The Houston, Texas-based EOG Resources, Inc. (EOG) is a premier oil and gas producer with a footprint stretching across major shale basins and Trinidad. Valued at roughly $60.8 billion, the company controls about 535,000 net acres in Eagle Ford and 160,000 in Dorado, while concentrating on high-return Wolfcamp, Bone Spring, and Leonard plays spanning oil, NGLs, and natural gas.

Over the past 52 weeks, EOG Resources’ shares slipped 13.6%, underperforming the S&P 500 Index ($SPX), which rose 14.3%. The short-term picture looks brighter, however, as the EOG stock has climbed 6.8% year-to-date (YTD), comfortably outpacing the index’s modest 1.4% gain.

Compared with its sector, EOG stock is trailing behind the State Street Energy Select Sector SPDR ETF (XLE) which has gained 13.2% over the past 52 weeks and 14.2% YTD.

However, price performance improved following the Nov. 6, 2025, Q3 2025 earnings release. The stock rose marginally on Nov. 7, 2025, and added 1.1% in the following trading session. During the quarter, revenue declined 2% year over year to $5.85 billion, slightly missing analyst estimates of $5.95 billion. Adjusted EPS also fell 6.2% from the year-ago value to $2.71 but surpassed the $2.43 analyst estimate.

Oil, NGL, and natural gas production came in above guidance midpoints, while the company generated $1.4 billion in free cash flow during the three-month period. Management also returned $545 million through dividends and repurchased $440 million in shares, reinforcing investor confidence and supporting the stock’s upward move even amid modest top-line weakness.

For fiscal year 2025, which ended in December, analysts pencil in diluted EPS of $10.11, a projected 13% year-over-year drop. Yet EOG has made a habit of outdelivering, topping earnings estimates in each of the past four quarters.

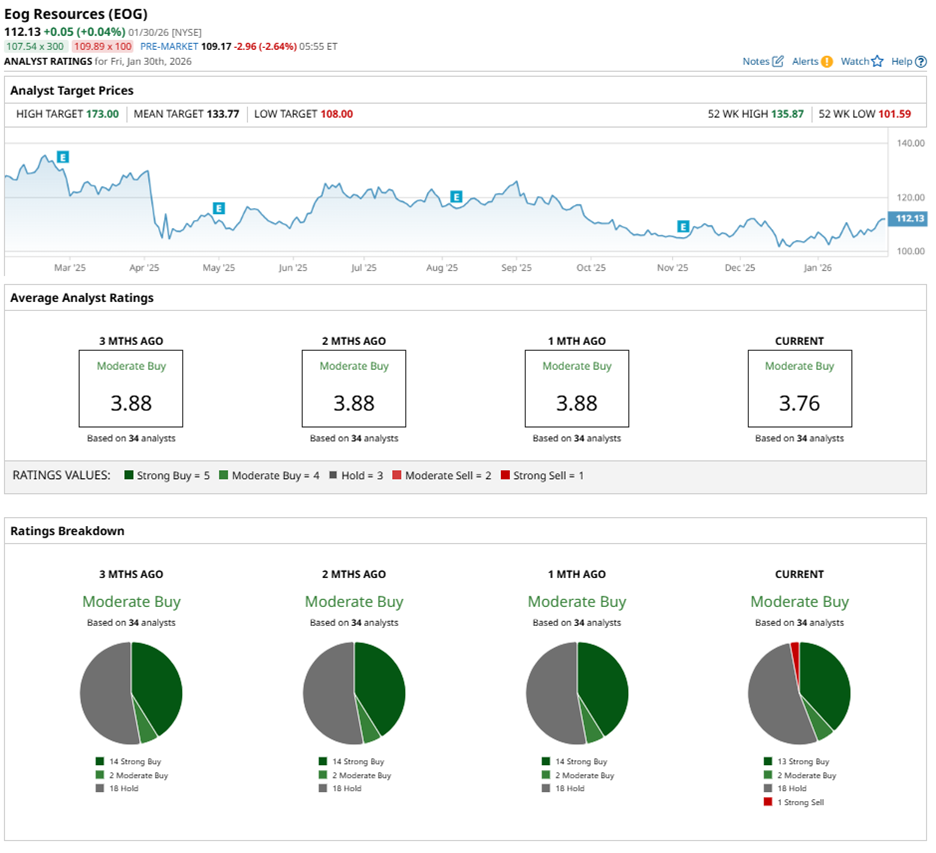

Wall Street maintains a positive outlook on EOG stock. Among 34 analysts, the consensus rating stands at “Moderate Buy,” comprising 13 “Strong Buy” ratings, two “Moderate Buy” calls, 18 “Hold” recommendations, and a single “Strong Sell.”

The current analyst sentiment has changed little over the past three months, when 14 analysts also labeled the stock a “Strong Buy.”

On Jan. 26, investment and trading firm Susquehanna trimmed its price target on EOG stock from $161 to $151 while maintaining a “Positive” rating. The firm cited a supply glut and softer demand weighing on oil prices, prompting a reduction in its 2026 WTI assumption from $65 to $60 per barrel. Even so, it remains optimistic about long-term natural gas demand tied to data centers and electrification.

That being said, the average price target of $133.77 implies potential upside of 19.3%, while the Street-high target of $173 suggest a gain of 54.3% from current levels.