The Trade Desk, Inc. (TTD), headquartered in Ventura, California, operates as a technology company. Valued at $26 billion by market cap, the company offers a self-service cloud-based ad-buying platform that enables buyers to plan, manage, optimize, and measure data-driven digital advertising campaigns.

Shares of this leading independent demand-side platform have considerably underperformed the broader market over the past year. TTD has declined 48.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. In 2025, TTD’s stock plummeted 54.7%, compared to the SPX’s 10% rise on a YTD basis.

Narrowing the focus, TTD has also lagged behind the Invesco AI and Next Gen Software ETF (IGPT). The exchange-traded fund has gained about 13.6% over the past year. Moreover, the ETF’s 12% gains on a YTD basis outshine the stock’s losses over the same time frame.

TTD's underperformance can be attributed to the ongoing battle between its open-internet model and the Walled Garden model. The company's slower growth compared to Meta Platforms, Inc. (META) in Q2 suggests that its open-internet approach may be facing challenges, leading to increased uncertainty about its long-term viability.

On Aug. 7, TTD reported its Q2 results, and its shares tumbled 38.6% in the following trading session. Its adjusted EPS of $0.41 did not meet Wall Street expectations of $0.42. The company’s revenue was $694 million, beating Wall Street forecasts of $684.5 million. For Q3, TTD expects revenue to be $717 million.

For the current fiscal year, ending in December, analysts expect TTD’s EPS to grow 23.1% to $0.96 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

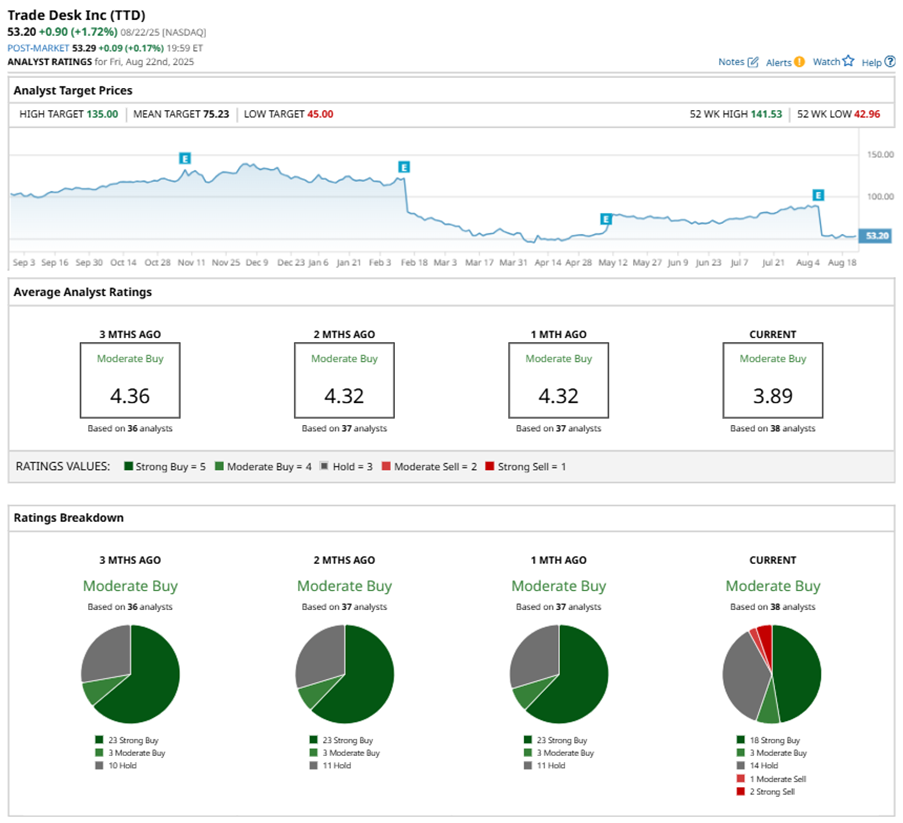

Among the 38 analysts covering TTD stock, the consensus is a “Moderate Buy.” That’s based on 18 “Strong Buy” ratings, three “Moderate Buys,” 14 “Holds,” one “Moderate Sell,” and two “Strong Sells.”

This configuration is less bullish than a month ago, with 23 analysts suggesting a “Strong Buy.”

On Aug. 15, UBS kept a “Buy” rating on TTD and lowered the price target to $80, implying a potential upside of 50.4% from current levels.

The mean price target of $75.23 represents a 41.4% premium to TTD’s current price levels. The Street-high price target of $135 suggests an ambitious upside potential of 153.8%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.