first-quarter revenue estimate of $1.055 billion, as its sales came in at $1.053 billion. The adjusted earnings of 35 cents per share were in line with the analyst estimates. –

Price Action: Arm shares fell 8.56% in after-hours on Wednesday. The stock was up 27.40% year-to-date and 13.29% over the past year.

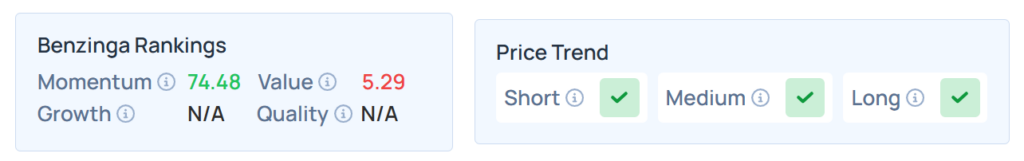

Benzinga's Edge Stock Rankings indicate that Arm maintains solid momentum across the short, medium, and long term. However, the stock scores poorly on value rankings. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, ended on a mixed note on Wednesday. The SPY was down 0.13% at $634.46, while the QQQ advanced 0.13% to $568.02, according to Benzinga Pro data.

On Thursday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were trading higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock