/Incyte%20Corp_%20office%20sign-by%20Bo%20Shen%20via%20iStock.jpg)

Incyte Corporation (INCY), headquartered in Wilmington, Delaware, discovers, develops, and commercializes therapeutics for hematology/oncology, as well as inflammation and autoimmunity areas. Valued at $16.7 billion by market cap, the company follows science to find solutions for patients with unmet medical needs.

Shares of this global biopharmaceutical company have outperformed the broader market over the past year. INCY has gained 35.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, INCY stock is up 23.7%, surpassing the SPX’s 9% rise on a YTD basis.

Zooming in further, INCY’s outperformance is also apparent compared to the iShares Biotechnology ETF (IBB). The exchange-traded fund has declined about 6.7% over the past year. Moreover, INCY’s double-digit returns on a YTD basis outshine the ETF’s 4.3% gains over the same time frame.

INCY is outperforming due to strong sales of its lead drug, Jakafi and the successful launch of Opzelura cream. Recent FDA approvals for new treatments, including Zynyz and Niktimvo, have also contributed to its success. Additionally, Incyte receives royalties from partnered drugs, such as Tabrecta and Olumiant, further enhancing its performance.

On Jul. 29, INCY shares closed up more than 10% after reporting its Q2 results. Its adjusted EPS of $1.57 topped Wall Street expectations of $1.39. The company’s revenue was $1.22 billion, exceeding Wall Street forecasts of $1.15 billion.

For the current fiscal year, ending in December, analysts expect INCY’s EPS to grow significantly to $5.06 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

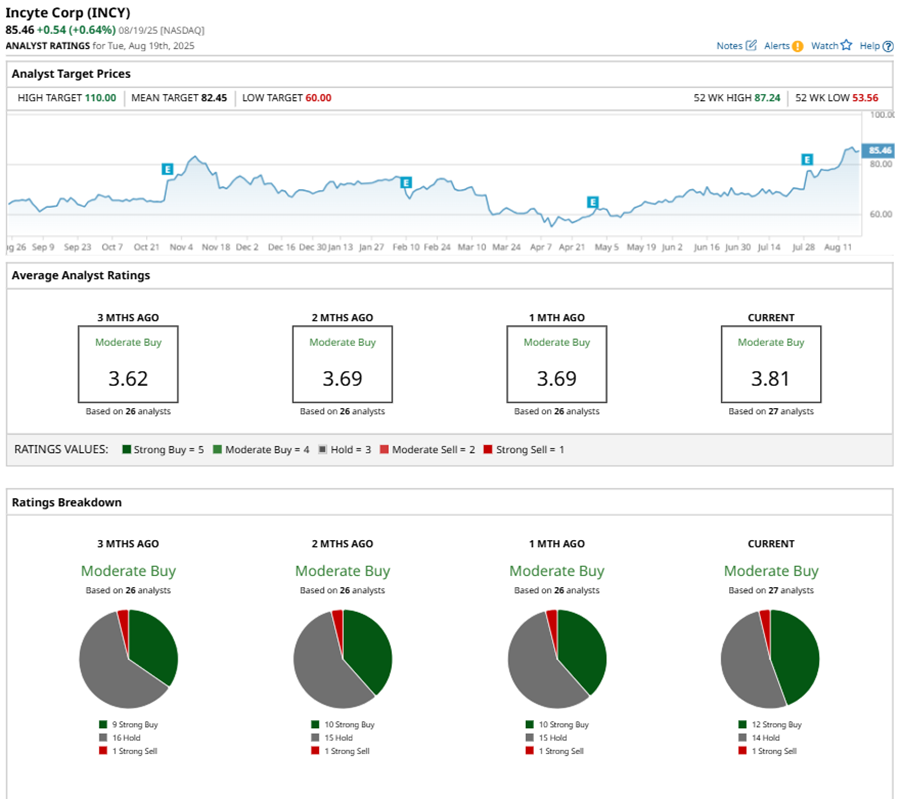

Among the 27 analysts covering INCY stock, the consensus is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, 14 “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with 10 analysts suggesting a “Strong Buy.”

On Aug. 13, Marc Frahm from TD Cowen maintained a “Buy” rating on INCY with a price target of $89, implying a potential upside of 4.1% from current levels.

While INCY currently trades above its mean price target of $82.45, the Street-high price target of $110 suggests a 28.7% upside potential.