Jericho, New York-based Kimco Realty Corporation (KIM) is a real estate investment trust (REIT) and leading owner and operator of high-quality, open-air, grocery-anchored shopping centers and mixed-use properties in the U.S. Valued at $14 billion by market cap, the company’s portfolio is strategically concentrated in the first-ring suburbs of the top major metropolitan markets, including high-barrier-to-entry coastal markets and rapidly expanding Sun Belt cities.

Shares of this leading grocery-anchored shopping center REIT have underperformed the broader market over the past year. KIM has declined 14% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.7%. In 2025, KIM’s stock fell 11.8%, compared to the SPX’s 16.3% rise on a YTD basis.

Narrowing the focus, KIM’s underperformance is also apparent compared to the Real Estate Select Sector SPDR Fund (XLRE). The exchange-traded fund has declined about 7% over the past year. Moreover, the ETF’s marginal returns on a YTD basis outshine the stock’s double-digit dip over the same time frame.

On Oct. 30, KIM shares closed down by 1.9% after reporting its Q3 results. Its FFO of $0.44 per share surpassed analyst expectations of $0.43 per share. The company’s revenue was $535.9 million, beating Wall Street forecasts of $524.3 million. KIM expects full-year FFO in the range of $1.75 to $1.76 per share.

For the current fiscal year, ending in December, analysts expect KIM’s FFO per share to grow 6.7% to $1.76 on a diluted basis. The company’s FFO surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

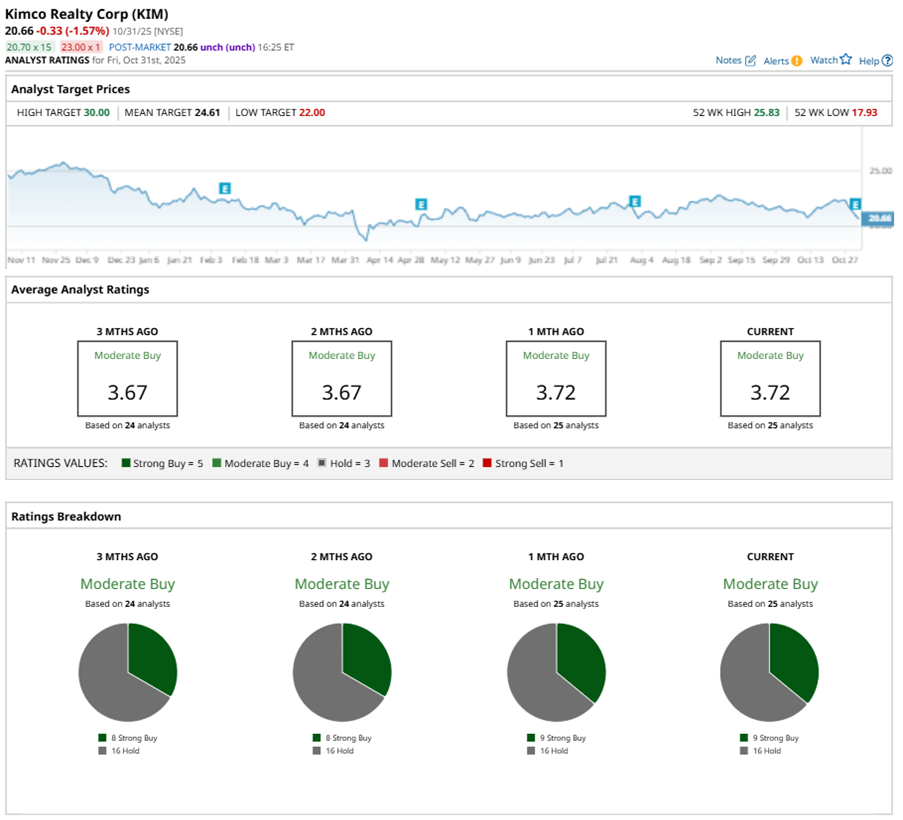

Among the 25 analysts covering KIM stock, the consensus is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, and 16 “Holds.”

This configuration is more bullish than two months ago, with eight analysts suggesting a “Strong Buy.”

On Oct. 31, Scotiabank analyst Greg McGinniss maintained a “Hold” rating on KIM and set a price target of $23, implying a potential upside of 11.3% from current levels.

The mean price target of $24.61 represents a 19.1% premium to KIM’s current price levels. The Street-high price target of $30 suggests an ambitious upside potential of 45.2%.