Denver, Colorado-based Newmont Corporation (NEM) is a mining company. It produces and explores gold, copper, silver, zinc, and lead with a primary focus on gold. With a market cap of $94.4 billion, Newmont’s operations span the Americas, Caribbean, Africa, and the Indo-Pacific.

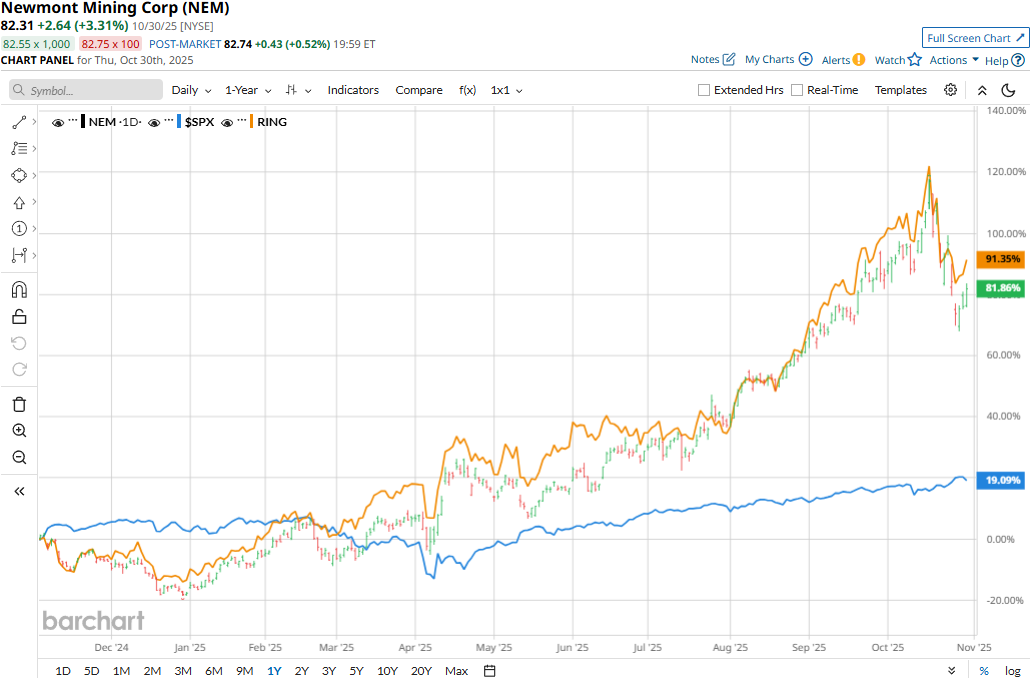

The mining giant has significantly outperformed the broader market over the past year and in 2025. NEM stock has soared 121.1% in 2025 and 75.4% over the past 52 weeks, outpacing the S&P 500 Index’s ($SPX) 16% gains on a YTD basis and 17.4% returns over the past year.

Narrowing the focus, Newmont has slightly lagged behind the industry-focused iShares Global Gold Miners ETF’s (RING) 121.2% surge in 2025 and 83.8% returns over the past year.

Despite delivering better-than-expected results, Newmont’s stock prices dropped 6.2% in the trading session following the release of its Q3 results on Oct. 23. Continuing its solid momentum in the quarter, Newmont’s sales for the quarter jumped nearly 20% year-over-year to $5.5 billion, beating the consensus estimates by 11.1%. Further, its adjusted EPS soared 111.1% year-over-year to $1.71, surpassing the Street’s expectations by 32.6%. Moreover, Newmont generated $1.6 billion in free cash flows, marking Q3 as the fourth consecutive quarter of over $1 billion in free cash flows.

These results were supported by 1.4 million gold ounces production during the quarter, coupled with sky-high gold prices. However, the recent cold down in gold prices since Oct. 21 has raised concerns among investors regarding the sustainability of these financials. Moreover, a further drop in gold prices can significantly hamper Newmont’s Q4 results.

For the full fiscal 2025, ending in December, analysts expect NEM to deliver an adjusted EPS of $5.75, up 65.2% year-over-year. The company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

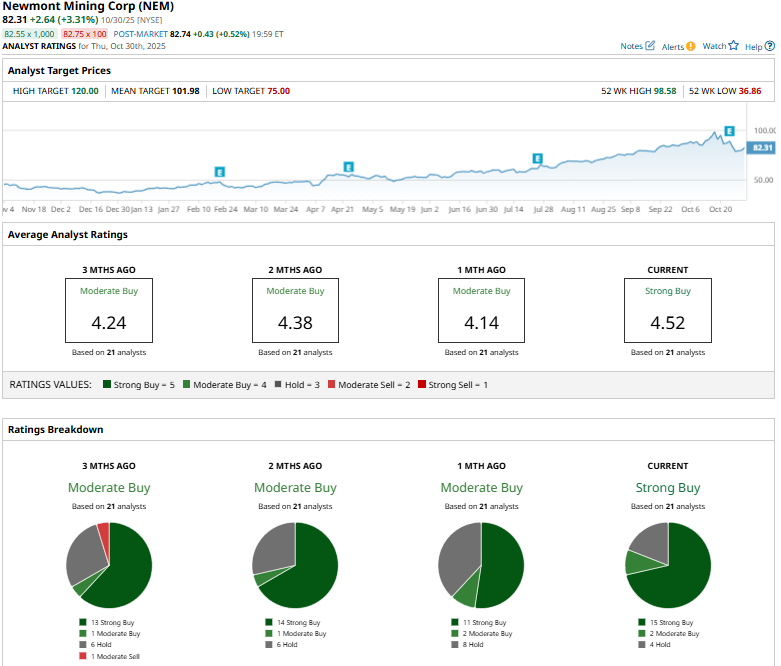

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 15 “Strong Buys,” two “Moderate Buys,” and four “Holds.”

This configuration is notably more optimistic than a month ago, when only 11 analysts gave “Strong Buy” recommendations.

On Oct. 16, UBS (UBS) analyst Daniel Major maintained a “Buy” rating on Newmont and raised the price target from $92 to $105.50.

Newmont’s mean price target of $101.98 suggests a 23.9% upside potential. Meanwhile, the street-high target of $120 represents a 45.8% premium to current price levels.