/Arista%20Networks%20Inc%20HQ%20photo-by%20Tada%20Images%20via%20Shutterstock.jpg)

Arista Networks, Inc. (ANET), headquartered in Santa Clara, California, develops, markets, and sells data-driven, client-to-cloud networking solutions for data center, campus, and routing environments. Valued at $183.4 billion by market cap, the leading tech company offers Ethernet switches, pass-through cards, transceivers, and enhanced operating systems. It also provides host adapter solutions and networking services. The cloud networking giant is expected to announce its fiscal third-quarter earnings for 2025 after the market closes on Tuesday, Nov. 4.

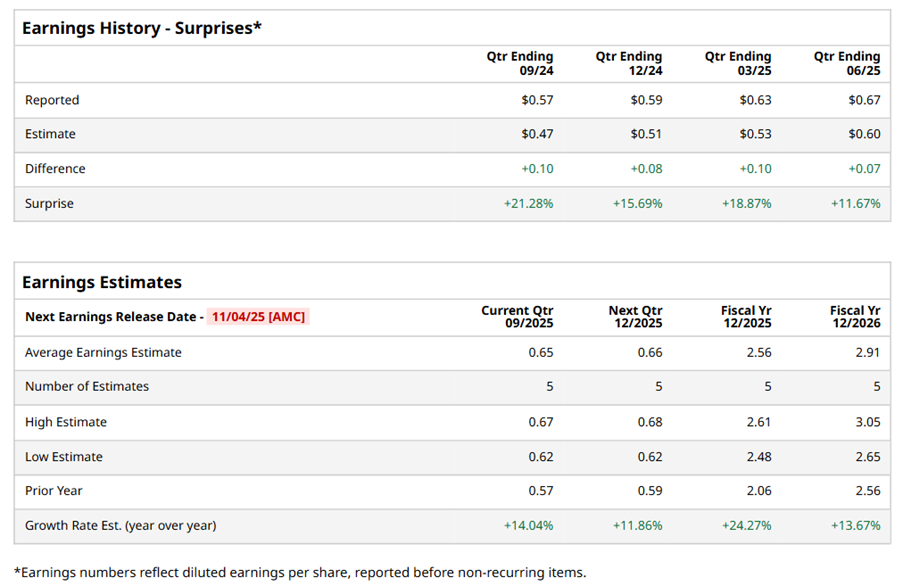

Ahead of the event, analysts expect ANET to report a profit of $0.65 per share on a diluted basis, up 14% from $0.57 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect ANET to report EPS of $2.56, up 24.3% from $2.06 in fiscal 2024. Its EPS is expected to rise 13.7% year over year to $2.91 in fiscal 2026.

ANET stock has significantly outperformed the S&P 500 Index’s ($SPX) 14.5% gains over the past 52 weeks, with shares up 47.9% during this period. Similarly, it notably outperformed the Technology Select Sector SPDR Fund’s (XLK) 23.2% rise over the same time frame.

Arista's strong performance is driven by its leadership in high-performance switching, robust demand for its cloud and AI networking solutions, and innovative product launches. Its software-driven approach and comprehensive portfolio enable customers to build cloud architectures and enhance cloud experiences, positioning Arista for continued growth in the AI networking boom.

On Aug. 5, ANET reported its Q2 results, and its shares surged by 17.5% in the following trading session. Its adjusted EPS of $0.73 surpassed Wall Street expectations of $0.65. The company’s revenue was $2.2 billion, beating Wall Street forecasts of $2.1 billion. For Q3, ANET expects revenue to be $2.3 billion.

Analysts’ consensus opinion on ANET stock is bullish, with a “Strong Buy” rating overall. Out of 24 analysts covering the stock, 17 advise a “Strong Buy” rating, two suggest a “Moderate Buy,” and five give a “Hold.” ANET’s average analyst price target is $166.78, indicating a potential upside of 13.8% from the current levels.