Valued at a market cap of $87.6 billion, Automatic Data Processing, Inc. (ADP) is a Roseland, New Jersey-based company that provides cloud-based human capital management (HCM) solutions.

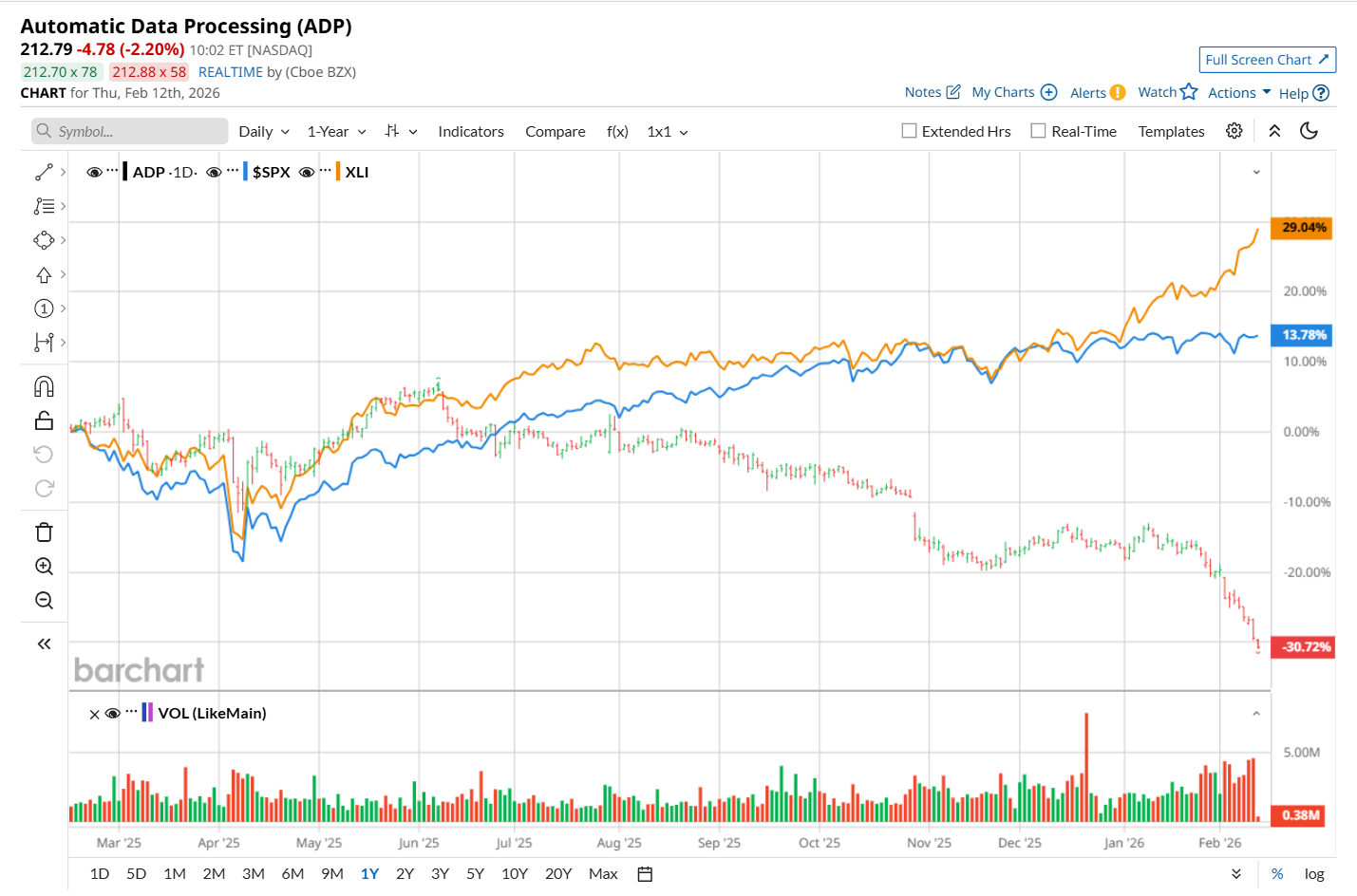

This HCM solutions provider has considerably underperformed the broader market over the past 52 weeks. Shares of ADP have declined 29.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.4%. Moreover, on a YTD basis, the stock is down 16%, compared to SPX’s 1.4% return.

Narrowing the focus, ADP has also notably lagged behind the State Street Industrial Select Sector SPDR ETF (XLI), which surged 28.9% over the past 52 weeks and 14.5% on a YTD basis.

Shares of ADP dipped 1.5% on Jan. 28, after its mixed Q2 earnings release. The company’s total revenue increased 6.2% year-over-year to $5.4 billion, but missed Wall Street expectations by a slight margin, which might have made investors jittery. However, on the upside, its adjusted EPS advanced 11.5% from the year-ago quarter to $2.62, surpassing consensus estimates of $2.58. Moreover, ADP raised its fiscal 2026 revenue and adjusted EPS growth guidance.

For fiscal 2026, ending in June, analysts expect ADP’s EPS to grow 9.5% year-over-year to $10.96. The company’s earnings surprise history is promising. It topped the consensus estimates in each of the last four quarters.

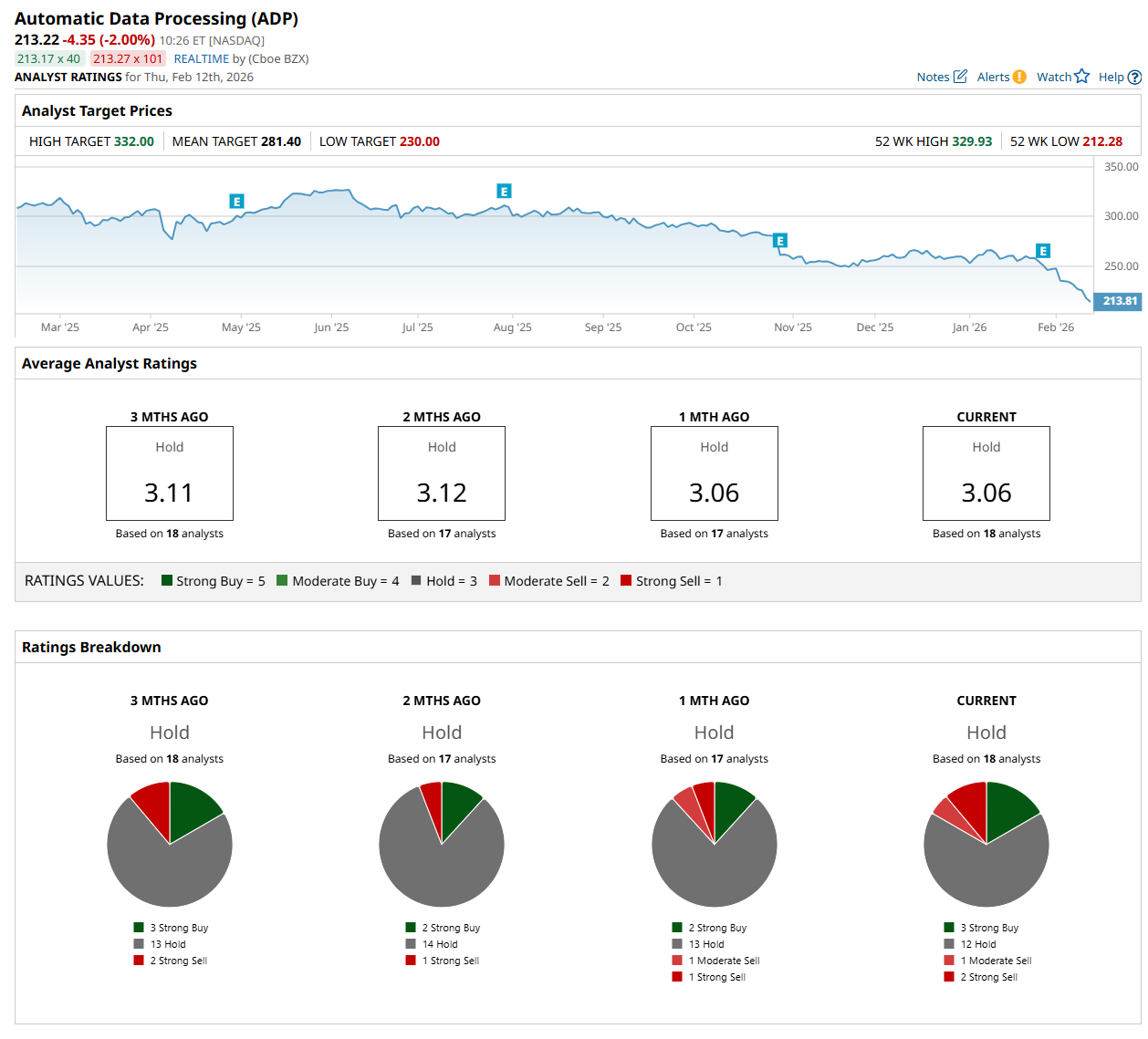

Among the 18 analysts covering the stock, the consensus rating is a "Hold,” which is based on three “Strong Buy,” 12 “Hold,” one "Moderate Sell,” and two “Strong Sell” ratings.

The configuration has changed since a month ago, with two analysts suggesting a “Strong Buy” rating and one recommending a “Strong Sell.”

On Feb. 9, Stifel Financial Corp. (SF) analyst David Grossman maintained a “Hold" rating on ADP and lowered its price target to $270, indicating a 26.6% potential upside from the current levels.

The mean price target of $281.40 represents a 32% premium to its current price, while its Street-high price target of $332 suggests an ambitious 55.7% potential upside from the current levels.