With a market cap of $9.6 billion, The Interpublic Group of Companies, Inc. (IPG) is a global provider of advertising and marketing services. The company operates through three segments: Media, Data & Engagement Solutions; Integrated Advertising & Creativity Led Solutions; and Specialized Communications & Experiential Solutions, serving multinational and local clients worldwide.

Shares of the New York-based company have underperformed the broader market over the past 52 weeks. IPG stock has decreased 14.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 19%. In addition, shares of the company are down 6.5% on a YTD basis, compared to SPX’s nearly 10% rise.

Moreover, the marketing and advertising company stock has lagged behind the Communication Services Select Sector SPDR ETF Fund’s (XLC) 29.6% gain over the past 52 weeks.

Shares of Interpublic Group climbed nearly 7% on Jul. 22 after the company posted Q2 2025 adjusted revenue of $2.2 billion, meeting the estimate, and adjusted EPS of $0.75, topping the forecast. The outperformance was driven by strong spending in its media and healthcare-focused businesses, as well as growth in sports marketing and public relations units. Investor sentiment was further boosted by the company’s expectation to close its $13.25 billion merger with Omnicom in the second half of the year.

For the current fiscal year, ending in December 2025, analysts expect IPG's EPS to grow nearly 4% year-over-year to $2.88. However, the company's earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

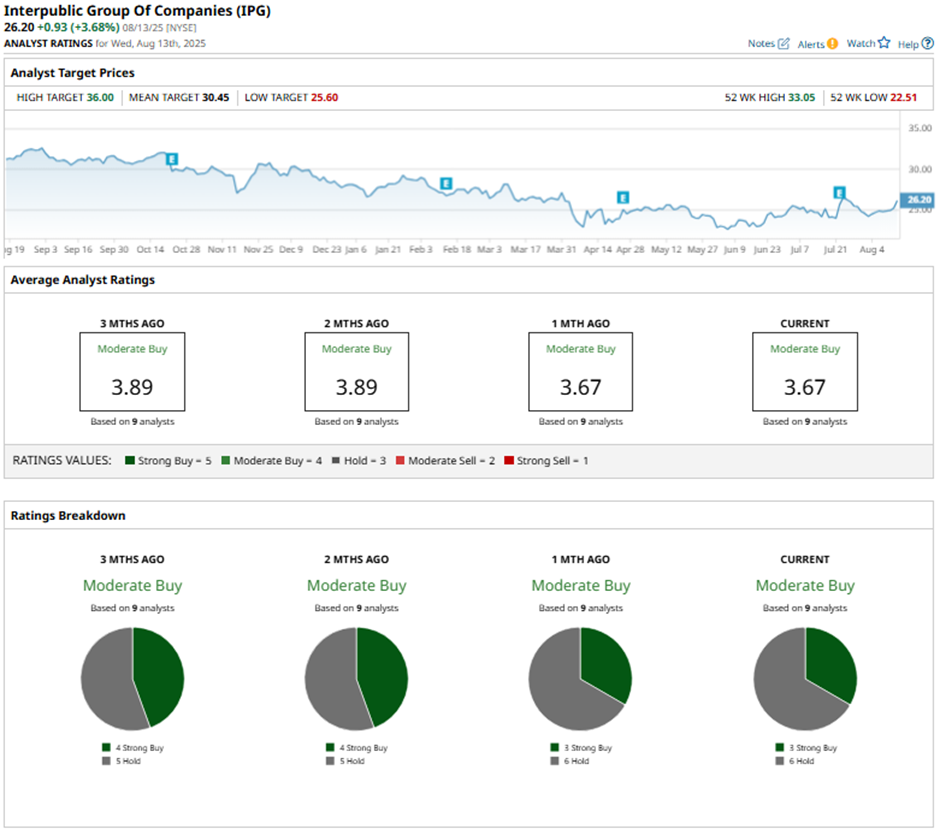

Among the nine analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on three “Strong Buy” ratings and six “Holds.”

This configuration is slightly less bullish than three months ago, with four “Strong Buy” ratings on the stock.

On Jul. 23, UBS lowered Interpublic Group’s price target to $25.60 while maintaining a “Neutral” rating.

As of writing, the stock is trading below the mean price target of $30.45. The Street-high price target of $36 implies a potential upside of 37.4% from the current price levels.