Throughout its history, Arm has licensed its instruction set architecture or designs of actual processor components, such as general-purpose cores or graphics processing units, but not the whole chip design. However, Reuters reports that the company is reconsidering its business strategy to increase its earnings.

Under the new strategy, Arm plans to offer more complete chip designs and even actual chiplets that compete against products developed by Arm’s customers. In addition, Arm reportedly intends to increase its license price threefold.

In 2019, Arm launched its Picasso project, aiming to increase smartphone revenue by $1 billion annually over the next 10 years. The strategy included raising royalty rates for pre-designed chip components built on its Armv9 architecture by as much as 300%. By now, Arm has indeed rolled out its compute subsystem (CSS) IP packages, which comprise high-performance and energy-efficient CPU and GPU IPs and enable Arm's partners to build processors for client or data center devices considerably faster than previously.

By late 2019, Arm chief executive Simon Segars informed SoftBank chairman Masayoshi Son that Qualcomm had agreed to use Arm’s pre-designed platforms. However, Qualcomm then acquired Nuvia, a company with a highly competitive CPU design and a talented development team, which made it change its mind about using pre-designed platforms. As a result, just like Apple, Qualcomm only uses Arm’s ISA, not prêt-à-porter CPU cores or CSS designs, and therefore pays considerably less.

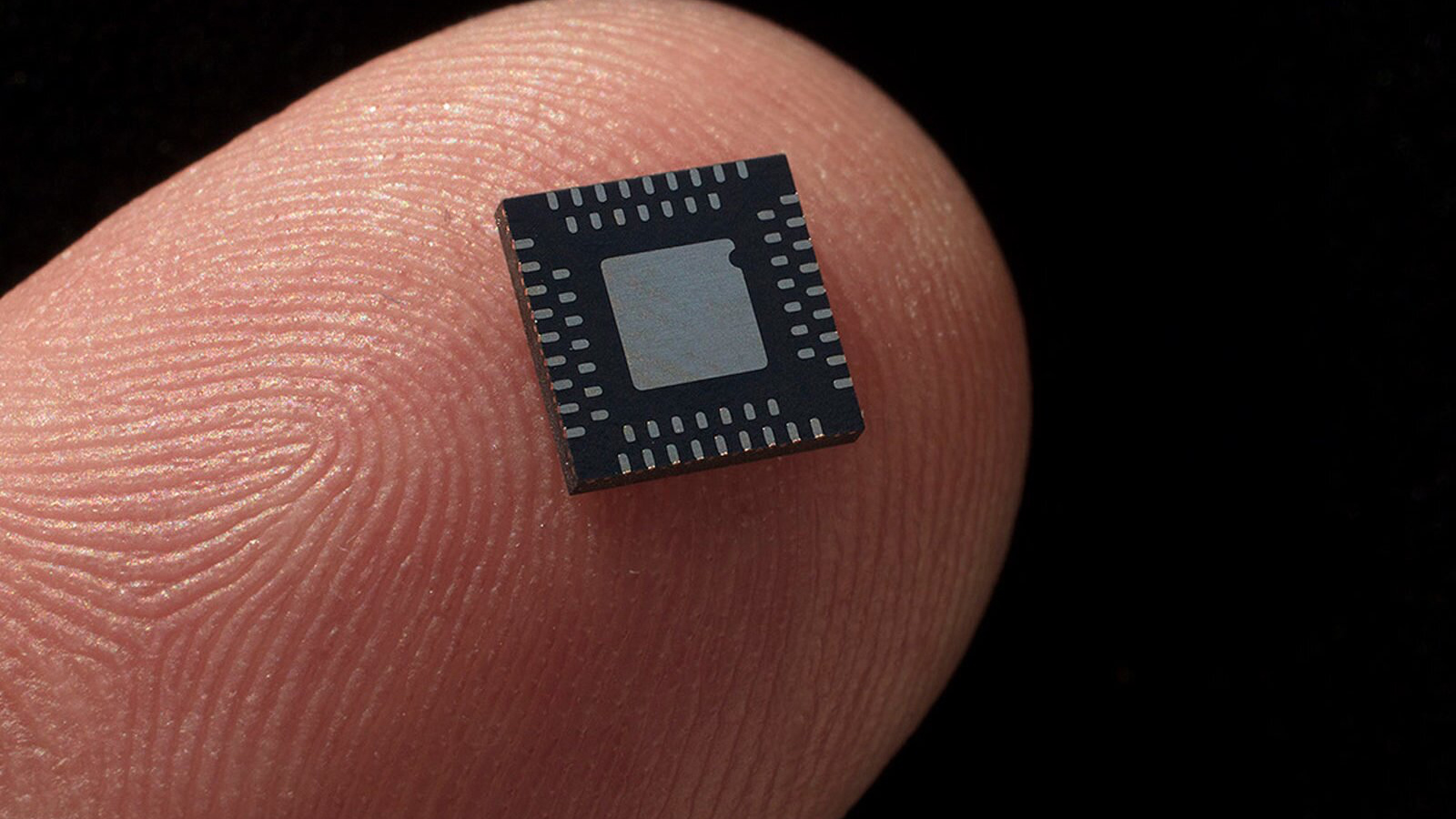

Meanwhile, the current CEO, Rene Haas, proposed an even more radical way to boost Arm's earnings. In a 2022 presentation, Haas proposed that the company should start selling finished chiplets that could be used to build system-in-packages (SiPs), enabling emerging partners to focus solely on the development of their differentiating IPs, such as general-purpose CPUs or GPUs. Such chiplets would directly compete against processors designed by companies like MediaTek and Qualcomm and, therefore, strain relationships with customers relying on Arm’s ISA designs. However, they would significantly increase Arm's earnings.

Arm's new strategy reflects its ambition to grow beyond its traditional licensing model. As part of its push that extends beyond smartphones and targets growth in PC and data center markets, the company has also pursued closer collaboration with device manufacturers like Samsung, which is logical since traditional processor suppliers like AMD and Intel certainly do so as well. While Arm has not yet started building its chips or chiplets, its intentions have already raised customer concerns.