/Verisk%20Analytics%20Inc%20office%20building-by%20JHVEPhoto%20via%20iStock.jpg)

Verisk Analytics, Inc. (VRSK) is a leading Jersey City–based data analytics company specializing in risk assessment for insurance, energy, and financial services. With a market cap of $37.9 billion, the company offers data, statistical, and actuarial services, as well as standardized insurance policy programs, underwriting information, and rating-integrity tools.

VRSK shares have lagged behind the broader market over the past year. VRSK has gained marginally over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, VRSK’s stock dipped 1.7%, trailing the SPX’s 8.7% rise on a YTD basis.

Zooming in further, VRSK has also underperformed the iShares U.S. Industrials ETF’s (IYJ) 14.5% rise over the past year and 10% gain in 2025.

On July 30, Verisk Analytics reported strong Q2 results, with revenue rising 7.8% year-over-year to $773 million (7.9% organic constant currency), driven by solid growth in underwriting and claims solutions. However, its shares tumbled 6.3% as net income declined 17.7% to $253 million due to prior-year one-time gains. Its adjusted EPS grew 8% to $1.88.

For the current fiscal year, ending in December, analysts expect VRSK’s EPS to grow 5% to $6.97 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

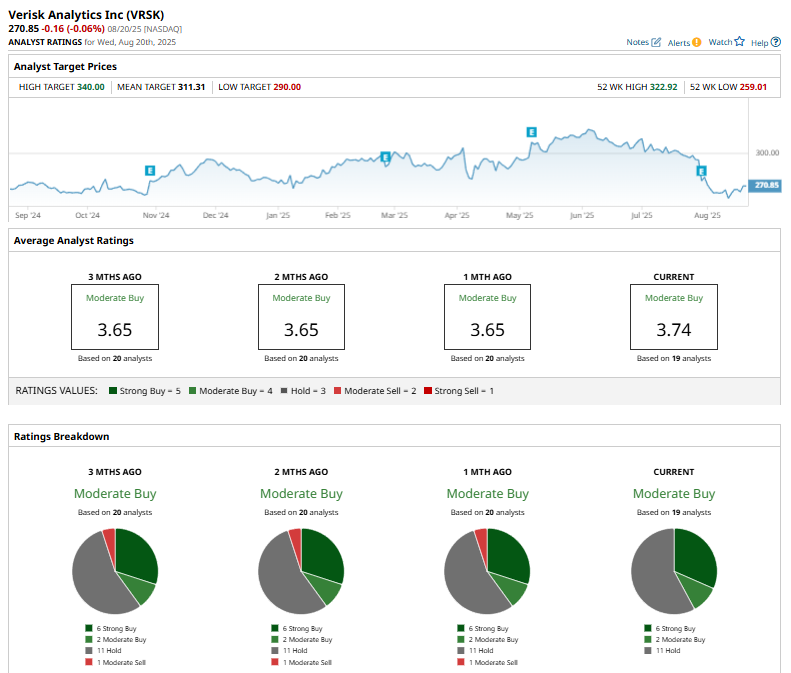

Among the 19 analysts covering VRSK stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, two “Moderate Buys,” and 11 “Holds.”

On August 4, Raymond James analyst C. Gregory Peters maintained an “Outperform” rating on Verisk Analytics but trimmed the price target to $315 from $325, a 3.08% reduction.

The mean price target of $311.31 represents a 14.9% premium to VRSK’s current price levels. The Street-high price target of $340 suggests an upside potential of 25.5%.