New York-based Omnicom Group Inc. (OMC) offers advertising, marketing, and corporate communications services. With a market cap of $14.8 billion, the company’s agencies, which operate in major markets around the world, provide a comprehensive range of services including traditional media advertising, customer relationship management (CRM), public relations, and specialty communications.

Shares of this global leader in marketing communications have underperformed the broader market over the past year. OMC has declined 19.9% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. In 2025, OMC stock is down 9.7%, compared to the SPX’s 9% rise on a YTD basis.

Narrowing the focus, OMC’s underperformance is also apparent compared to the Communication Services Select Sector SPDR ETF (XLC). The exchange-traded fund has gained about 26.3% over the past year. Moreover, the ETF’s 13.8% returns on a YTD basis outshine the stock’s single-digit losses over the same time frame.

On Jul. 15, OMC shares closed down by 2.6% after reporting its Q2 results. Its revenue stood at $4 billion, up 4.2% year over year. The company’s adjusted EPS increased 5.1% year over year to $2.05.

For the current fiscal year, ending in December, analysts expect OMC’s EPS to grow 5.2% to $8.48 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

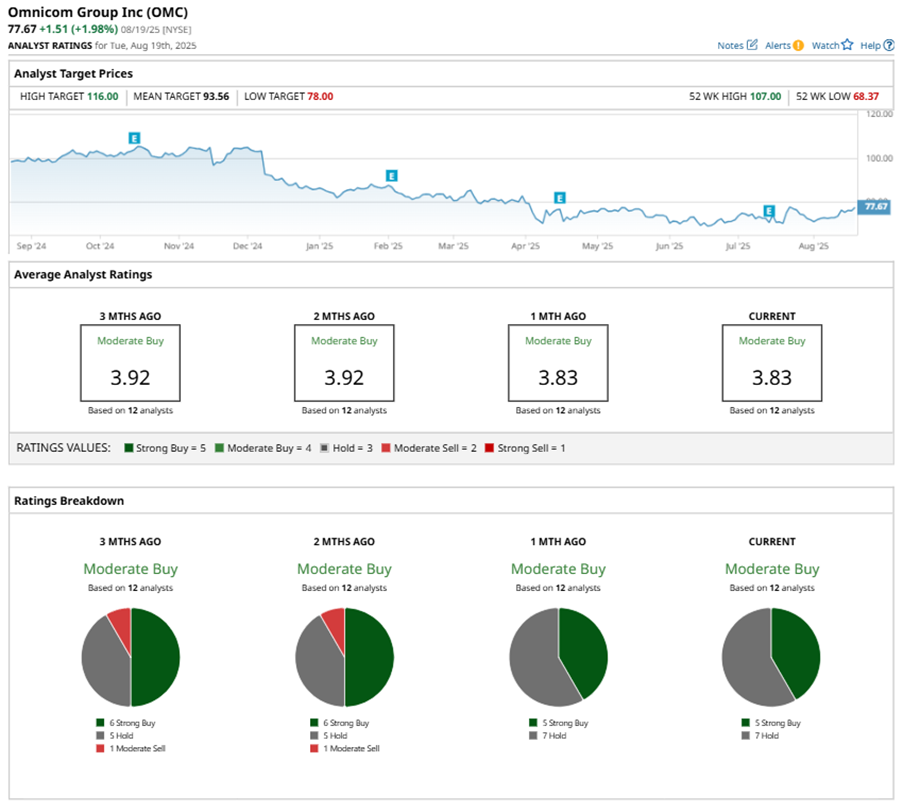

Among the 12 analysts covering OMC stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, and seven “Holds.”

This configuration is less bullish than two months ago, with six analysts suggesting a “Strong Buy,” and one recommending a “Moderate Sell.”

On Jul. 17, Julien Roch from Barclays PLC (BCS) maintained a “Hold” rating on OMC with a price target of $80, implying a potential upside of 3% from current levels.

The mean price target of $93.56 represents a 20.5% premium to OMC’s current price levels. The Street-high price target of $116 suggests an ambitious upside potential of 49.3%.