/Carmax%20Inc%20storefront%20by-jetcityimage%20via%20iStock.jpg)

Valued at a market cap of $8.7 billion, CarMax, Inc. (KMX) is a leading retailer of used vehicles and related products. The Richmond, Virginia-based company offers customers a broad selection of domestic, imported, luxury, hybrid, and electric vehicles. Additionally, it offers vehicle financing, extended protection plans, reconditioning services, and repair services.

This used vehicle retailer has significantly lagged behind the broader market over the past 52 weeks. Shares of CarMax have declined 27.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.4%. Moreover, on a YTD basis, the stock is down 29.4%, compared to SPX’s 9.7% surge.

Narrowing the focus, KMX has also considerably underperformed the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 24.8% uptick over the past 52 weeks and 1.8% YTD rise.

On Jun. 20, CarMax’s shares surged 6.6% following its better-than-expected Q1 earnings release. Primarily due to a 7.5% rise in used vehicle sales, the company reported overall revenue of $7.5 billion, up 6.1% from the same period last year and marginally above the consensus estimates. Moreover, this solid top-line performance, along with a 70-basis-point expansion in gross profit margin, contributed to a notable 42.3% year-over-year increase in its net income to $1.38 per share, which topped the consensus estimates by an impressive margin of 16.9%.

For the current fiscal year, ending in February 2026, analysts expect KMX’s EPS to grow 19.3% year over year to $3.90. The company’s earnings surprise history is mixed. It met or exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

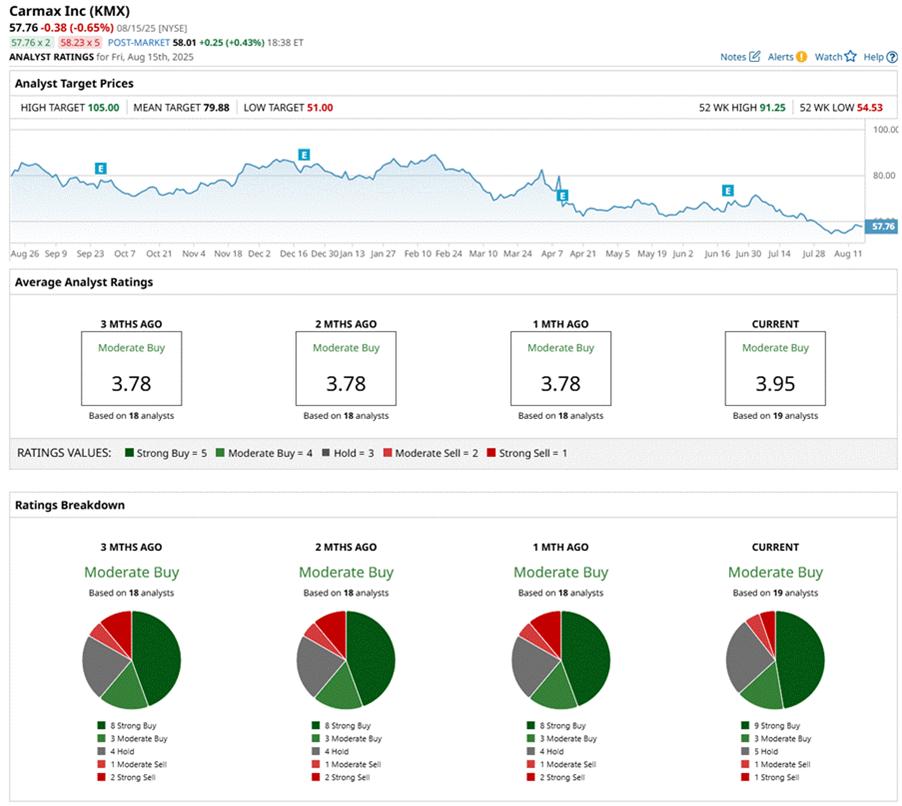

Among the 19 analysts covering the stock, the consensus rating is a "Moderate Buy” which is based on nine “Strong Buy,” three "Moderate Buy," five “Hold,” one "Moderate Sell,” and one “Strong Sell” rating.

This configuration is more bullish than a month ago, with eight analysts suggesting a “Strong Buy” rating, and two recommending a “Strong Sell.”

On Aug. 12, Evercore Inc. (EVR) analyst Michael Montani maintained a "Buy" rating on KMX and set a price target of $80, implying a 38.5% potential upside from the current levels.

The mean price target of $79.88 represents a 38.3% premium from KMX’s current price levels, while the Street-high price target of $105 suggests an ambitious upside potential of 81.8%.