/Amazon%20-%20Image%20by%20Tada%20Images%20via%20Shutterstock.jpg)

With a market cap of $2.4 trillion, Amazon.com, Inc. (AMZN) is a global technology and e-commerce leader. It operates the world’s largest online marketplace and a dominant cloud computing platform through Amazon Web Services (AWS). The Seattle-based company also has significant businesses in digital advertising, entertainment, logistics, and smart devices, supported by a vast customer ecosystem.

Shares of this e-commerce giant have outperformed the broader market over the past year. AMZN has gained 21.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 18.3%. However, momentum has cooled in 2025 as AMZN is up 4.5% year-to-date, trailing the SPX’s 17.2% rise.

Narrowing the focus, AMZN has lagged behind the ProShares Online Retail ETF (ONLN). The exchange-traded fund has gained 40.6% over the past year. Moreover, the ETF’s 38.8% gains on a YTD basis outshine the stock’s single-digit returns over the same time frame.

On Oct. 28, Amazon shares rose 1% after the company announced plans to cut roughly 14,000 corporate jobs, aiming to redirect resources toward artificial intelligence investments while reducing costs.

For the current fiscal year, ending in December, analysts expect AMZN’s EPS to grow 23.7% to $6.84 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

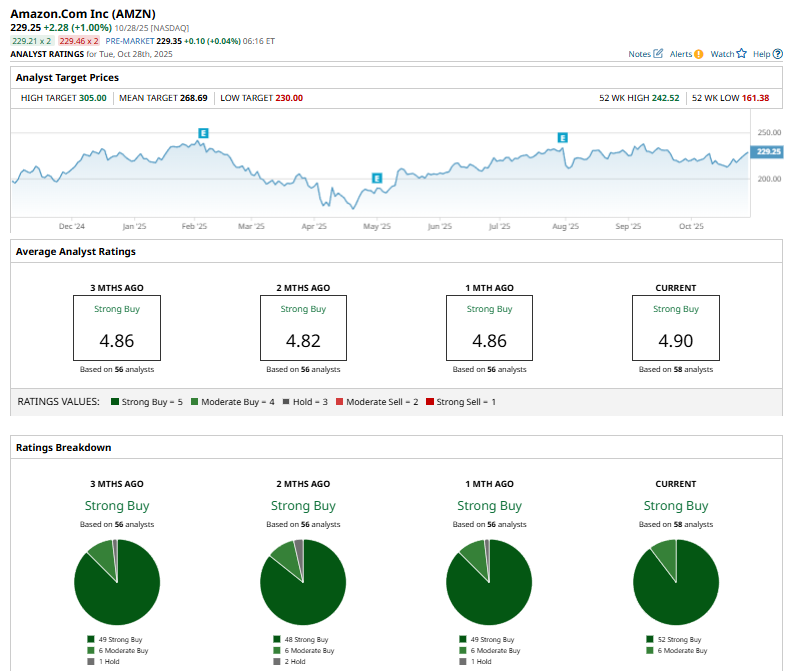

Among the 58 analysts covering AMZN stock, the consensus is a “Strong Buy.” That’s based on 52 “Strong Buy” ratings, and six “Moderate Buys.”

This configuration is more bullish than a month ago, with 49 analysts suggesting a “Strong Buy.”

On Oct. 28, UBS raised its price target on Amazon to $279 from $271 while reiterating its “Buy” rating ahead of the company’s Q3 earnings. The move reflects updated valuation assumptions as Amazon continues to show solid momentum.

The mean price target of $268.69 represents a 17.2% premium to AMZN’s current price levels. The Street-high price target of $305 suggests an ambitious upside potential of 33%.