The S&P opened Friday’s session with a remarkable 7th straight intraday record. It can thank a blowout June jobs report for that. The U.S. added 850,000 jobs in June, crushing estimates of 706,000 and dwarfing May’s 559,000 total in the process. The Dow Jones rose 60 points, the S&P 500 ticked up 0.2%, and the Nasdaq climbed 0.4% to hit its own intraday record. The Nasdaq has led the way for the week and was up 1.1% as of Thursday’s close. The S&P 500 and Dow were also up about 0.9% and 0.6%, respectively. For investors looking to find the best opportunities, the deep learning algorithms at Q.ai have crunched the data to give you a set of Top Buys. Our Artificial Intelligence (“AI”) systems assessed each firm on parameters of Technicals, Growth, Low Volatility Momentum, and Quality Value to find the best Top Buys.

Sign up for the free Forbes AI Investor newsletter here to join an exclusive AI investing community and get premium investing ideas before markets open.

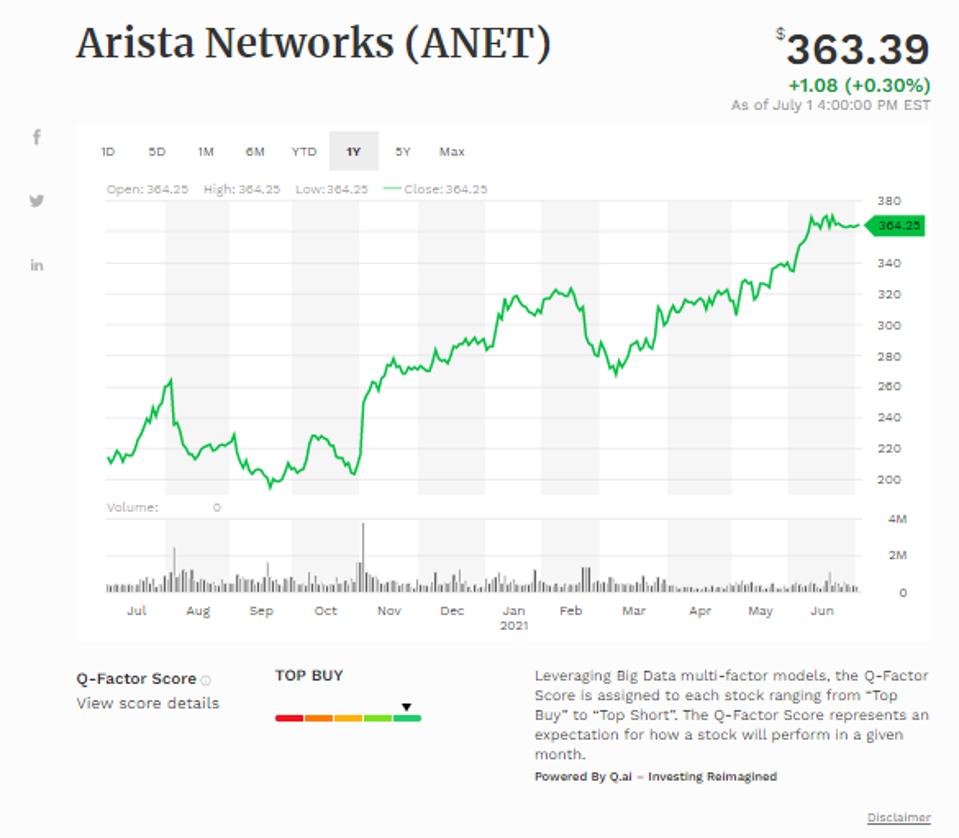

Arista Networks Inc (ANET)

Arista Networks Inc is today’s first Top Buy. Arista Networks is a major player in the development, marketing, and sale of cloud networking solutions. Our AI systems rated the company B in Technicals, C in Growth, B in Low Volatility Momentum, and B in Quality Value. The stock closed up 0.3% to $363.39 on volume of 327,032 vs its 10-day price average of $363.94 and its 22-day price average of $360.56, and is up 28.33% for the year. Revenue grew by 6.24% in the last fiscal year and grew by 14.44% over the last three fiscal years, Operating Income grew by 6.35% in the last fiscal year and grew by 10.73% over the last three fiscal years, and EPS grew by 6.79% in the last fiscal year and grew by 110.35% over the last three fiscal years. Revenue was $2317.51M in the last fiscal year compared to $2151.37M three years ago, Operating Income was $706.28M in the last fiscal year compared to $678.35M three years ago, EPS was $7.99 in the last fiscal year compared to $4.06 three years ago, and ROE was 20.42% in the last year compared to 17.25% three years ago. Forward 12M Revenue is expected to grow by 2.16% over the next 12 months, and the stock is trading with a Forward 12M P/E of 34.88.

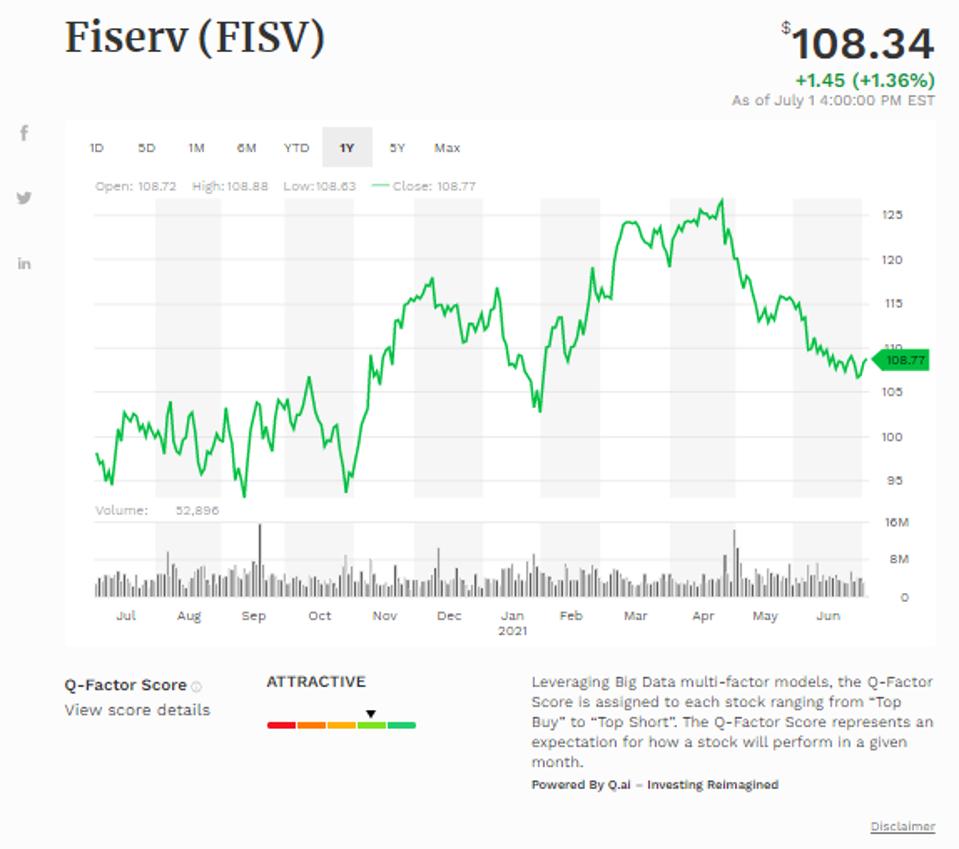

Fiserv Inc (FISV)

Fiserv Inc is our second Top Buy today. Fiserv is a FinTech company focused on financial services such as Payments, Financial, and Corporate and Other segments. Our AI systems rated the company C in Technicals, A in Growth, A in Low Volatility Momentum, and B in Quality Value. The stock closed up 1.36% to $108.34 on volume of 3,196,813 vs its 10-day price average of $107.92 and its 22-day price average of $109.4, and is down 3.2% for the year. Revenue grew by 154.82% over the last three fiscal years, while Operating Income grew by 17.36% in the last fiscal year and grew by 25.36% over the last three fiscal years. Revenue was $14852.0M in the last fiscal year compared to $5823.0M three years ago, Operating Income was $1630.0M in the last fiscal year compared to $1526.0M three years ago, EPS was $1.4 in the last fiscal year compared to $2.87 three years ago, and ROE was 2.86% in the last year compared to 47.25% three years ago. Forward 12M Revenue is expected to grow by 2.94% over the next 12 months, and the stock is trading with a Forward 12M P/E of 19.16.

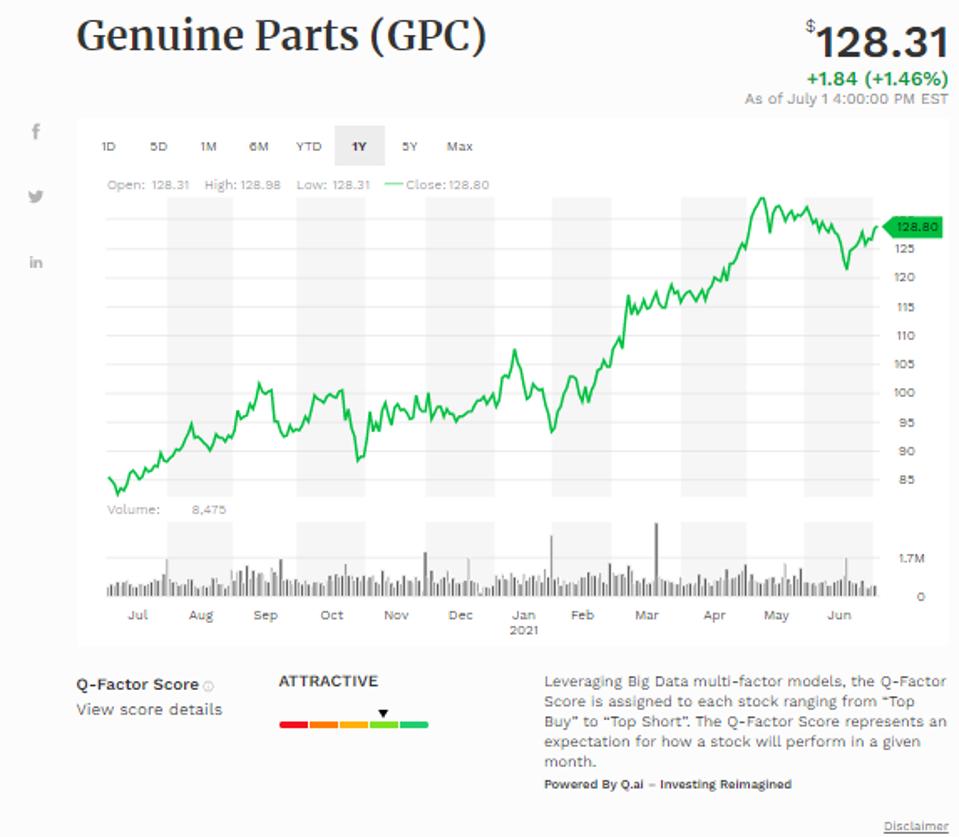

Genuine Parts Co (GPC)

Genuine Parts Co is our next Top Buy. Genuine Parts Co engages in the distribution of automotive replacement parts, industrial replacement parts, office products and electrical/electronic materials. Our AI systems rated the company C in Technicals, C in Growth, A in Low Volatility Momentum, and C in Quality Value. The stock closed up 1.45% to $128.31 on volume of 506,314 vs its 10-day price average of $125.66 and its 22-day price average of $126.94, and is up 30.34% for the year. Revenue grew by 2.25% in the last fiscal year and grew by 0.46% over the last three fiscal years, Operating Income grew by 9.85% in the last fiscal year and grew by 3.69% over the last three fiscal years, and EPS grew by -285.68% in the last fiscal year. Revenue was $16537.43M in the last fiscal year compared to $16831.6M three years ago, Operating Income was $1001.76M in the last fiscal year compared to $1061.22M three years ago, EPS was $(0.2) in the last fiscal year compared to $5.5 three years ago, and ROE was 4.73% in the last year compared to 21.61% three years ago. Forward 12M Revenue is expected to grow by 0.77% over the next 12 months, and the stock is trading with a Forward 12M P/E of 21.34.

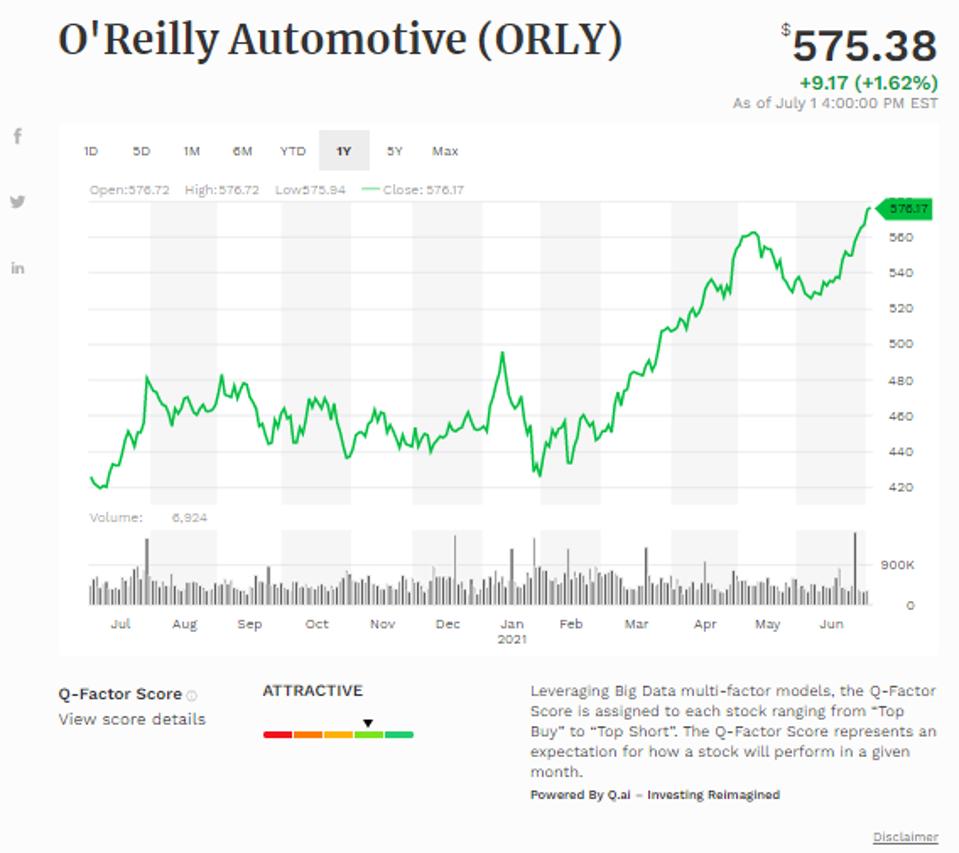

O'Reilly Automotive Inc (ORLY)

O’Reilly Automotive is our fourth Top Buy today. O’Reilly Automotive is a staple in the automotive parts industry, and serves both professional auto service providers and do-it-yourself customers. Our AI systems rated O’Reilly Automotive C in Technicals, D in Growth, A in Low Volatility Momentum, and B in Quality Value. The stock closed up 1.62% to $575.38 on volume of 351,484 vs its 10-day price average of $556.05 and its 22-day price average of $542.43, and is up 26.74% for the year. Revenue grew by 5.29% in the last fiscal year and grew by 28.13% over the last three fiscal years, Operating Income grew by 11.04% in the last fiscal year and grew by 47.28% over the last three fiscal years, and EPS grew by 13.24% in the last fiscal year and grew by 65.5% over the last three fiscal years. Revenue was $11604.49M in the last fiscal year compared to $9536.43M three years ago, Operating Income was $2422.74M in the last fiscal year compared to $1826.58M three years ago, EPS was $23.53 in the last fiscal year compared to $16.1 three years ago, and ROE was 651.9% in the last year compared to 263.13% three years ago. The stock is also trading with a Forward 12M P/E of 22.9.

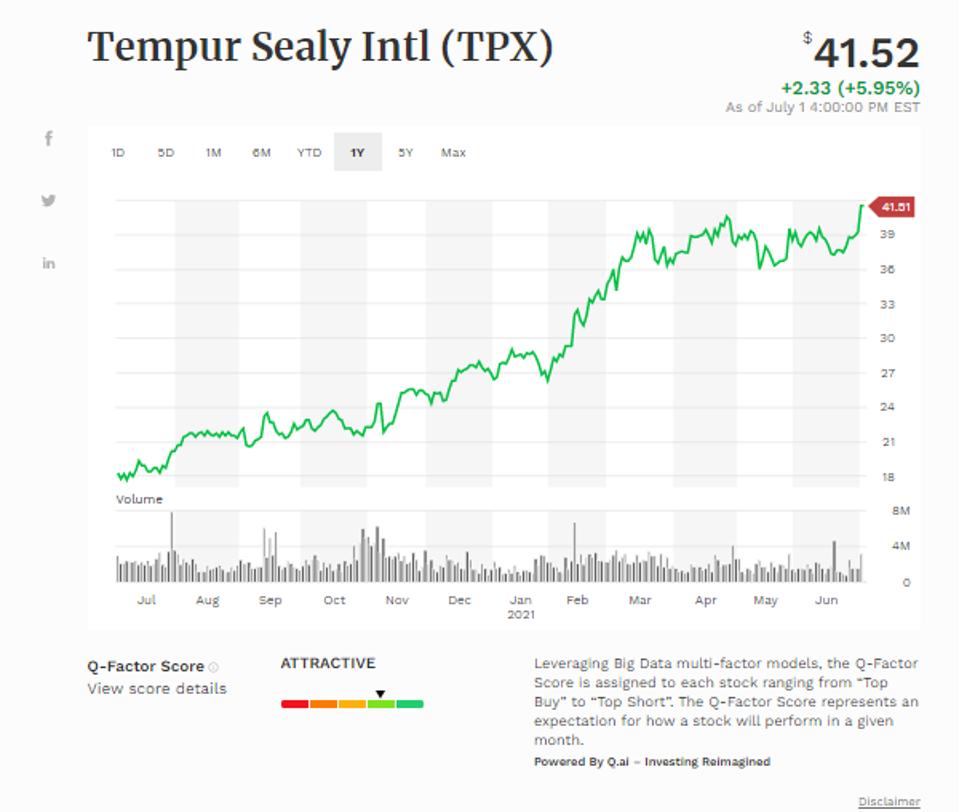

Tempur Sealy Intl Inc (TPX)

Tempur Sealy Intl Inc is our final Top Buy of the day. The company manufactures mattresses and bedding products. Originally known as Tempur-Pedic, the name changed after it acquired its biggest competitor Sealy Corporation in 2012. Our AI systems rated Tempur Sealy C in Technicals, A in Growth, B in Low Volatility Momentum, and B in Quality Value. The stock closed up 5.95% to $41.52 on volume of 3,205,080 vs its 10-day price average of $38.49 and its 22-day price average of $38.52, and is up 56.92% for the year. Revenue grew by 6.02% in the last fiscal year and grew by 44.23% over the last three fiscal years, Operating Income grew by 14.64% in the last fiscal year and grew by 149.62% over the last three fiscal years, and EPS grew by 21.17% in the last fiscal year and grew by 332.72% over the last three fiscal years. Revenue was $3676.9M in the last fiscal year compared to $2702.9M three years ago, Operating Income was $520.4M in the last fiscal year compared to $239.0M three years ago, EPS was $1.64 in the last fiscal year compared to $0.46 three years ago, and ROE was 80.05% in the last year compared to 69.48% three years ago. Forward 12M Revenue is expected to grow by 1.98% over the next 12 months, and the stock is trading with a Forward 12M P/E of 14.7.

Liked what you read? Sign up for our free Forbes AI Investor Newsletter here to get AI driven investing ideas weekly. For a limited time, subscribers can join an exclusive slack group to get these ideas before markets open.