With a market cap of $16.7 billion, Evergy, Inc. (EVRG) is an energy company that, through its subsidiaries Kansas City Power & Light Company and Westar Energy Inc., generates, transmits, distributes, and sells electricity. Its diverse energy mix includes coal, natural gas, oil, uranium, and renewable sources such as wind, solar, and landfill gas, serving residential, commercial, industrial, and municipal customers.

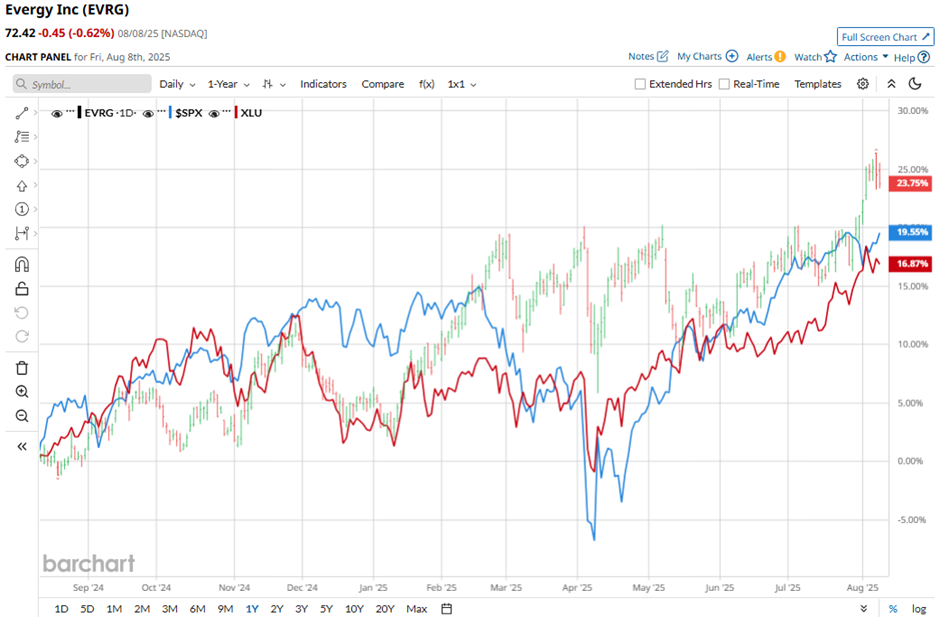

Shares of the Kansas City, Missouri-based company have outperformed the broader market over the past 52 weeks. EVRG stock has returned 22.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 20.1%. Moreover, shares of Evergy are up 17.7% on a YTD basis, compared to SPX's 8.6% gain.

Looking closer, the electric utility stock has also outpaced the Utilities Select Sector SPDR Fund's (XLU) 17.5% rise over the past 52 weeks.

Despite reporting better-than-expected Q2 2025 adjusted EPS of $0.82, Evergy’s shares fell marginally on Aug. 7 due to a 17.2% drop in net income to $171.3 million, driven by higher operating and interest expenses. Weaker power demand from milder weather and a 6.38% decline in retail sales further pressured revenue, which slipped to $1.4 billion.

For the fiscal year ending in December 2025, analysts expect EVRG's adjusted EPS to grow nearly 5% year-over-year to $4. The company's earnings surprise history is mixed. It beat the consensus estimates in two of the last four quarters while missing on two other occasions.

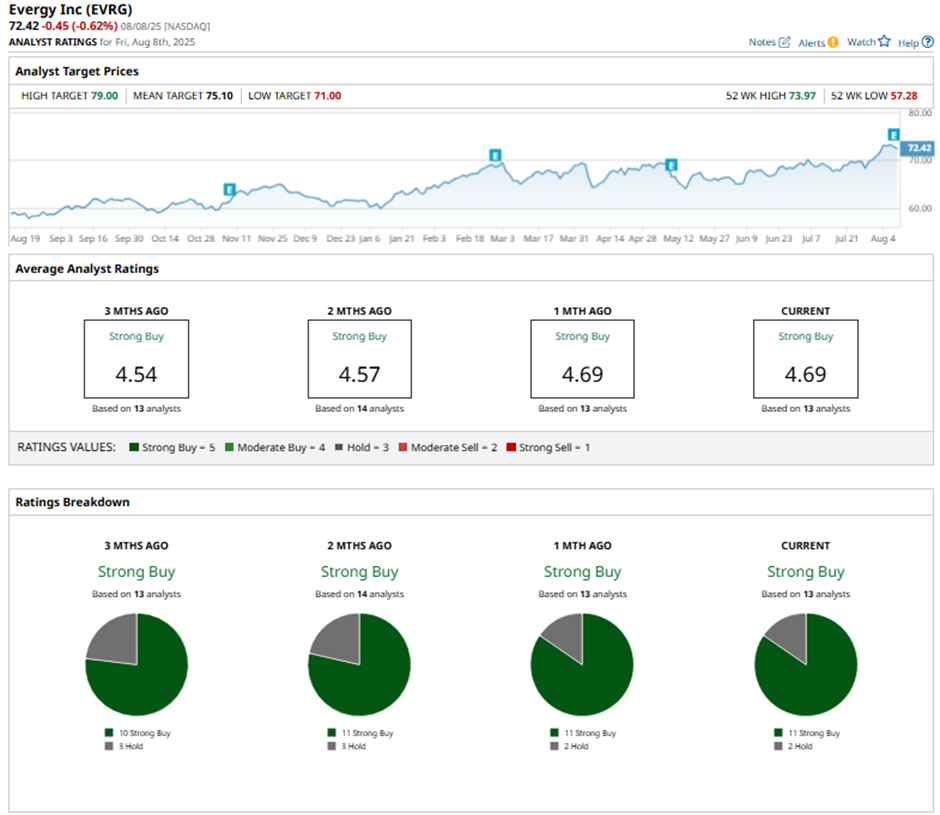

Among the 13 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings and two “Holds.”

This configuration is slightly more bullish than three months ago, with 10 “Strong Buy” ratings on the stock.

On Aug. 8, Mizuho analyst Anthony Crowdell raised Evergy’s price target to $77 and maintained an “Outperform" rating, citing strong large-load customer demand.

As of writing, the stock is trading below the mean price target of $75.10. The Street-high price target of $79 implies a potential upside of 9.1%.