/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)

With a market cap of $3.2 trillion, Apple Inc. (AAPL) is one of the world’s largest technology companies, renowned for its innovative consumer electronics, software, and digital services. Headquartered in Cupertino, California, Apple designs, manufactures, and markets products such as the iPhone, iPad, Mac computers, Apple Watch, and AirPods. Its software ecosystem includes iOS, macOS, watchOS, and services like the App Store, Apple Music, iCloud, and Apple TV+.

Shares of this tech giant have underperformed the broader market over the past year. AAPL has declined 1.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 17.1%. Additionally, in 2025, AAPL stock is down 14.5%, compared to SPX’s 8.6% rise on a YTD basis.

Zooming in further, AAPL has also lagged behind the Technology Select Sector SPDR Fund’s (XLK). The exchange-traded fund has gained about 22.1% over the past year and 13.6% in 2025.

Shares of AAPL surged marginally on Jul. 25 after the company released the beta version of iOS 26, marking the biggest iPhone software update since iOS 7 in 2013.

For the current fiscal year, ending in September, analysts expect AAPL’s EPS to grow 5.3% to $7.11 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

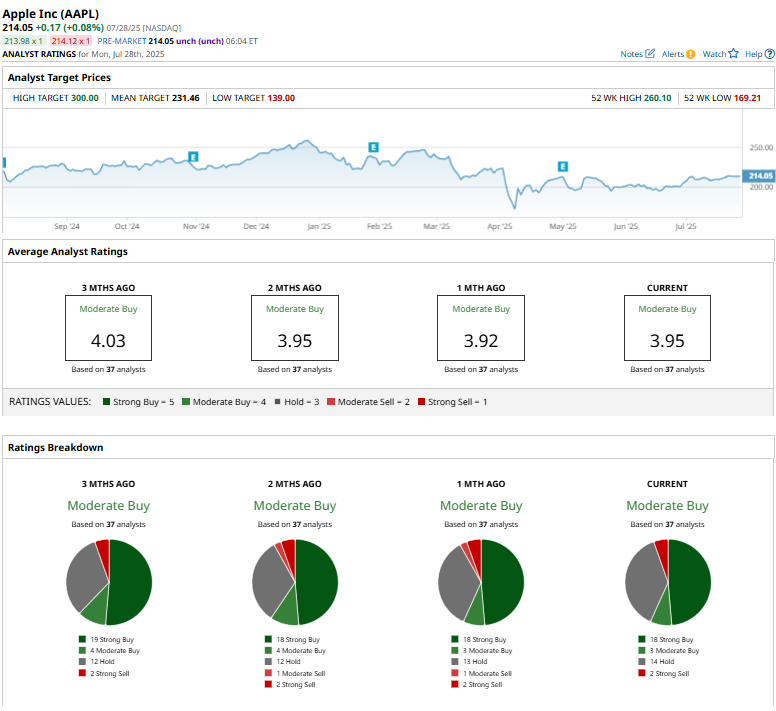

Among the 37 analysts covering AAPL stock, the consensus is a “Moderate Buy.” That’s based on 18 “Strong Buy” ratings, three “Moderate Buys,” 14 “Holds,” and two “Strong Sells.”

This configuration is less bullish than three months ago, with 19 analysts suggesting a “Strong Buy.”

On July 26, JPMorgan Chase & Co. (JPM) lowered its price target for Apple from $240 to $230, citing weaker demand expectations for the iPhone 17 and ongoing macroeconomic uncertainty. While Analyst Samik Chatterjee maintained an “Overweight” rating, he sees reduced volume for the iPhone 17, forecasting 85 million units in 2025, down 9% from the iPhone 16. However, he anticipates a stronger iPhone 18 cycle, potentially featuring a foldable design and enhanced AI features.

The mean price target of $231.46 represents an 8.1% premium to AAPL’s current price levels. The Street-high price target of $300 suggests an ambitious upside potential of 40.2%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.