Headquartered in Raleigh, North Carolina, Martin Marietta Materials, Inc. (MLM) is a natural resource-based building materials company that supplies aggregates and heavy-side building materials to the construction industry. Valued at a market cap of $37.2 billion, the company’s core products include crushed stone, sand, gravel, cement, ready-mixed concrete, asphalt, and paving services.

Shares of this building materials company have lagged behind the broader market over the past 52 weeks. MLM has surged 13.5% over this time frame, while the broader S&P 500 Index ($SPX) has gained 15.1%. Nonetheless, on a YTD basis, the stock is up 19.5%, outperforming SPX’s 9.9% rise.

Narrowing the focus, MLM has underperformed the Invesco Building & Construction ETF’s (PKB) 25.7% returns over the past 52 weeks and 22.4% rise on a YTD basis.

On Aug. 7, Martin Marietta Materials reported strong Q2 results, driving a 1.8% share gain in the following trading session. Revenue rose 3% to $1.81 billion, while net earnings surged 14% to $5.43 per share. For FY2025, Martin Marietta Materials expects revenue between $6.82 billion and $7.12 billion, net earnings of $1.10 billion to $1.19 billion, and Adjusted EBITDA of $2.25 billion to $2.35 billion.

For the current fiscal year, ending in December, analysts expect MLM’s EPS to decline 42% year over year to $18.81. The company’s earnings surprise history is mixed. It missed the consensus estimates in two of the last four quarters, while surpassing on two other occasions.

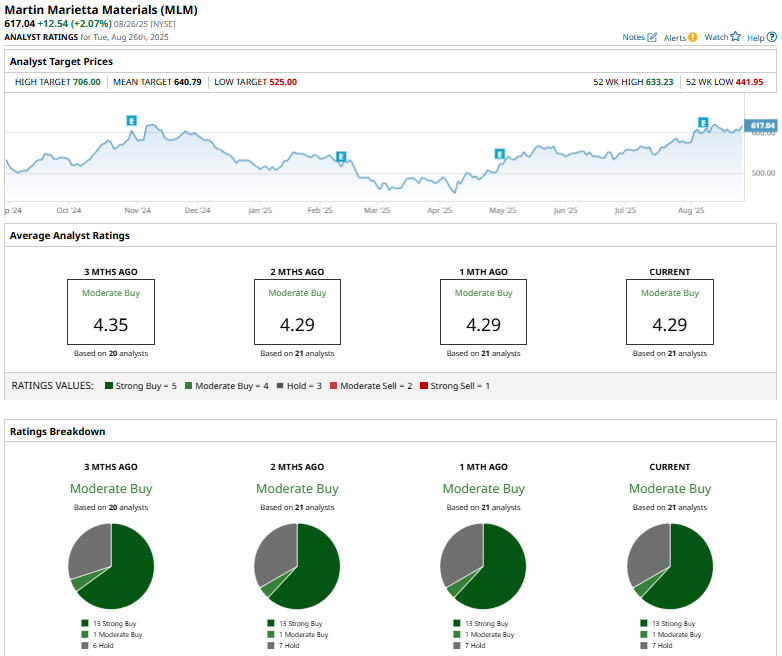

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy,” which is based on 13 “Strong Buy,” one “Moderate Buy,” and seven “Hold” ratings.

On August 12, Stifel analyst Brian Brophy reiterated a “Buy” rating on Martin Marietta Materials, and raised the price target from $609 to $637, a 4.6% increase, signaling ongoing confidence in the stock’s growth potential.

The mean price target of $640.79 represents a 3.8% premium from MLM’s current price levels, while the Street-high price target of $706 suggests an upside potential of 14.4%.