With a market cap of $816.9 billion, Walmart Inc. (WMT) is a global retail leader offering a wide range of products and services through its brick-and-mortar stores, eCommerce platforms, and mobile applications. Operating under three main segments: Walmart U.S.; Walmart International; and Sam's Club, the company emphasizes everyday low prices and costs to deliver value and convenience to customers worldwide.

Shares of the Bentonville, Arkansas-based company have outperformed the broader market over the past 52 weeks. WMT stock has soared 25.9% over this time frame, while the broader S&P 500 Index ($SPX) has gained 18.3%. However, shares of Walmart are up 13.4% on a YTD basis, lagging behind SPX’s nearly 17% increase.

Narrowing the focus, the retail giant's stock has also outpaced the Consumer Staples Select Sector SPDR Fund’s (XLP) 4.7% decline over the past 52 weeks and 2.7% dip on a YTD basis.

Walmart shares fell 4.5% on Aug. 21 after its Q2 2026 adjusted EPS came in at $0.68, missing the consensus estimate despite revenue rising 4.8% year-over-year to $177.4 billion, above the estimate. Operating income declined 8.2% to $7.3 billion, pressured by discrete legal and restructuring costs, higher liability claims, wage increases, and strategic investments that offset strong e-commerce and membership income growth.

For the fiscal year, ending in January 2026, analysts expect WMT’s adjusted EPS to grow 3.6% year-over-year to $2.60. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

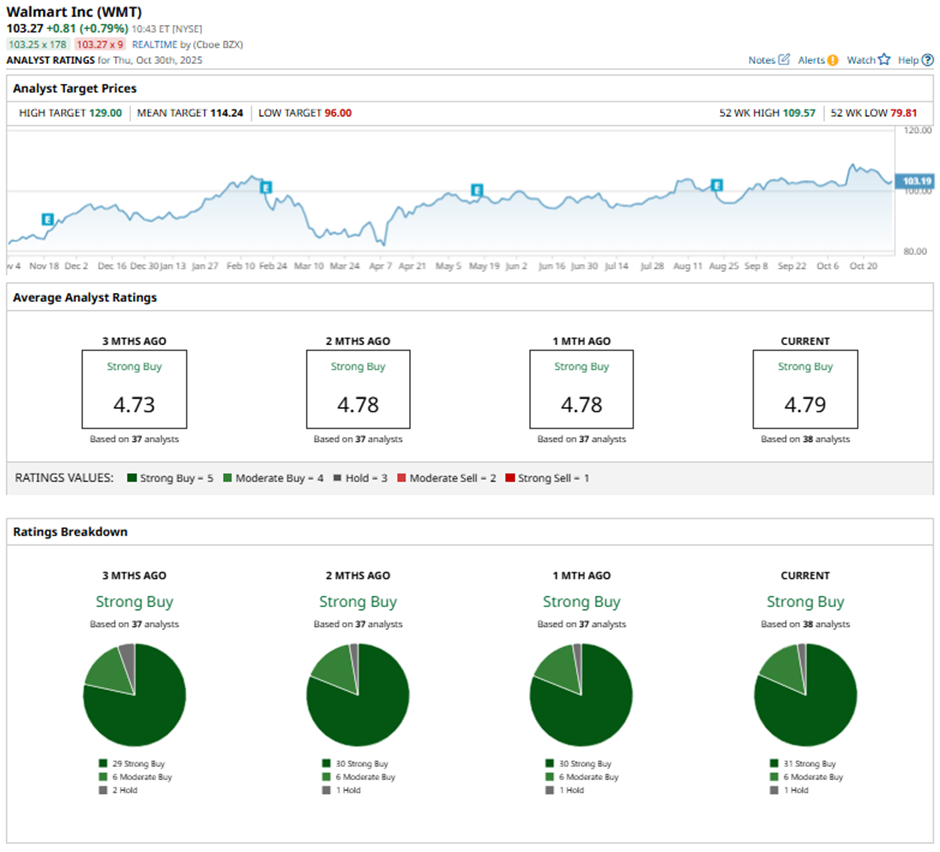

Among the 38 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 31 “Strong Buy” ratings, six “Moderate Buys,” and one “Hold.”

This configuration is more bullish than it was three months ago, when WMT had 29 “Strong Buys” in total.

On Oct. 30, RBC Capital analyst Steven Shemesh reaffirmed a “Buy” rating on Walmart, maintaining a price target of $116.

The mean price target of $114.24 represents a 10.6% premium to WMT’s current price levels. The Street-high price target of $129 suggests a 24.9% potential upside.