/Synchrony%20Financial%20site%20on%20phone-by%20madamF%20via%20Shutterstock.jpg)

With a market cap. of $26.6 billion, Synchrony Financial (SYF) provides a wide range of credit products, including credit cards, installment loans, and commercial financing, along with consumer banking and deposit products. It partners with major retailers, healthcare providers, and brands across industries such as retail, health and wellness, home, auto, and digital services.

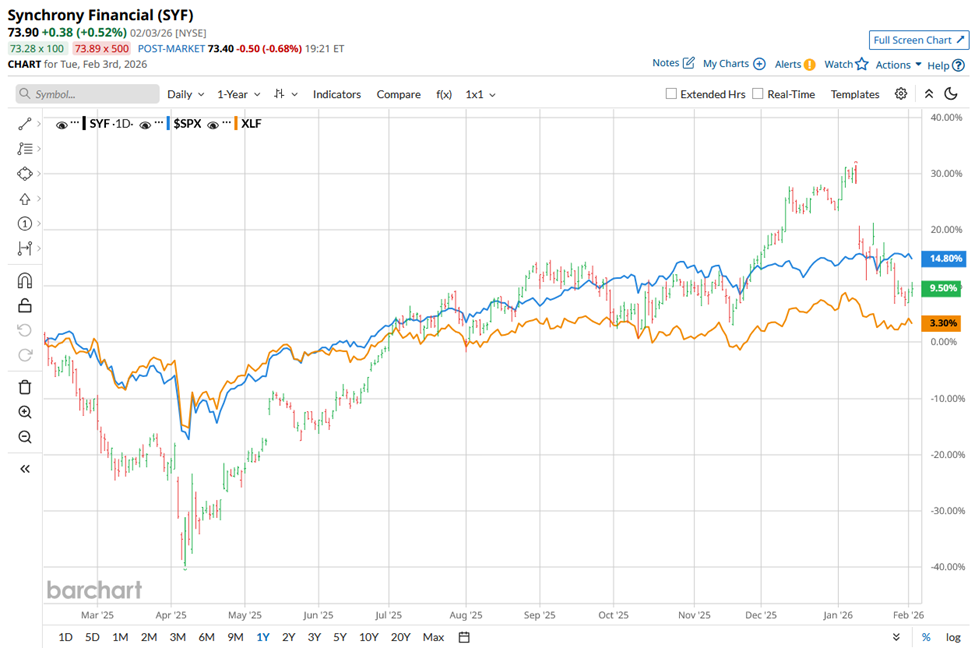

Shares of the Stamford, Connecticut-based company have lagged behind the broader market over the past 52 weeks. SYF stock has soared 13.2% over this time frame, while the broader S&P 500 Index ($SPX) has risen 14.8%. Moreover, shares of the company are down 10.6% on a YTD basis, compared to SPX’s 1.3% gain.

But narrowing the focus, SYF stock has outperformed the State Street Financial Select Sector SPDR ETF’s (XLF) 4.9% rise over the past 52 weeks.

Despite reporting better-than-expected Q4 2025 adjusted EPS of $2.18, Synchrony’s shares fell 5.8% on Jan. 27. The company forecast lower 2025 net revenue of $15.2 billion - $15.7 billion, citing moderating consumer spending, a 3% decline in purchase volume, and expected Federal Reserve rate cuts that could compress credit card margins. Additionally, adjusted revenue of $4.76 billion missed Street expectations, reinforcing concerns about slowing growth despite improvements in net interest income and credit-loss provisions.

For the fiscal year ending in December 2026, analysts expect SYF’s adjusted EPS to decline 1.4% year-over-year to $9.29. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

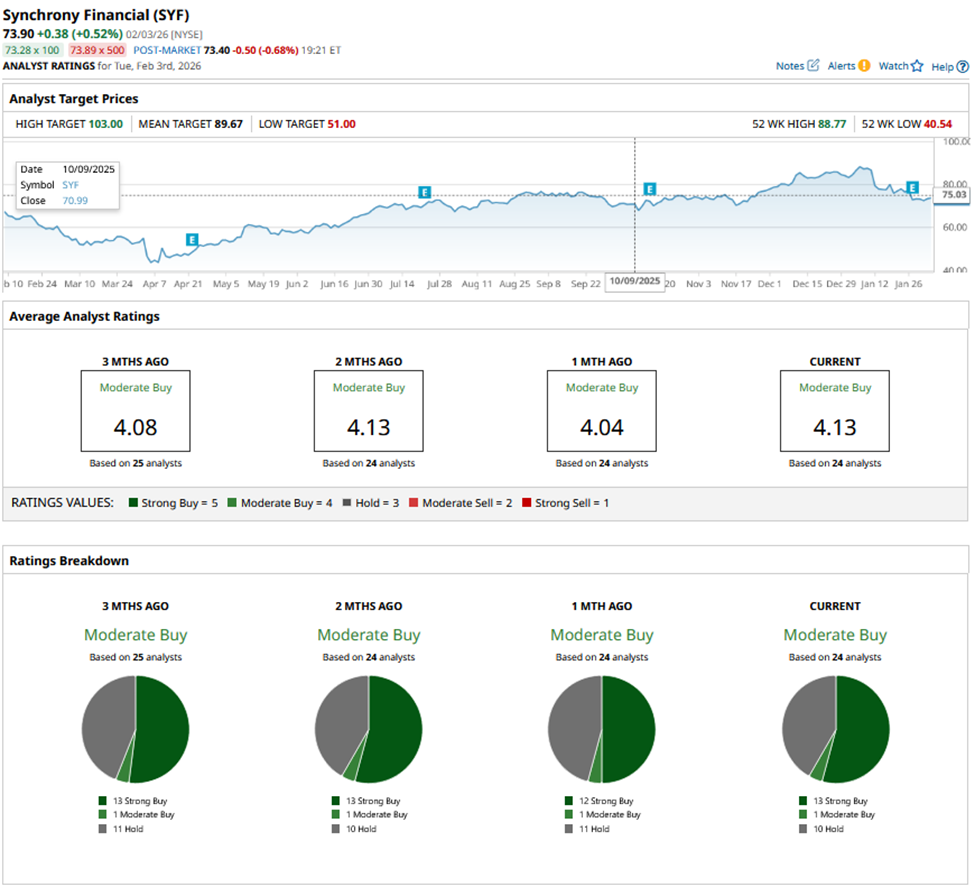

SYF stock has a consensus “Moderate Buy” rating overall. Of the 24 analysts covering the stock, opinions include 13 “Strong Buys,” one “Moderate Buy,” and 10 “Holds.”

On Jan. 28, Morgan Stanley analyst Jeffrey Adelson maintained a “Hold” rating on Synchrony Financial today and set a price target of $83.

The mean price target of $89.67 represents a premium of 21.3% to SYF's current levels. The Street-high price target of $103 implies a potential upside of 39.4% from the current price levels.