/Howmet%20Aerospace%20Inc%20logoon%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Howmet Aerospace Inc. (HWM) is a major global supplier of engineered aerospace and transportation components. Headquartered in Pittsburgh, Pennsylvania, it operates through four key segments: Engine Products, Fastening Systems, Engineered Structures, and Forged Wheels. With a market cap of $74.4 billion, the company provides critical components such as jet engine parts, structural aerospace assemblies, and forged aluminum wheels. Its global customer base spans commercial aviation, defense, and various industrial markets.

Shares of HWM have substantially outperformed the broader market over the past 52 weeks. HWM has surged 94.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.5%. In 2025, shares of HWM are up 68.5%, compared to SPX’s 6.1% rise on a YTD basis.

Focusing more closely, Howmet Aerospace has also outpaced the SPDR S&P Aerospace & Defense ETF’s (XAR) 44.6% return over the past 52 weeks and a 29.2% YTD return.

On July 31, Howmet Aerospace shares fell 6.4% despite reporting strong fiscal Q2 2025 results. The company delivered record revenue of $2.05 billion, up 9% year-over-year, and exceeded expectations with adjusted EPS of $0.91, alongside notable margin expansion. It also generated $344 million in free cash flow, repurchased $275 million in stock, raised its dividend by 20%, and reduced debt. However, the market reaction was tempered by softness in the commercial transportation segment and concerns over the stock’s elevated valuation.

Analysts expect HWM’s EPS to grow 36.4% year-over-year to $3.67 in the current year ending in December 2025. The company's earnings surprise history is auspicious, as it topped the consensus estimates in all of the last four quarters.

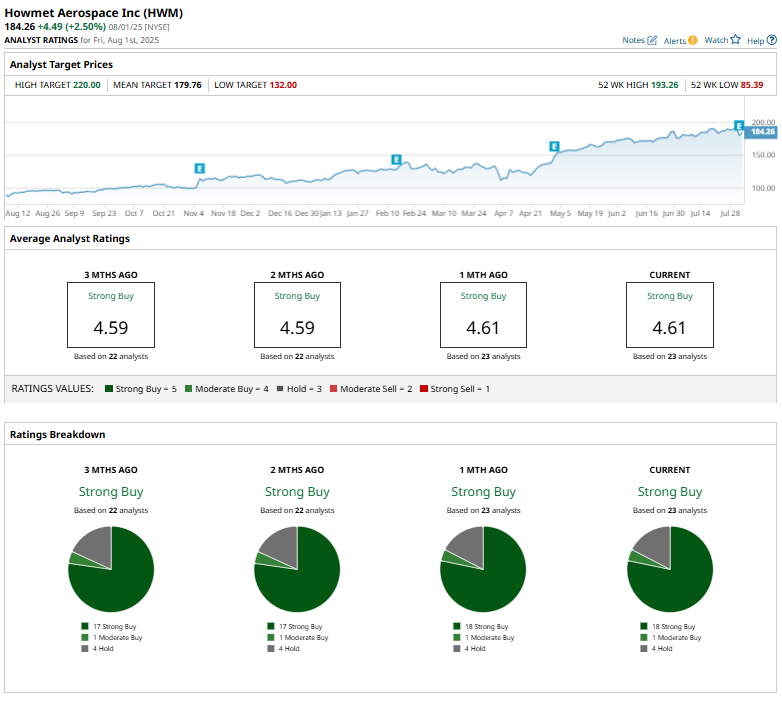

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, one “Moderate Buy,” and four “Holds.”

This configuration is more bullish than two months ago, with 17 “Strong Buy” ratings.

On Jul. 17, Morgan Stanley (MS) analyst Kristine Liwag raised the price target on Howmet Aerospace from $170 to $210 while maintaining an “Overweight” rating. The firm highlighted that aerospace stocks are trading at record-high multiples, reflecting the sector's resilience. Citing improving supply chains and steady air traffic demand, Morgan Stanley remains bullish on aerospace names with a balanced mix of aftermarket and original equipment exposure, positioning Howmet favorably within the industry.

While HWM currently trades above its mean price target of $179.76, its Street-high price target of $220 implies a potential upside of 19.4% from the current price levels.