/Rollins%2C%20Inc_%20phone%20and%20website-%20by%20T_Schneider%20via%20Shutterstock.jpg)

Atlanta, Georgia-based Rollins, Inc. (ROL) is a premier global provider of consumer and commercial services. Valued at $28.1 billion by market cap, the company provides essential pest and wildlife control services and protection against termite damage, rodents and insects to residential and commercial customers.

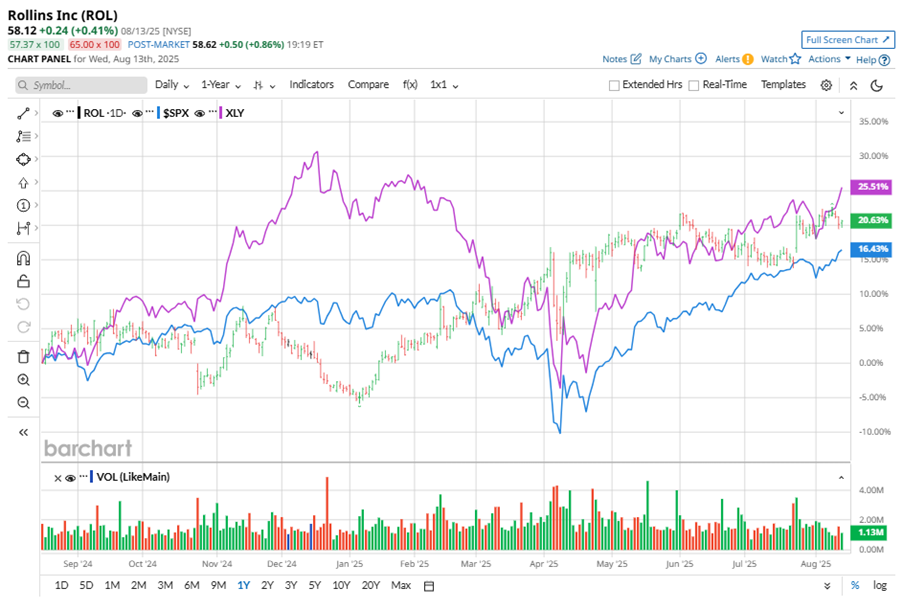

Shares of this global leader in route-based pest-control services have outperformed the broader market over the past year. ROL has gained 19.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19%. In 2025, ROL stock is up 25.4%, surpassing the SPX’s 10% rise on a YTD basis.

Narrowing the focus, ROL’s underperformance is apparent compared to the Consumer Discretionary Select Sector SPDR Fund (XLY). The exchange-traded fund has gained about 29.1% over the past year. However, ROL’s double-digit gains on a YTD basis outshine the ETF’s 2.5% returns over the same time frame.

Rollins’ success can be attributed to its effective use of technology and a careful approach to acquisitions. Innovations like BOSS and Orkin 2.0 have transformed ROL’s field operations, boosting customer satisfaction and reducing expenses. VRM and BizSuite have also improved scheduling and commercial sales. Additionally, ROL’s sound financial management, including a healthy cash reserve and no debt, has earned the trust of investors. With a record number of acquisitions in 2024 alone and a commitment to increasing dividends, ROL continues to impress and is poised for sustained growth in the future.

On Jul. 23, ROL reported its Q2 results, and shares closed up more than 5% in the following trading session. Its adjusted EPS of $0.30 surpassed Wall Street expectations of $0.29. The company’s revenue was $999.5 million, beating Wall Street forecasts of $979.4 million.

For the current fiscal year, ending in December, analysts expect ROL’s EPS to grow 12.1% to $1.11 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

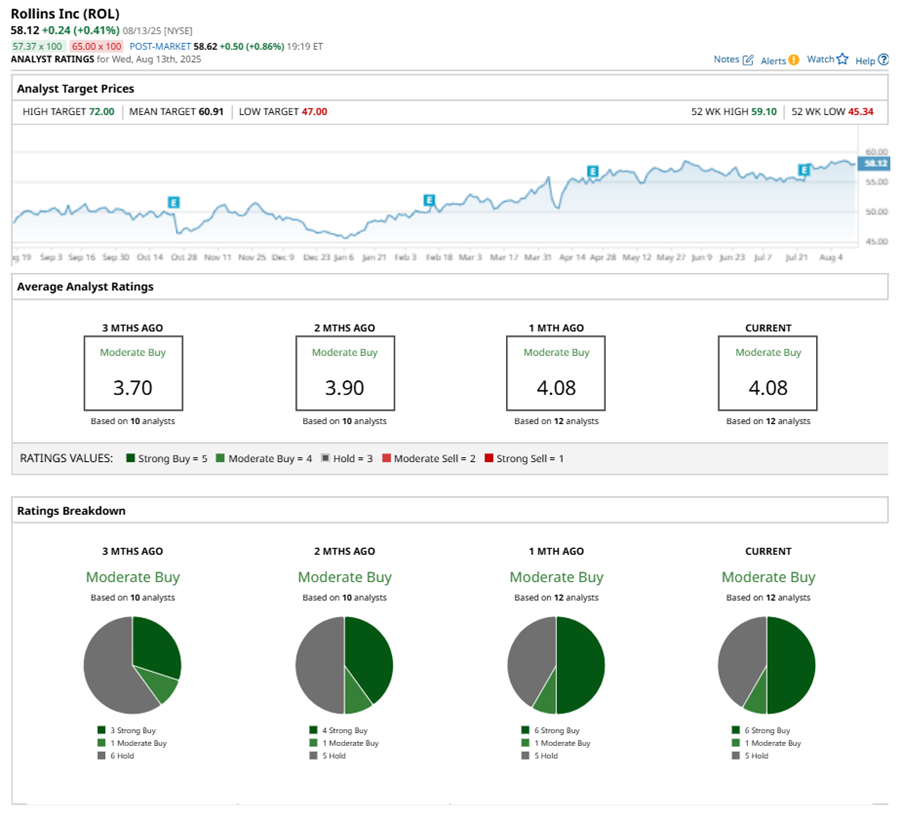

Among the 12 analysts covering ROL stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

This configuration is more bullish than two months ago, with four analysts suggesting a “Strong Buy.”

On Aug. 1, Brian McNamara from Canaccord Genuity maintained a “Hold” rating on ROL with a price target of $50.

The mean price target of $60.91 represents a 4.8% premium to ROL’s current price levels. The Street-high price target of $72 suggests an upside potential of 23.9%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.