With a market cap of $569.2 billion, Exxon Mobil Corporation (XOM) is a global energy and chemical company engaged in the exploration, production, manufacturing, and sale of crude oil, natural gas, petroleum products, petrochemicals, and specialty products across the United States and internationally. It operates through Upstream, Energy Products, Chemical Products, and Specialty Products segments while also investing in lower-emission solutions such as carbon capture, hydrogen, and sustainable aviation fuel.

Shares of the Spring, Texas-based company have outperformed the broader market over the past 52 weeks. XOM stock has increased 24.1% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.9%. Moreover, shares of Exxon Mobil are up 12.1% on a YTD basis, compared to SPX's 1.5% gain.

Looking closer, shares of the oil and natural gas company have also outpaced the State Street Energy Select Sector SPDR ETF's (XLE) 7.8% rise over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.88, shares of XOM fell marginally on Oct. 31 as the company reported revenue of $85.29 billion, below forecasts. Investors also focused on weakness in key segments, including a $1.4 billion year-over-year decline in Chemical Products earnings and lower base volumes, which overshadowed the positive production and cash-flow headlines.

For the fiscal year that ended in December 2025, analysts expect XOM's adjusted EPS to dip 10.9% year-over-year to $6.94. However, the company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

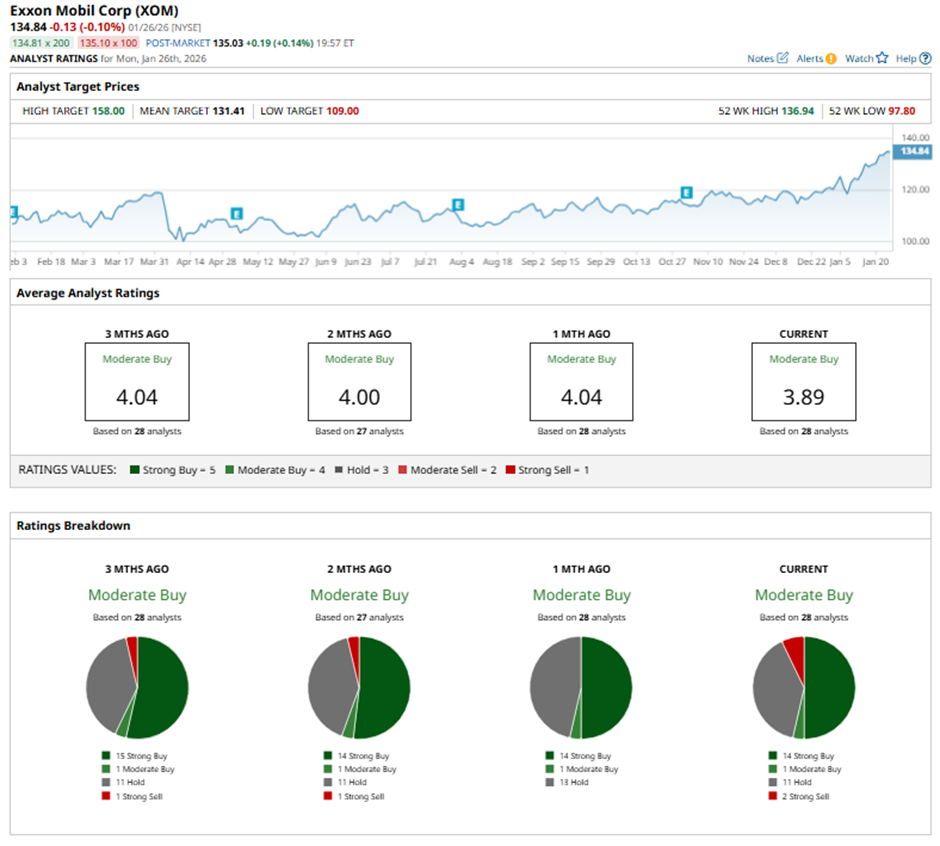

Among the 28 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 14 “Strong Buy” ratings, one “Moderate Buy,” 11 “Holds,” and two “Strong Sells.”

On Jan. 23, Morgan Stanley analyst Devin McDermott cut Exxon Mobil’s price target to $134 while maintaining an “Overweight” rating.

As of writing, the stock is trading above the mean price target of $131.41. The Street-high price target of $158 suggests a 17.2% potential upside.