/Capital%20One%20Financial%20Corp_%20bank%20exterior-by%20Brett_Hondow%20via%20iStock.jpg)

With a market cap of $138.3 billion, Capital One Financial Corporation (COF) is a leading financial services holding company serving consumers, small businesses, and commercial clients in the U.S., Canada, and the U.K. Through its subsidiaries, the company operates across Credit Card, Consumer Banking, and Commercial Banking segments, offering a wide range of lending, deposit, and financial management solutions.

The McLean, Virginia-based company's shares have outperformed the broader market over the past 52 weeks. COF stock has climbed 54.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.1%. In addition, shares of Capital One Financial are up 21.2% on a YTD basis, compared to SPX’s 9.7% gain.

Looking closer, the credit card issuer and bank stock have also outpaced the Financial Select Sector SPDR Fund’s (XLF) nearly 20% return over the past 52 weeks.

Shares of Capital One rose 2.5% following its Q2 2025 results on Jul. 22, 2025. The company reported adjusted EPS of $5.48 and adjusted revenue of $12.5 billion, both exceeding Wall Street expectations, boosted by higher interest income on credit card debt and increased fee income. The company also completed its acquisition of Discover, making it the largest U.S. credit card issuer by balances, which investors viewed as a long-term growth driver.

For the fiscal year ending in December 2025, analysts expect COF’s adjusted EPS to grow 19.3% year-over-year to $16.66. The company’s earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

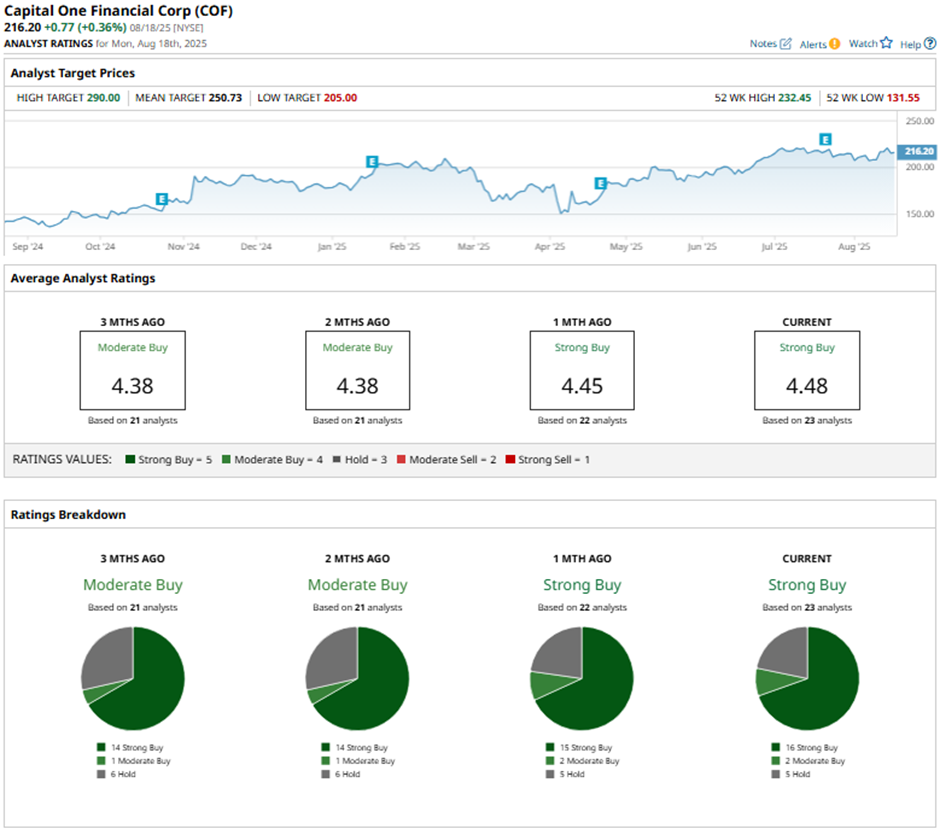

Among the 23 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 16 “Strong Buy” ratings, two “Moderate Buys,” and five “Holds.”

On Aug. 15, BofA Securities analyst Mihir Bhatia raised its price target on Capital One Financial to $245 while maintaining a “Buy” rating.

As of writing, the stock is trading below the mean price target of $250.73. The Street-high price target of $290 implies a potential upside of 34.1% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.