/Johnson%20Controls%20International%20plc%20logo%20on%20building-by%20Jonathan%20Weiss%20via%20Shutterstock.jpg)

With a market cap of $69.1 billion, Johnson Controls International plc (JCI) is a global leader in smart building technologies and integrated infrastructure solutions. The company designs, manufactures, and services advanced HVAC, fire and security systems, and energy efficiency solutions across commercial, industrial, and governmental sectors worldwide.

Shares of the Cork, Ireland-based company have outperformed the broader market over the past 52 weeks. JCI stock has climbed 52.1% over this time frame, while the broader S&P 500 Index ($SPX) has returned 16.6%. Moreover, shares of Johnson Controls are up over 33% on a YTD basis, compared to SPX’s 7.8% gain.

Focusing more closely, shares of the technology and industrial company have also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 20.2% increase over the past 52 weeks and a 15.4% YTD rise.

Despite Johnson Controls reporting stronger-than-expected Q3 2025 adjusted EPS of $1.05 and total revenue of $6.1 billion, shares tumbled 7.4% on Jul. 29. Organic orders rose just 2% year-over-year, signaling weaker demand momentum, especially with APAC orders declining 8%. Additionally, the Americas segment, its largest revenue contributor, posted flat reported sales and a 150 basis point decline in EBITA margin to 18.4%.

While the company raised its full-year adjusted EPS guidance to $3.65–$3.68, the muted Q4 organic sales growth outlook of "low single digits" and modest margin expansion targets likely fell short of investor expectations.

For the fiscal year ending in September 2025, analysts expect Johnson Controls’ adjusted EPS to decline marginally year-over-year to $3.68. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

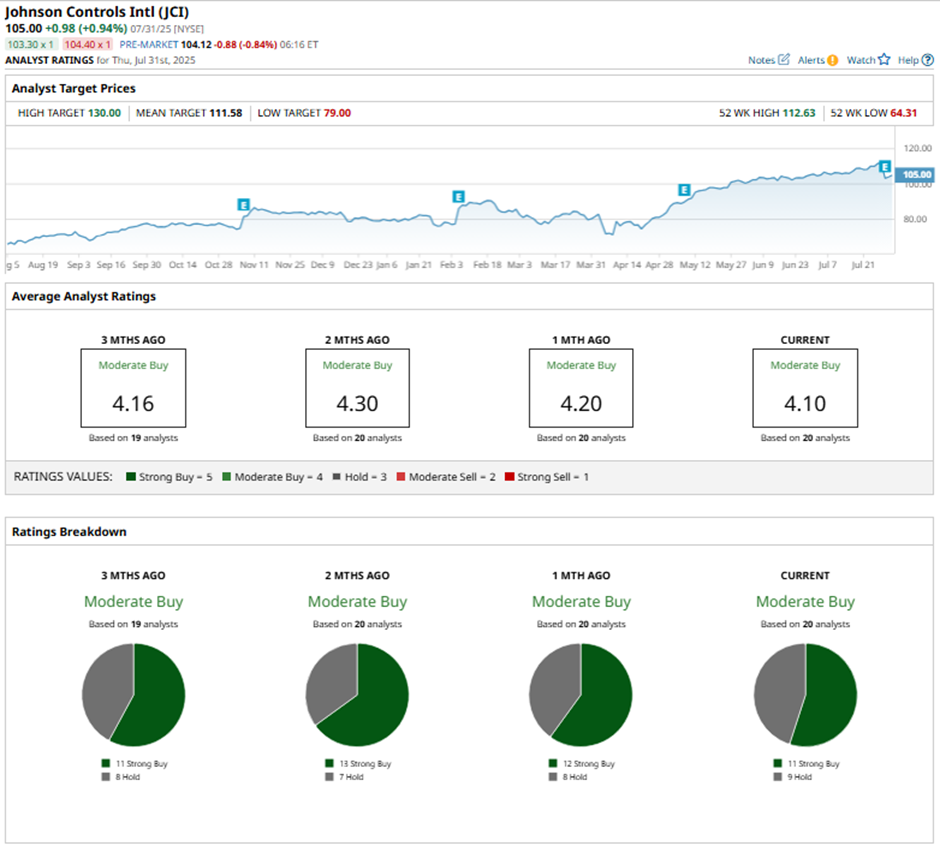

Among the 20 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 11 “Strong Buy” ratings and nine “Holds.”

On Jul. 30, Barclays raised its price target on Johnson Controls to $101 while maintaining an “Equal Weight” rating.

As of writing, the stock is trading below the mean price target of $111.58. The Street-high price target of $130 implies a potential upside of 23.8% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.