/C_H_%20Robinson%20Worldwide%2C%20Inc_%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

C.H. Robinson Worldwide, Inc. (CHRW), headquartered in Eden Prairie, Minnesota, is a leading global logistics and transportation company. Valued at a market cap of $13.8 billion, it specializes in freight brokerage, supply chain management, and third-party logistics (3PL), efficiently linking shippers with a vast network of carriers worldwide.

Over the past 52 weeks, shares of C.H. Robinson have returned 18%, slightly underperforming the broader S&P 500 Index’s ($SPX) 19.3% rally. However, the stock is up 12.5% in 2025, surpassing SPX’s 8.4% rise on a YTD basis.

Narrowing the focus, CHRW stock has outpaced the Pacer Industrials and Logistics ETF’s (SHPP) 7.7% climb over the past year and 5.6% return in 2025.

C.H. Robinson announced a strong Q2 2025 performance on July 30, with earnings of $1.29 per share beating estimates by nearly 10%. Net income rose 20.8% to $152.5 million, supported by a 21% increase in operating income and improved cash flow from operations. The company emphasized its focus on digital transformation and AI-driven logistics tools to boost efficiency. While revenue declined 7.7% year-over-year to $4.14 billion, the stock popped over 18% following the earnings release.

For the current fiscal year ending in December, analysts expect C.H. Robinson’s EPS to climb 9.1% to $4.92. The company’s earnings surprise history is robust. It beat the consensus estimates in the last four quarters.

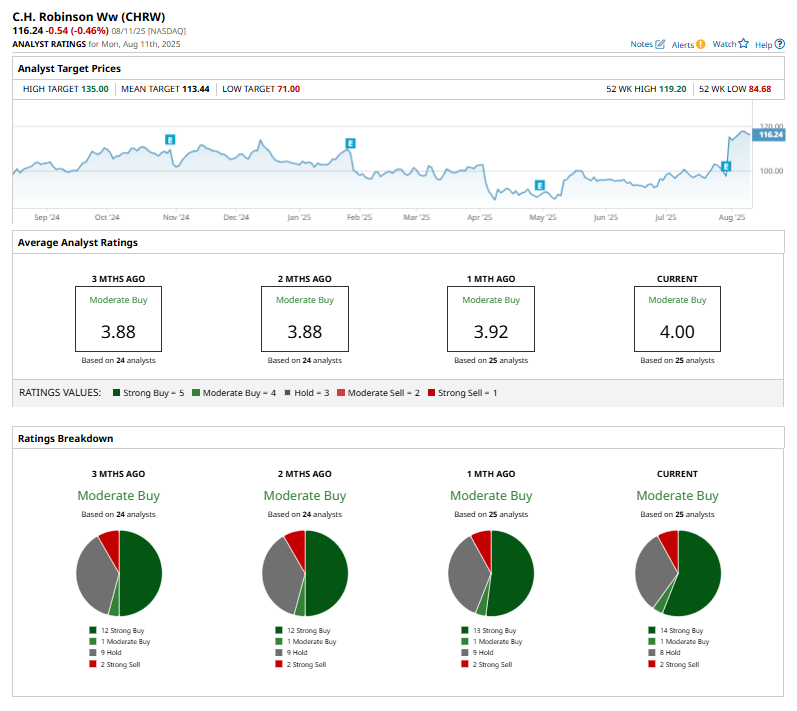

Among the 25 analysts covering CHRW stock, the consensus rating is a “Moderate Buy.” The current rating is based on 14 “Strong Buys”, one “Moderate Buy,” eight “Holds,” and two “Strong Sells.”

This configuration is more bullish than a month ago, when the stock had 13 “Strong Buys.”

On July 31, Stifel analyst J. Bruce Chan reaffirmed a "Buy" rating on C.H. Robinson Worldwide and raised the price target by 2.78%, from $108 to $111, reflecting continued confidence in the stock’s prospects.

While the stock currently trades above the mean price target of $113.44, its Street-high target of $135 suggests a potential upside of 16.1% from the current market prices.