/Truist%20Financial%20Corporation%20branch%20photo-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Truist Financial Corporation (TFC), headquartered in Charlotte, North Carolina, is a leading financial services provider specializing in banking and trust services. Valued at $65.1 billion by market cap, the company provides a diverse array of services, encompassing retail, small business, and commercial banking, asset management, capital markets, commercial real estate, corporate and institutional banking, insurance, mortgage, payments, and specialized lending and wealth management solutions.

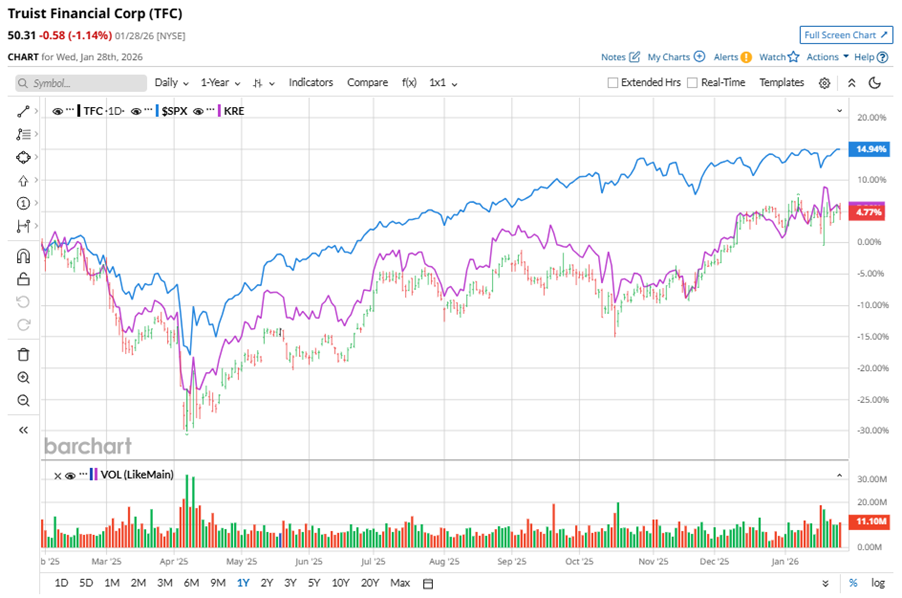

Shares of this leading commercial bank have underperformed the broader market over the past year. TFC has gained 6.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 15%. However, in 2026, TFC stock is up 2.2%, surpassing the SPX’s 1.9% rise on a YTD basis.

Narrowing the focus, TFC’s trajectory mirrors the SPDR S&P Regional Banking ETF (KRE). The exchange-traded fund has gained about 6.4% over the past year. Meanwhile, the ETF’s 4.6% gains on a YTD basis outshine the stock’s returns over the same time frame.

On Jan. 21, TFC shares closed up by 1.8% after reporting its Q4 results. Its revenue was $5.25 billion, missing analyst estimates by 1.3%. The company’s EPS of $1 beat analyst expectations of $1.09.

For the current fiscal year, ending in December, analysts expect TFC’s EPS to grow 13.4% to $4.48 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

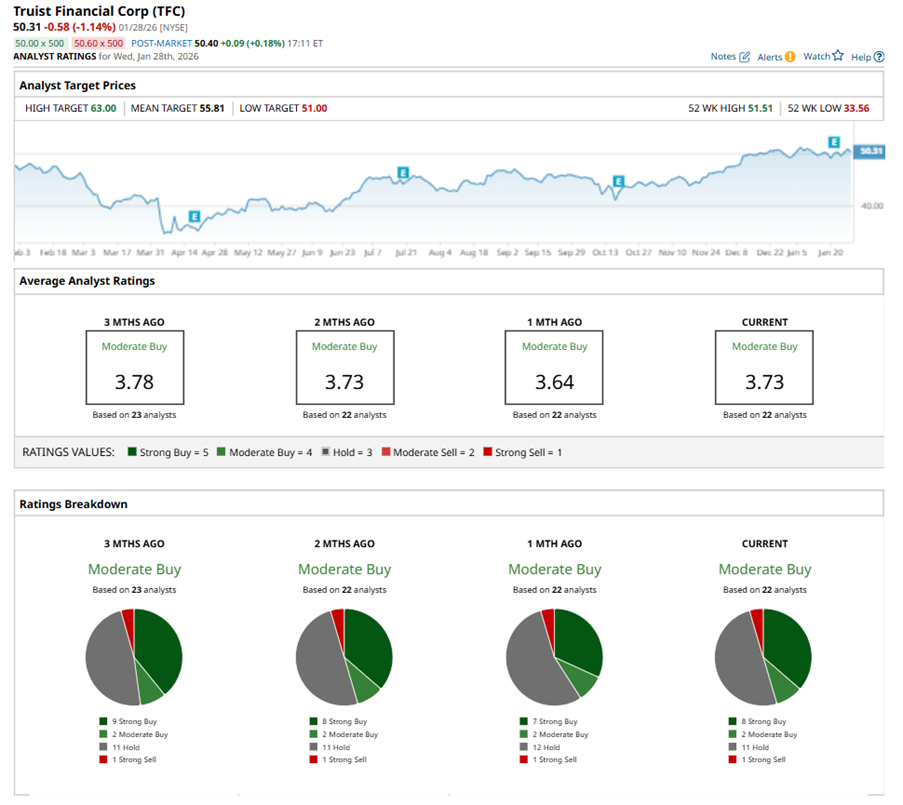

Among the 22 analysts covering TFC stock, the consensus is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buys,” 11 “Holds,” and one “Strong Sell.”

This configuration is more bullish than a month ago, with seven analysts suggesting a “Strong Buy.”

On Jan. 23, Argus kept a “Buy” rating on TFC and raised the price target to $58, implying a potential upside of 15.3% from current levels.

The mean price target of $55.81 represents a 10.9% premium to TFC’s current price levels. The Street-high price target of $63 suggests an upside potential of 25.2%.