/Delta%20Air%20Lines%2C%20Inc_%20passanger%20plane-by%20viper-zero%20via%20iStock.jpg)

With a market cap of around $35 billion, Delta Air Lines, Inc. (DAL) is one of the four major carriers that dominate over 60% of the U.S. aviation market. Operating primarily through its Airline and Refinery segments, Delta provides domestic and international air transportation for passengers and cargo, supported by a fleet of approximately 1,292 aircraft.

Shares of the Atlanta, Georgia-based company have outperformed the broader market over the past 52 weeks. DAL stock has climbed 23.6% over this time frame, while the broader S&P 500 Index ($SPX) has returned over 18%. However, shares of Delta Air Lines are down 11.7% on a YTD basis, lagging behind SPX’s 9.1% gain.

Focusing more closely, the airline stock has also outpaced the Industrial Select Sector SPDR Fund’s (XLI) 20.9% return over the past 52 weeks.

Shares of Delta Air Lines jumped nearly 12% on Jul. 10 after the company reported better-than-expected Q2 2025 adjusted EPS of $2.10 and revenue of $16.7 billion. Despite flat passenger revenue and a 5% drop in domestic unit revenue, Delta issued a full-year profit forecast of $5.25 per share to $6.25 per share and projected Q3 EPS of $1.25 to $1.75, surpassing the consensus at the high end. The management also cited stabilizing demand, industry capacity cuts to support fares, and strong spending on premium services and co-branded credit cards as drivers of renewed investor confidence.

For the fiscal year ending in December 2025, analysts expect Delta Air Lines’ adjusted EPS to decline nearly 8% year-over-year to $5.67. The company's earnings surprise history is mixed. It topped the consensus estimates in three of the last four quarters while missing on another occasion.

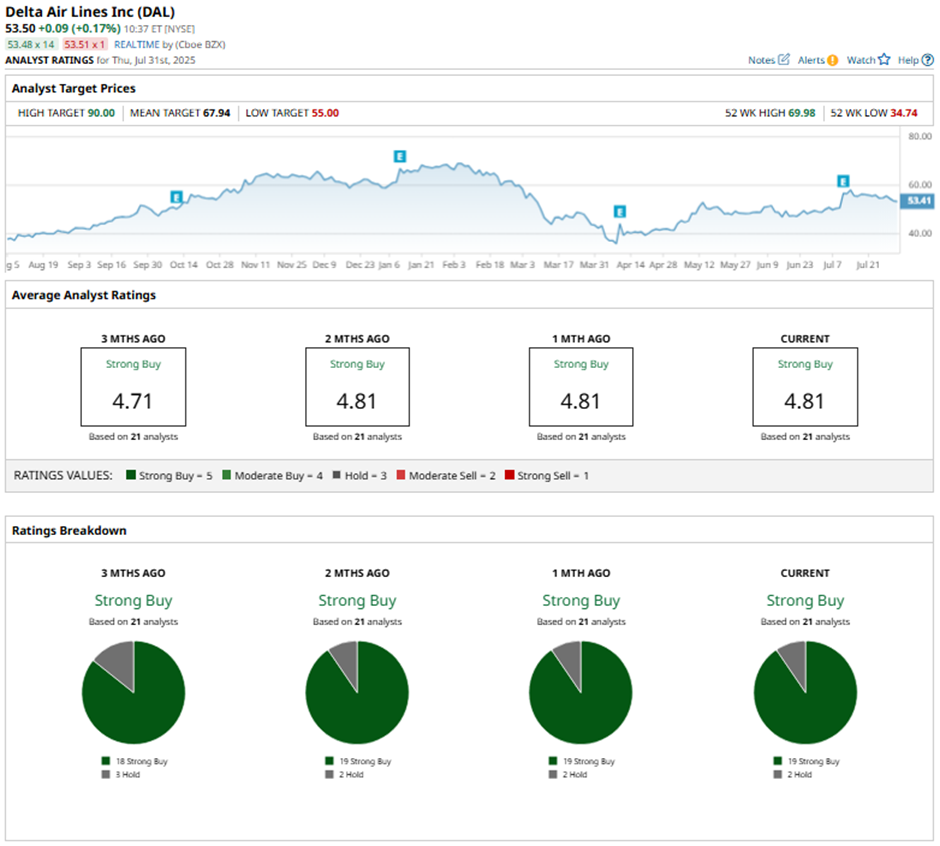

Among the 21 analysts covering the stock, the consensus rating is a “Strong Buy.” That’s based on 19 “Strong Buy” ratings and two “Holds.”

On Jul. 11, Susquehanna analyst Christopher Stathoulopoulos raised Delta Air Lines’ price target to $65 and maintained a “Positive” rating, citing stable demand across consumer and corporate segments and potential upside in unit revenues amid easing domestic capacity and benign inflation risks.

As of writing, the stock is trading below the mean price target of $67.94. The Street-high price target of $90 implies a potential upside of 68.2% from the current price levels.