/Paycom%20Software%20Inc%20logo%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $13.1 billion, Paycom Software, Inc. (PAYC) provides cloud-based human capital management (HCM) solutions delivered as software-as-a-service. Its platform streamlines the entire employee lifecycle from recruitment to retirement through integrated applications for payroll, talent acquisition, HR management, time tracking, and compliance.

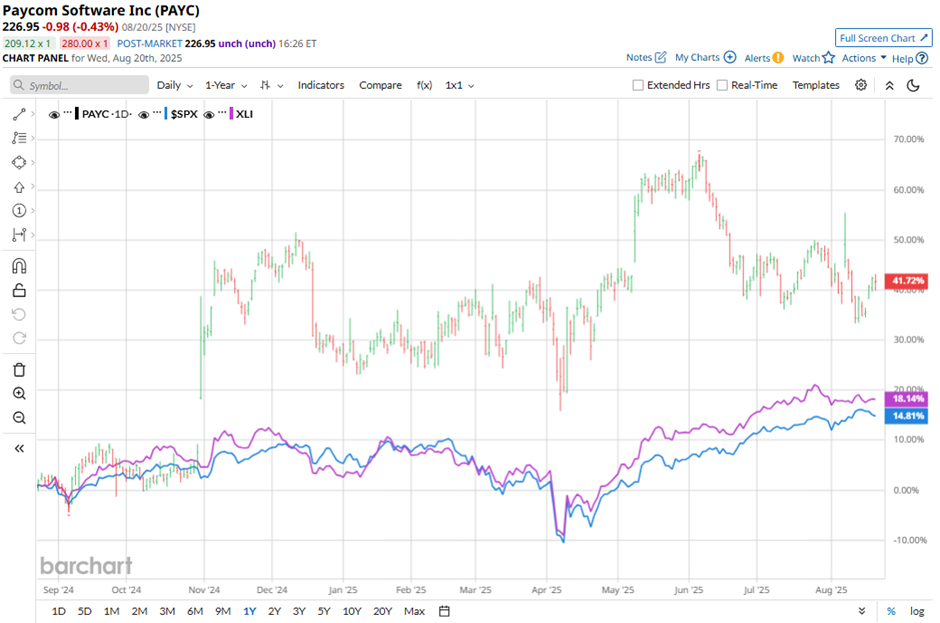

Shares of the Oklahoma City, Oklahoma-based company have outperformed the broader market over the past 52 weeks. PAYC stock has climbed 43.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. Moreover, shares of Paycom Software are up 10.7% on a YTD basis, compared to SPX’s 8.7% gain.

Focusing more closely, shares of the human-resources and payroll software maker have also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 18.7% return over the past 52 weeks.

Shares of Paycom soared 4.5% following its Q2 2025 results on Aug. 6, with adjusted EPS of $2.06 and revenue of $483.6 million, surpassing the forecasts. The company raised its full-year revenue outlook to $2.05 billion - $2.06 billion and boosted its core profit forecast to $872 million - $882 million. Investor optimism was further fueled by strong demand driven by Paycom’s new AI-powered features, which automate HR tasks and enhance employee management capabilities.

For the fiscal year, ending in December 2025, analysts expect PAYC’s EPS to decrease 12.3% year-over-year to $7.56. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

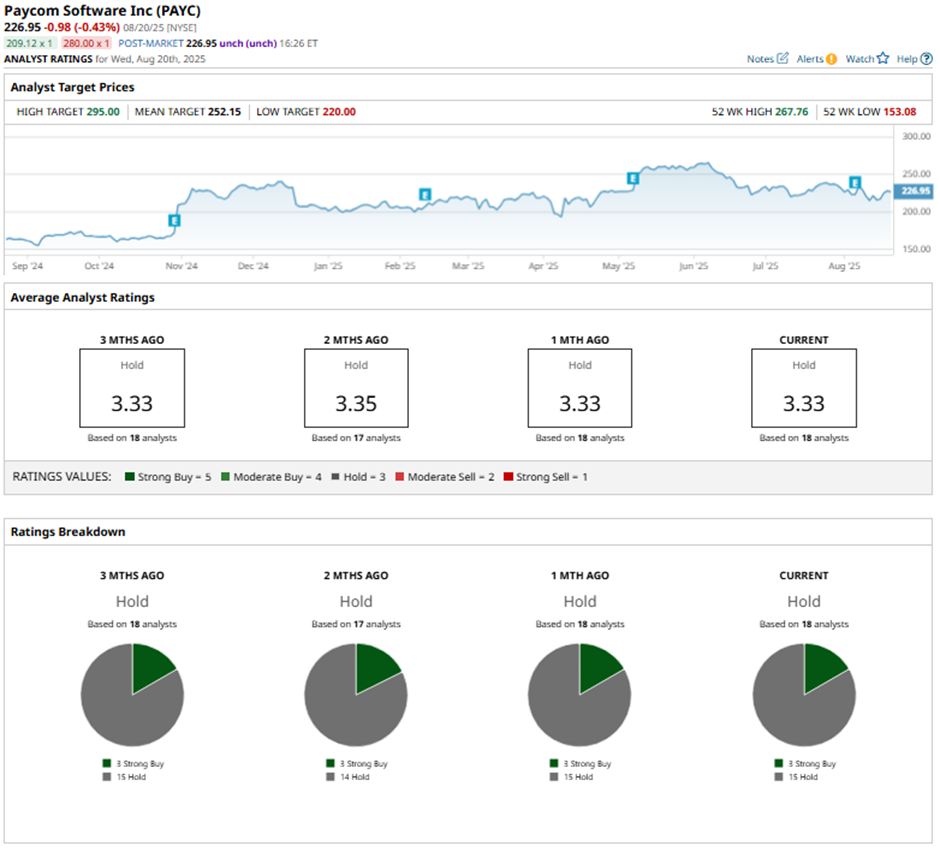

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings and 15 “Holds.”

On Aug. 7, BMO Capital raised Paycom’s price target to $258 with a “Market Perform" rating, citing the company’s Q2 beat-and-raise results and the upcoming launch of its AI search engine, IWant.

The mean price target of $252.15 represents a 11.1% premium to PAYC’s current price levels. The Street-high price target of $295 suggests a nearly 30% potential upside.

.png?w=600)