With a market cap of $19.2 billion, Invitation Homes Inc. (INVH) is a top real estate investment trust (REIT) that engages in owning, renovating, leasing, and operating single-family residential properties. Based in Dallas, Texas, the company has approximately 85,138 homes for lease, and also manages properties on behalf of others.

Shares of the REIT have lagged behind the broader market over the past 52 weeks. INVH has declined 12.4% over this time frame, while the broader S&P 500 Index ($SPX) has gained 16.6%. Moreover, shares of INVH are down 4.1% on a YTD basis, compared to SPX’s 7.8% rise.

Zooming in further, Invitation Homes has also underperformed the Real Estate Select Sector SPDR Fund’s (XLRE) marginal rise over the past 52 weeks and 1.8% rally in 2025.

On Jul. 30, Invitation Homes posted its second-quarter earnings, and its shares dipped 1.9%. Its revenue rose 4.3% year-over-year to $681 million, driven by a 3.4% rise in rental income and a 39% jump in third-party management fees. Core FFO per share grew 1.7% to $0.48, and AFFO per share increased 3.4% to $0.41. Same-store NOI rose 2.5%, supported by balanced revenue and expense growth.

For the current fiscal year, ending in December 2025, analysts expect INVH's core FFO to remain flat year-over-year to $1.88. However, the company's earnings surprise history is strong. It beat the consensus estimates in the last four quarters.

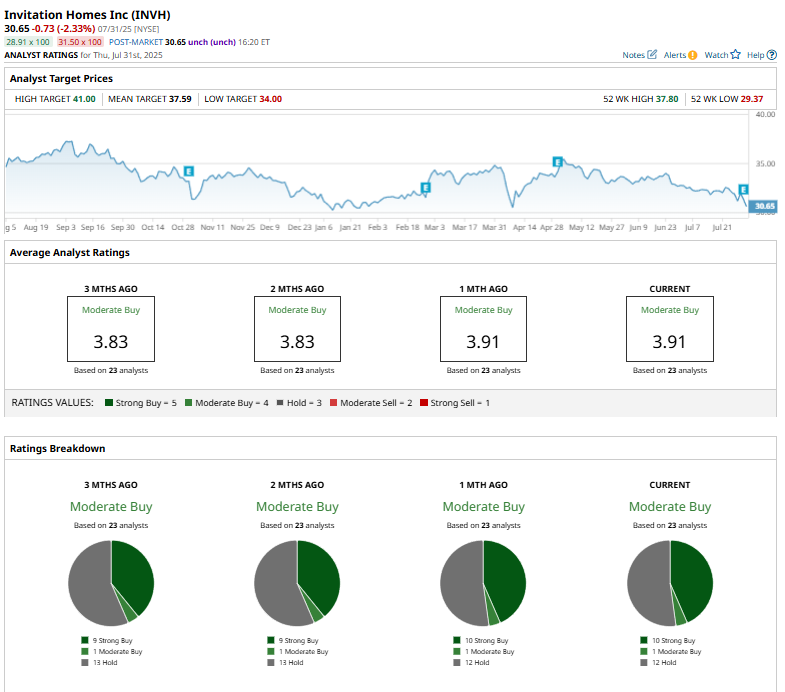

Among the 23 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on ten “Strong Buy” ratings, one “Moderate Buy,” and 12 “Holds.”

This configuration is slightly more bullish than two months ago, with nine “Strong Buy” ratings on the stock.

On June 6, Citi analyst Eric Wolfe upgraded Invitation Homes to “Buy” from “Neutral,” raising the price target from $35 to $38.50.

INVH’s mean price target of $37.59 implies a premium of 22.6% from the current market prices. The Street-high target of $41 suggests a 33.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.