/Home%20Depot%2C%20Inc_%20location%20by-hapabapa%20via%20iStock.jpg)

Atlanta, Georgia-based The Home Depot, Inc. (HD) operates as a home improvement retailer. Valued at $372.9 billion by market cap, the company offers a wide range of building materials, home improvement, lawn, and garden products, as well as provides DYI ideas, installation, repair, and other services.

Shares of this world's largest home improvement specialty retailer have underperformed the broader market over the past year. HD has declined 8.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15.5%. However, in 2026, HD stock is up 9.9%,surpassing SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, HD’s underperformance is also apparent compared to iShares U.S. Home Construction ETF (ITB). The exchange-traded fund has declined about 4.3% over the past year. However, HD’s returns on a YTD basis outshine the ETF’s 6.6% gains over the same time frame.

Home Depot's underperformance is due to a tough operating environment, driven by fewer storms impacting certain categories and ongoing consumer uncertainty, with housing pressure also expected to continue in Q4.

For the current fiscal year, ended in January, analysts expect HD’s EPS to decline 4.9% to $14.50 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

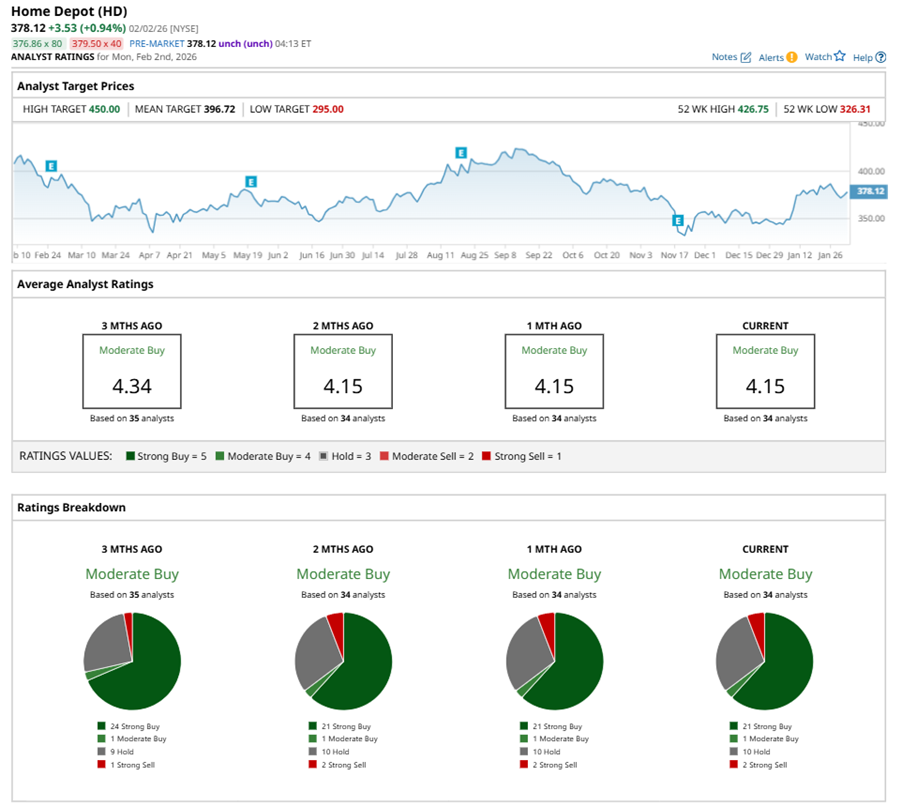

Among the 34 analysts covering HD stock, the consensus is a “Moderate Buy.” That’s based on 21 “Strong Buy” ratings, one “Moderate Buy,” 10 “Holds,” and two “Strong Sells.”

This configuration is less bullish than three months ago, with 24 analysts suggesting a “Strong Buy,” and one recommending a “Strong Sell.”

On Jan. 16, Truist Financial Corporation (TFC) kept a “Buy” rating on HD and raised the price target to $405, implying a potential upside of 7.1% from current levels.

The mean price target of $396.72 represents a 4.9% premium to HD’s current price levels. The Street-high price target of $450 suggests an upside potential of 19%.