Dominion Energy, Inc. (D) is a Richmond, Virginia-based utility company that provides electricity and natural gas to millions of customers, primarily in the Mid-Atlantic and Southeastern regions. Valued at a market cap of $52.1 billion, the company operates through segments like Power Delivery, Gas Distribution, and Dominion Energy Virginia.

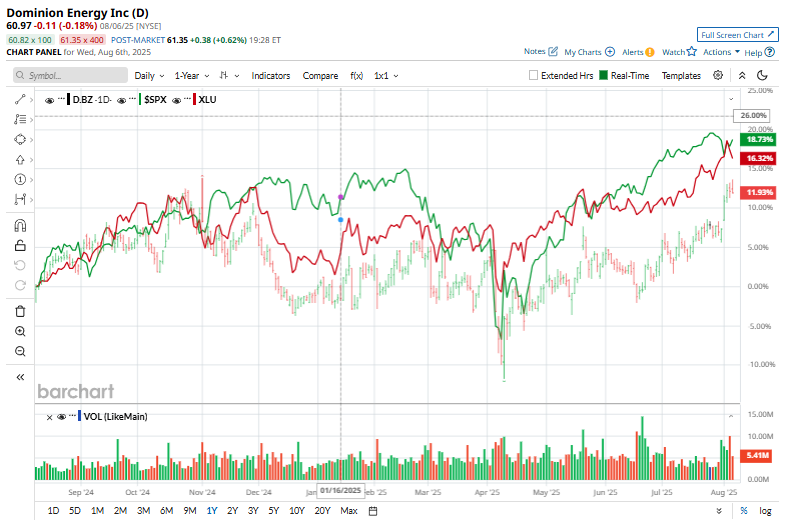

This utility company has lagged behind the broader market over the past 52 weeks. Shares of D have gained 12.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.1%. However, on a YTD basis, the stock is up 13.2%, outpacing SPX’s 7.9% upstick.

Narrowing the focus, D has also underperformed the Utilities Select Sector SPDR Fund’s (XLU) 17.5% uptick over the past 52 weeks and 17.5% rise on a YTD basis.

On Aug. 1, Dominion Energy released its second-quarter earnings, and its shares surged 3.4%. Its non-GAAP earnings reached $0.75 per share, reflecting a 14.5% year-over-year increase, which matched expectations. Revenue climbed 9.3% to $3.81 billion, slightly below forecasts by about $40 million. The company maintained its full-year 2025 earnings guidance of $3.28 to $3.52 per share.

For the current fiscal year, ending in December, analysts expect D’s EPS to grow 22.4% year over year to $3.39. The company’s earnings surprise history is robust. It topped the consensus estimates in each of the last four quarters.

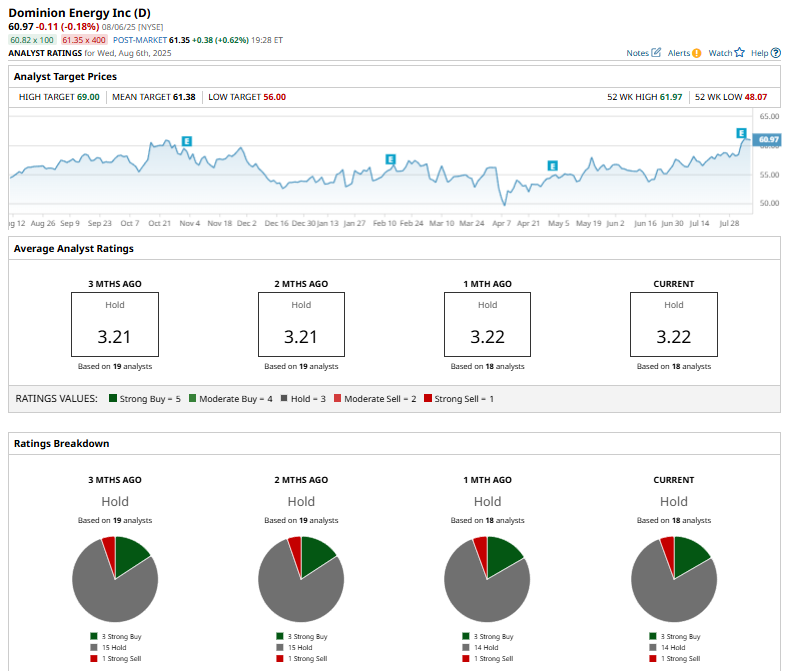

Among the 18 analysts covering the stock, the consensus rating is a “Hold,” which is based on three “Strong Buy,” 14 “Hold,” and one “Strong Sell” rating.

On July 15, JPMorgan Chase & Co. (JPM) analyst Jeremy Tonet reaffirmed an "Underweight" rating on Dominion Energy, citing a consistent strategic outlook. However, the firm raised its price target from $53 to $56.

The mean price target of $61.38 represents a marginal premium from D’s current price levels, and the Street-high price target of $69 suggests an upside potential of 13.2%.