Constellation Brands, Inc. (STZ) is a top name in the beverage alcohol sector, based in Victor, New York. The company’s core offerings span three major categories: beer, wine, and spirits. Its beer lineup features well-known imports like Modelo, Corona, and Pacifico. In the wine segment, it owns premium labels such as Meiomi, Kim Crawford, and Robert Mondavi.

The spirits portfolio includes names like SVEDKA Vodka and High West Whiskey. With operations mainly across the U.S., Canada, and Mexico, Constellation focuses on innovation, premiumization, and sustainability, positioning itself as a significant global competitor in the evolving alcoholic beverage market. The company has a market capitalization of $29.55 billion.

But despite its reach, the company’s price performance paints a grim picture. The beverage stock has declined by 33.2% over the past 52 weeks, while it is down 25.9% year-to-date (YTD). It has broadly underperformed the S&P 500 Index ($SPX), which has gained 14.3% and 9.5% over the same periods, respectively.

The overall consumer staples sector has also been performing better than Constellation Brands’ stock. The Consumer Staples Select Sector SPDR Fund (XLP) has declined marginally over the past 52 weeks and has gained 3.1% YTD.

The stock’s underperformance this year can be attributed to weak consumer demand, concerns over tariffs, and overall economic uncertainties. And that weakness was reflected in Constellation Brands' first-quarter results for fiscal 2026 (the quarter that ended on May 31), reported on Jul. 1. The company’s net sales declined by 5.5% year-over-year (YOY) to $2.52 billion, falling short of the Wall Street analysts’ expected figure of $2.57 billion.

Its adjusted EPS dropped by 9.8% from its year-ago value to $3.22, also missing the analyst estimate of $3.34. Despite this, Constellation Brands’ stock gained 4.5% intraday on Jul. 2. That’s because the company still forecasts growth in its fiscal year 2026 outlook. It is now expected to report either a decline of 2% or an increase of up to 1% organically. Its beer business is forecasted to report flat to 3% growth in net sales.

For the fiscal year 2026, ending in February 2026, Wall Street analysts expect Constellation Brands’ EPS to decline by 8.5% YOY to $12.61 on a diluted basis, but grow by 8.6% to $13.69 in fiscal 2027. The company has a mixed history of surpassing consensus estimates, topping them in two of the trailing four quarters and missing them on two other occasions.

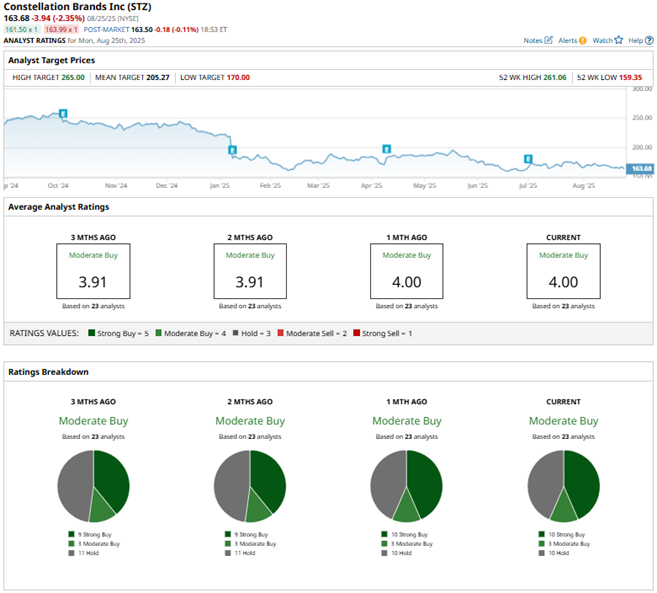

Among the 23 Wall Street analysts covering Constellation Brands’ stock, the consensus is a “Moderate Buy.” That’s based on 10 “Strong Buy” ratings, three “Moderate Buy” ratings, and 10 “Hold” ratings.

The configuration of the ratings is more bullish than it was two months ago, with 10 “Strong Buy” ratings now, up from nine previously.

In July, analysts at Jefferies upgraded Constellation Brands’ rating from “Hold” to “Buy.” They also raised the price target on the stock to $205, based on the fact that the analyst firm believes that the company’s valuation is too low and that the pressures on its core customer base seem to be stabilizing.

Constellation Brands’ mean price target of $205.27 indicates a 25.4% upside over current market prices. The Street-high price target of $265 implies a potential upside of 61.9%.

On the date of publication, Anushka Mukherjee did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.