/Carnival%20Corp_%20logo%20at%20night%20by-%20JHVEPhoto%20via%20Shutterstock.jpg)

With a market cap of $34.3 billion, Carnival Corporation & plc (CCL) is the world’s largest cruise company, providing leisure travel experiences across North America, Australia, Europe, and other international markets. Operating under well-known brands such as Carnival Cruise Line, Princess Cruises, Holland America Line, and Cunard, the company carries nearly half of global cruise guests.

Shares of the Miami, Florida-based company have outperformed the broader market over the past 52 weeks. CCL stock has gained 27.1% over this time frame, while the broader S&P 500 Index ($SPX) has increased 18.3%. However, shares of the company are up 11.8% on a YTD basis, lagging behind SPX’s 17.2% rise.

Focusing more closely, shares of the cruise operator have outpaced the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.8% return over the past 52 weeks.

Despite beating Q3 2025 expectations with adjusted EPS of $1.43 and revenue of $8.15 billion, Carnival Corp shares fell nearly 4% on Sept. 29. The company projected cruise costs (excluding fuel) to rise 3.3% for the year and warned that heavier 2026 dry dock and destination investments could impact earnings growth.

For the fiscal year ending in November 2025, analysts expect CCL’s adjusted EPS to climb 52.8% year-over-year to $2.17. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

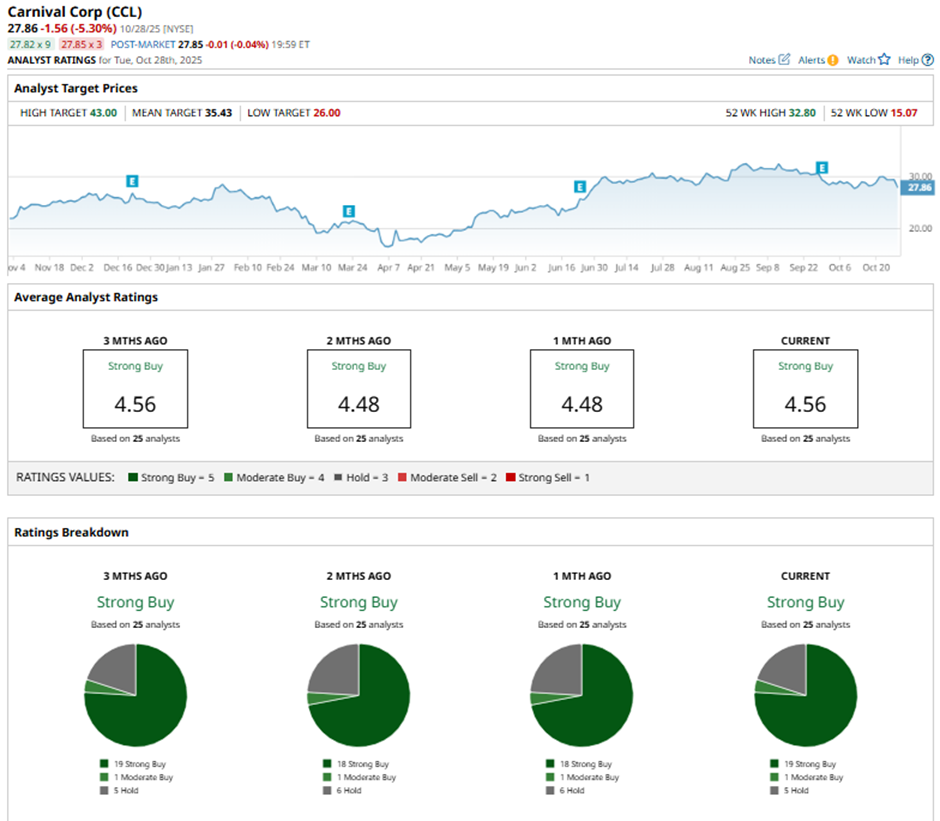

Among the 25 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings, one “Moderate Buy,” and five “Holds.”

On Oct. 1, Citi raised its price target on Carnival to $38 and maintained a “Buy” rating.

The mean price target of $35.43 represents a premium of 27.2% to CCL's current price. The Street-high price target of $43 suggests a 54.3% potential upside.