/Cincinnati%20Financial%20Corp_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of around $24 billion, Cincinnati Financial Corporation (CINF) provides a broad range of property casualty, life, and specialty insurance products in the United States. The company operates through five segments: Commercial Lines; Personal Lines; Excess and Surplus Lines; Life Insurance; and Investments, supported by its insurance and financial subsidiaries.

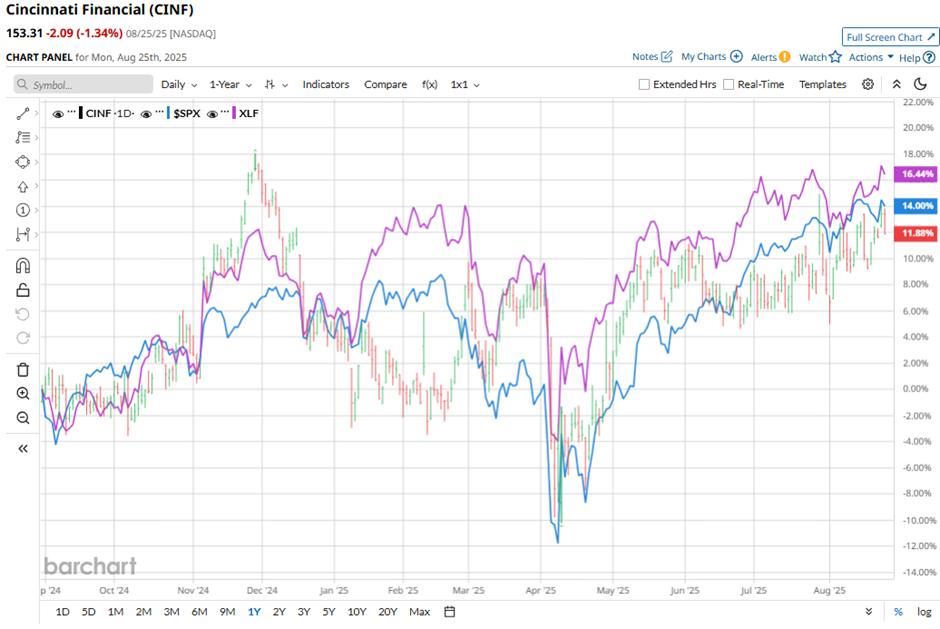

Shares of the Fairfield, Ohio-based company have slightly outperformed the broader market over the past 52 weeks. CINF stock has increased 15.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. However, shares of the company are up 6.7% on a YTD basis, lagging behind SPX’s 9.5% gain.

Furthermore, the insurer stock has underperformed the Financial Select Sector SPDR Fund’s (XLF) 19.4% return over the past 52 weeks.

Cincinnati Financial shares rose 3.6% following its Q2 2025 results on Jul. 28, after profit more than doubled to $685 million, or $4.34 per share, compared with $312 million, or $1.98 per share, a year earlier. Adjusted EPS of $1.97 topped Wall Street’s estimate, supported by a 15% increase in earned premiums to $2.5 billion and investment income surged 18% to $285 million on higher bond yields. Total revenue came in at $3.3 billion, matching forecasts and underscoring steady insurance demand.

For the fiscal year ending in December 2025, analysts expect CINF’s adusted EPS to decline 22.6% year-over-year to $5.87. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

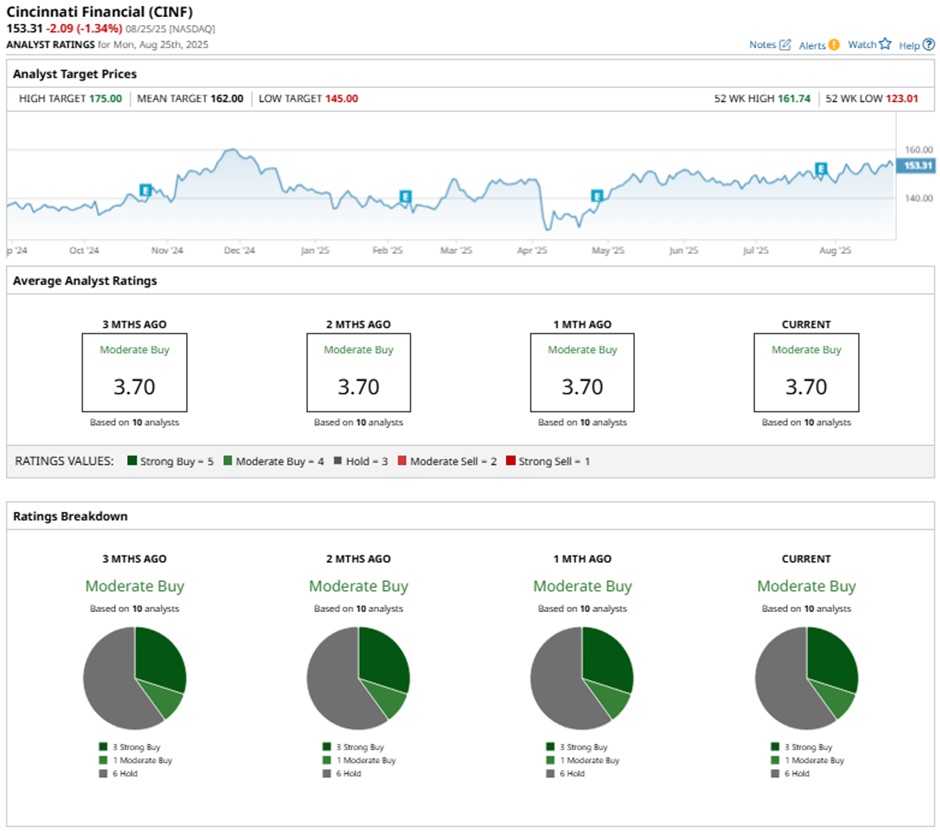

Among the 10 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” and six “Holds.”

On Aug. 5, Keefe Bruyette raised its price target on Cincinnati Financial to $168 while maintaining an “Outperform” rating.

The mean price target of $162 represents a 5.7% premium to CINF’s current price levels. The Street-high price target of $175 suggests a 14.1% potential upside.