Valued at a market cap of $47.8 billion, Target Corporation (TGT) is one of the largest retail chains in the U.S., operating a wide network of general merchandise stores. Based in Minneapolis, Minnesota, the company is known for its affordable yet stylish product offerings and sells a mix of private-label and national brands across categories like apparel, home goods, electronics, and groceries.

Shares of this discount behemoth have considerably lagged behind the broader market over the past 52 weeks. TGT has declined 17% over this time frame, while the broader S&P 500 Index ($SPX) has surged 15.4%. However, on a YTD basis, the stock is up 13.9%, compared to SPX’s 1.1% rise.

Narrowing the focus, TGT has also underperformed the VanEck Retail ETF’s (RTH) 11.2% rise over the past 52 weeks but has outpaced the ETF’s 6.8% uptick on a YTD basis.

On Jan. 22, Target announced a quarterly dividend of $1.14 per share, payable on Mar. 1 to shareholders of record as of Feb. 11, 2026, extending its dividend streak to 234 consecutive quarters since going public in 1967. The announcement reinforced investor confidence in the company’s financial stability, driving TGT shares up 1.5% in the next trading session.

For the year that ended in January 2026, analysts expect TGT’s EPS to decrease 17.6% year over year to $7.30. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in two of the last four quarters, while missing on two other occasions.

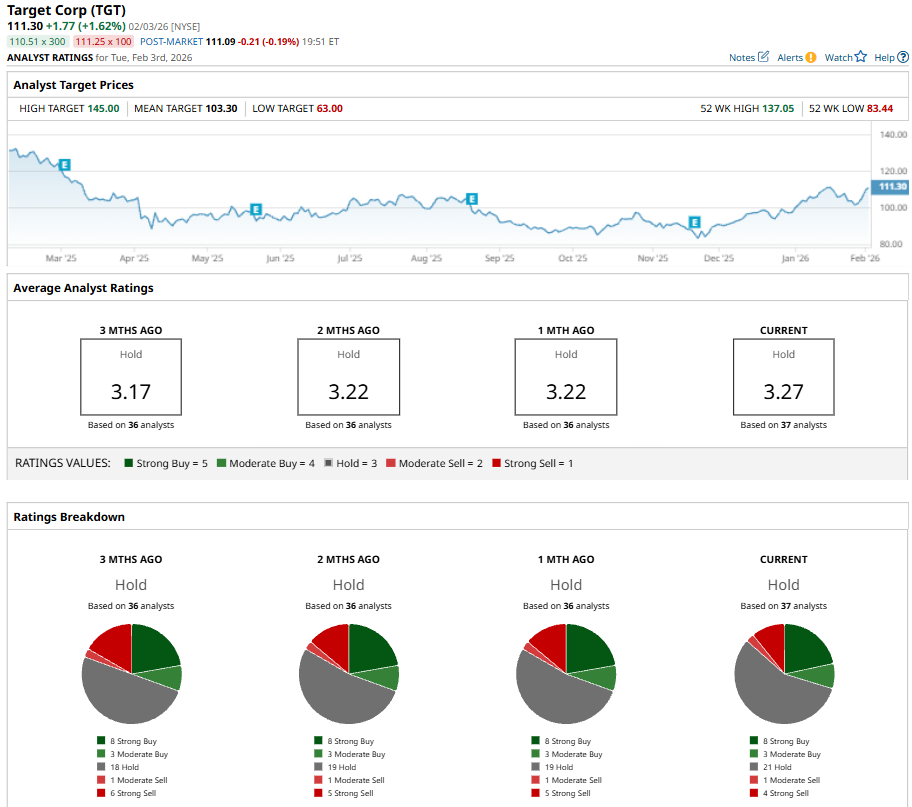

Among the 37 analysts covering the stock, the consensus rating is a “Hold” which is based on eight “Strong Buy,” three “Moderate Buy,” 21 “Hold,” one “Moderate Sell,” and four “Strong Sell” ratings.

On Feb. 3, Evercore ISI Group analyst Greg Melich raised its price target on Target from $95 to $100, a 5.26% increase, while maintaining its “In-Line” rating, signaling steady confidence in the stock’s outlook without a change in its overall investment stance.

While the stock currently trades above the mean price target of $103.30, the Street-high price target of $145 suggests an ambitious upside potential of 30.3%.