GE Vernova Inc. (GEV) is a leading global energy technology company headquartered in Cambridge, Massachusetts. Formed in 2024, the company is dedicated to advancing electrification and accelerating decarbonization across the global energy landscape. With a current market capitalization of $101.4 billion, GE Vernova is positioned at the forefront of the transition to cleaner, more sustainable energy solutions.

Shares of GE Vernova have delivered exceptional returns, dramatically outperforming the broader market and sector peers over the past year. GEV has surged 300.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 21.5%. Year-to-date, GEV is up 97.5%, compared to a 7.1% rise in the S&P 500.

Even within its sector, GEV stands out, surpassing the Industrial Select Sector SPDR Fund (XLI), which posted a 25.1% return over the past year and a 14.5% gain YTD.

On Jul. 23, GEV shares skyrocketed 14.6% after the company released its fiscal 2025 second-quarter earnings. Its revenue rose 11% year-over-year to $9.1 billion, beating forecasts, and adjusted EBITDA margins reached 8.5%, driven by solid growth in both equipment and services. Orders climbed 4% organically to $12.4 billion, led by a 44% surge in Gas Power, which also saw margin expansion to 16.4%. The company has raised its 2025 free cash flow guidance to $3.0–$3.5 billion and now targets the upper end of its $36–$ 37 billion revenue range.

For the current fiscal year, ending in December 2025, analysts expect GEV’s EPS to grow 235% year-over-year to $8.04. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

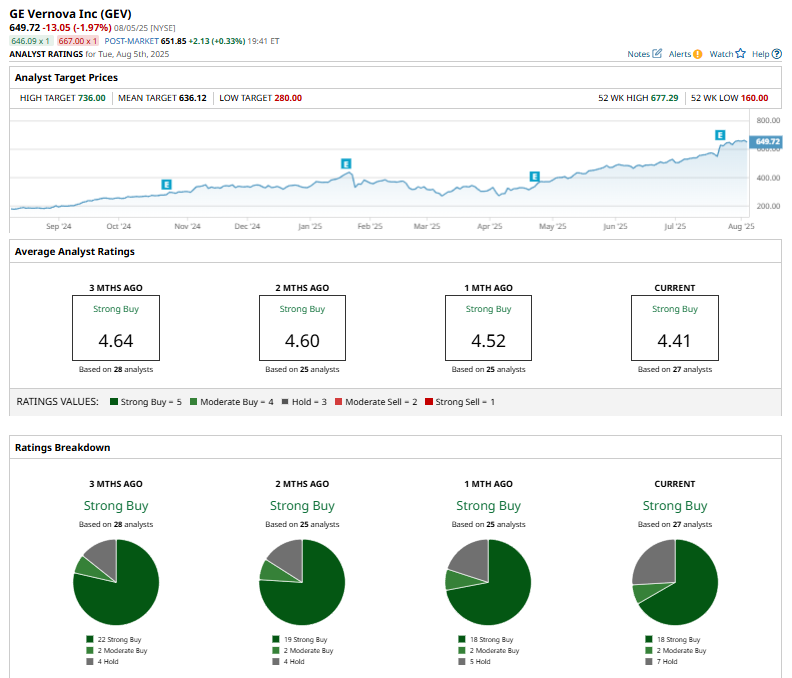

Among the 27 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 18 “Strong Buy” ratings, two “Moderate Buys,” and seven “Holds.”

This configuration is less bullish than two months ago, with 19 “Strong Buy” ratings on the stock.

On July 24, Citigroup Inc. (C) raised its price target on GE Vernova from $544 to $670 while maintaining a “Neutral” rating after the company’s Q2 2025 earnings release.

While GEV currently trades above the mean price target of $636.12, the Street-high price target of $736 implies a potential upside of 13.3% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.