/Jabil%20Inc%20logo%20on%20building-by%20Michael%20Vi%20via%20Shutterstock.jpg)

Saint Petersburg, Florida-based Jabil Inc. (JBL) provides manufacturing services and solutions. With a market cap of $22.1 billion, the company offers digital prototyping, printed electronics, device integration, circuit designing, and volume board assembly services.

Shares of this leading manufacturing and supply chain management provider have considerably outperformed the broader market over the past year. JBL has gained 90.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, JBL’s stock rose 41.8%, surpassing the SPX’s 8.7% rise on a YTD basis.

Zooming in further, JBL’s outperformance is also apparent compared to the iShares U.S. Technology ETF (IYW). The exchange-traded fund has gained about 19.9% over the past year. Moreover, JBL’s gains on a YTD basis outshine the ETF’s 12.4% returns over the same time frame.

Jabil is outperforming due to strong growth in key areas, including cloud, data center infrastructure, and capital equipment, driven by rising demand for AI-related solutions. Its Intelligent Infrastructure segment, as well as the digital commerce and warehouse automation markets, also contributed to the positive performance.

On Jun. 17, JBL shares soared 8.9% after reporting its Q3 results. Its adjusted EPS of $2.55 exceeded Wall Street expectations of $2.33. The company’s revenue advanced 15.7% year-over-year to $7.8 billion. JBL expects full-year adjusted EPS to be $9.33, and its revenue is expected to be $29 billion.

For the current fiscal year, ending in August, analysts expect JBL’s EPS to grow 1.8% to $8.64 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

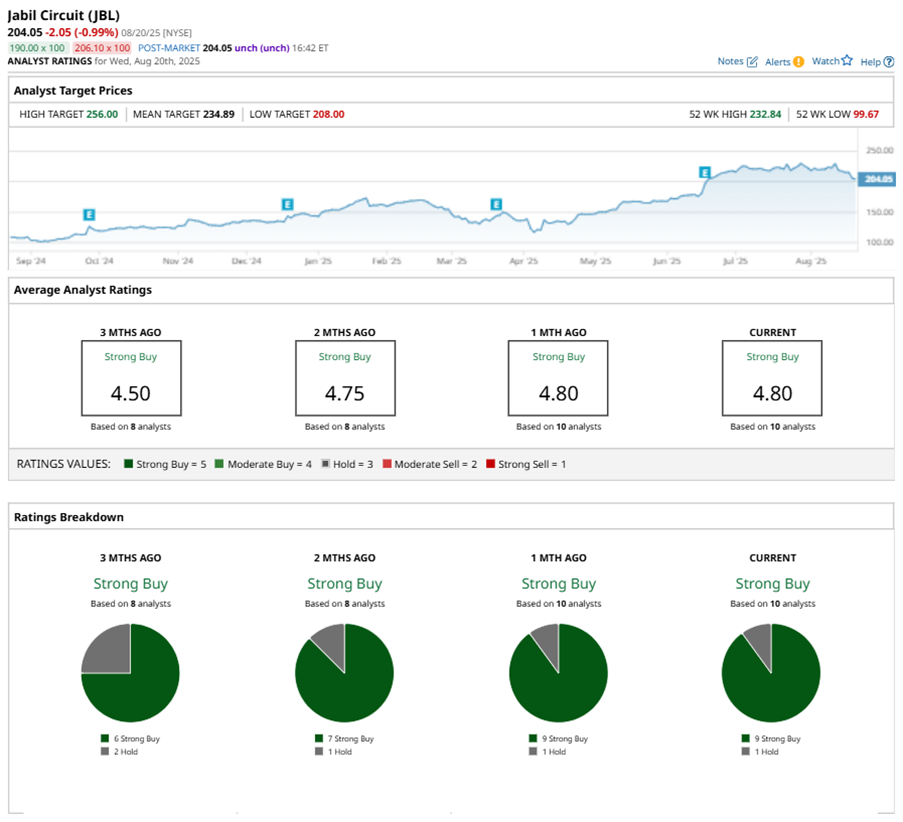

Among the 10 analysts covering JBL stock, the consensus is a “Strong Buy.” That’s based on nine “Strong Buy” ratings, and one “Hold.”

This configuration is more bullish than two months ago, with seven analysts suggesting a “Strong Buy.”

The mean price target of $234.89 represents a 15.1% premium to JBL’s current price levels. The Street-high price target of $256 suggests an upside potential of 25.5%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.