Valued at a market cap of $16.5 billion, Erie Indemnity Company (ERIE) is a U.S.-based insurance services company headquartered in Erie, Pennsylvania. It serves as the managing attorney-in-fact for the Erie Insurance Exchange, which is a reciprocal insurance exchange offering auto, home, business, and life insurance.

Shares of ERIE have underperformed the broader market, plunging 19.8% over the past 52 weeks and 12.5% this year. In contrast, the S&P 500 Index ($SPX) has gained 19.3% over the past year and is up 8.4% in 2025.

Zooming out, ERIE has also lagged behind the SPDR S&P Insurance ETF (KIE). The exchange-traded fund has gained 8.7% over the past 52 weeks and 1.2% on a YTD basis.

On Aug. 7, Erie announced its second-quarter earnings, and its shares rose 1.3% in the following trading session. Its net income rose 6.6% year-over-year to $174.7 million, or $3.34 per share, though slightly below analyst expectations. Revenue grew 7% to $1.06 billion, driven by higher management fees and administrative services revenue, but fell just short of forecasts.

For fiscal 2025, which ends in December, analysts expect Erie Indemnity’s EPS to grow 8.4% to $12.44. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters, while missing in the other two quarters.

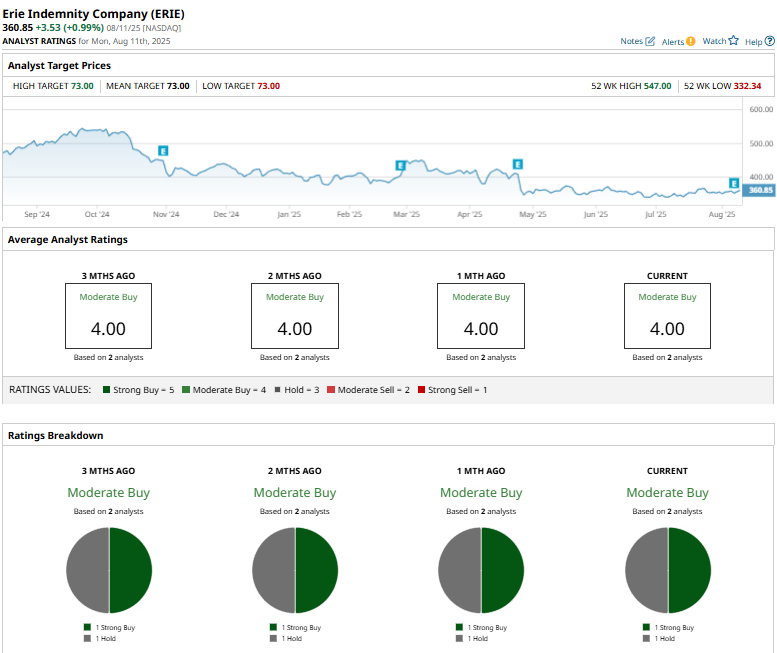

ERIE stock has a consensus “Moderate Buy” rating overall. Of the two analysts covering the stock, one recommends a “Strong Buy,” and one suggests a “Hold” rating.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.