/Marriott%20International%2C%20Inc_%20JW%20Marriott%20at%20night%20by-%20Robert%20Way%20via%20iStock.jpg)

Valued at $71.2 billion by market cap, Marriott International, Inc. (MAR) is a leading global hospitality company operating over 9,000 properties across more than 37 brands, including The Ritz-Carlton, Sheraton, and Westin. Headquartered in Bethesda, Maryland, Marriott franchises, manages, and licenses hotels, resorts, and timeshare properties worldwide and is part of both the S&P 500 and Nasdaq-100.

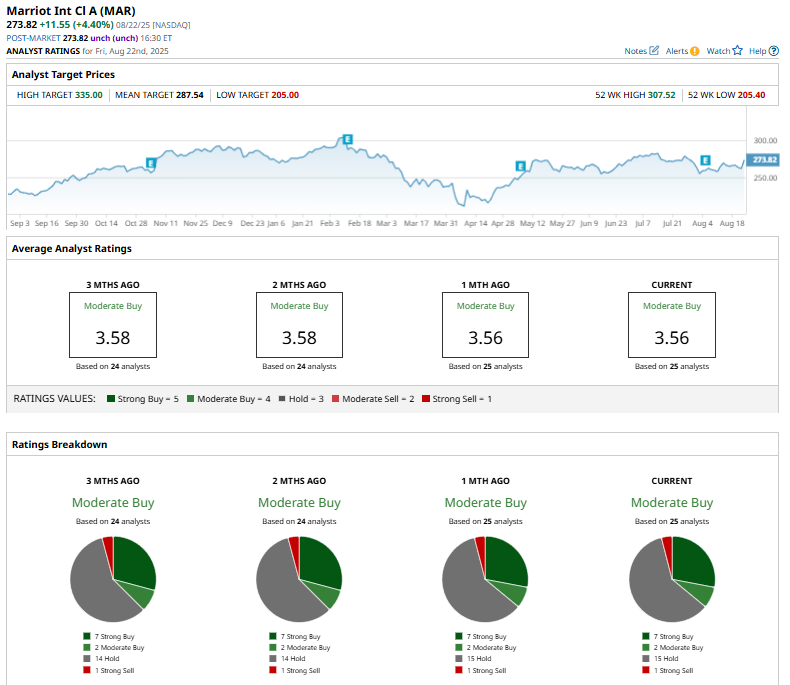

Shares of MAR have outperformed the broader market over the past year. MAR has surged 22.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 16.1%. However, in 2025, MAR stock is down 10%, compared to SPX’s 10% rise on a YTD basis.

Narrowing the focus, MAR has underperformed the AdvisorShares Hotel ETF’s (BEDZ) 24.9% rise over the past year and 4.2% rise in this year.

On Aug. 5, Marriott International posted strong Q2 2025 results, with revenue up 5% year-over-year to $6.74 billion and adjusted EPS of $2.65, topping expectations, while net income slipped slightly to $763 million. Adjusted EBITDA rose 7% as global RevPAR grew 1.5%, driven by international strength offsetting flat U.S. performance.

The company added 17,300 net rooms, grew its pipeline to a record 590,000 rooms, and advanced its portfolio through the Series by Marriott launch and the citizenM acquisition. Despite solid results and $2.1 billion returned to shareholders, Marriott narrowed full-year guidance, now expecting 1.5–2.5% room revenue growth and adjusted EPS of $9.85–10.08 amid softer U.S. demand. MAR shares climbed 1.2% in the next trading session.

For fiscal 2025, ending in December, analysts expect MAR’s EPS to grow 7.3% to $10.01 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing the forecast on another occasion.

Among the 25 analysts covering MAR stock, the consensus is a “Moderate Buy.” That’s based on seven “Strong Buy” ratings, two “Moderate Buy,” 15 “Holds,” and a “Strong Sell.”

This configuration has been consistent over the past months.

On August 20, Baird analyst Michael Bellisario reiterated a “Neutral” rating on Marriott International and raised the price target from $285 to $287, a 0.7% increase.

The mean price target of $287.54 represents a 5% premium to MAR’s current price levels. The Street-high price target of $335 suggests an upside potential of 22%.