Valued at $84.5 billion by market cap, Apollo Global Management, Inc. (APO) is a prominent alternative asset manager with over $750 billion in assets under management. Founded in 1990 and based in New York, Apollo specializes in private credit, private equity, and real assets.

While the company has slightly outpaced the broader market over the past year, it has underperformed in 2025. APO stock has soared 18.6% over the past 52 weeks and plunged 11.9% on a YTD basis, compared to the S&P 500 Index’s ($SPX) 17% surge over the past year and 8.2% rise on a YTD basis.

Zooming in further, APO has underperformed the iShares U.S. Financials ETF (IYF), which has gained about 20.8% over the past year and 11.1% in 2025.

Apollo Global’s shares slipped 1.8% on May 2 after posting Q1 results that weighed on investor sentiment. A significant drag came from its Retirement Services unit, which recorded $828 million in investment-related losses, marking a sharp contrast to the $1.7 billion gain reported in the prior-year quarter. As a result, total revenue fell 21.2% year-over-year to $5.5 billion. While adjusted net income rose 5.2% to $1.1 billion, the figure missed Wall Street estimates, contributing to the market’s muted reaction.

For the current FY2025, ending in December, analysts expect Apollo Global Management to deliver adjusted EPS of approximately $7.20, representing around a 9.3% increase year-over-year. However, the firm's track record of meeting expectations has been inconsistent. It has missed the Street's earnings estimates three times over the past four quarters, and only once exceeded them.

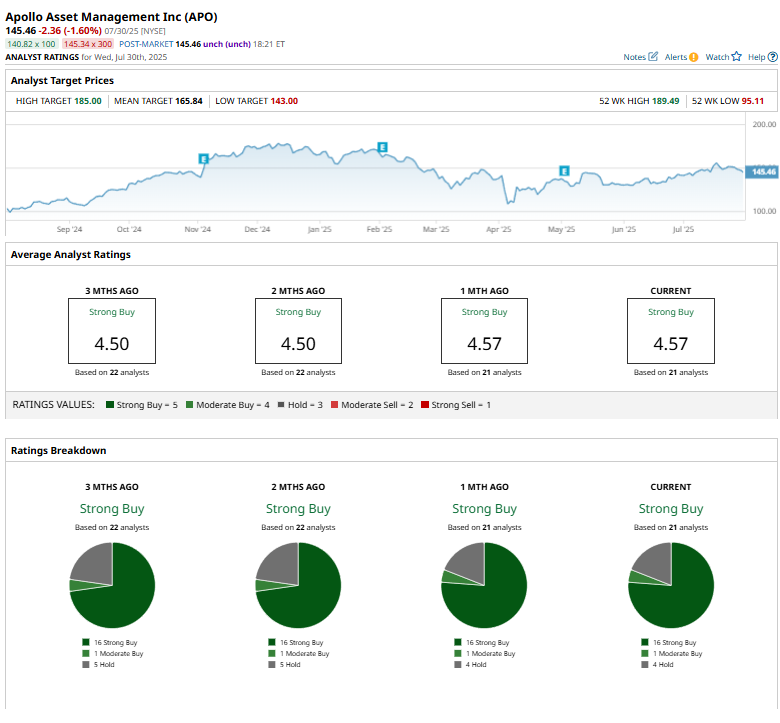

Analysts remain optimistic about the stock’s long-term prospects. APO holds a consensus “Strong Buy” rating overall. Of the 21 analysts covering the stock, opinions include 16 “Strong Buys,” one “Moderate Buy,” and four “Holds.”

On Jul. 12, Wells Fargo analyst Michael Brown reaffirmed a “Buy” rating on Apollo Global Management and raised the price target from $160 to $173, reflecting strong confidence in the stock’s upside potential.

APO’s mean price target of $165.84 indicates a 14% premium to current price levels, while its Street-high target of $185 suggests a staggering 27.2% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.