/CVS%20Health%20Corp%20website-by%20chrisdorney%20via%20Shutterstock.jpg)

With a market cap of $75.4 billion, CVS Health Corporation (CVS) is a leading U.S. healthcare company that operates across multiple segments, including retail pharmacies, pharmacy benefit management (PBM), and health insurance. Headquartered in Rhode Island, CVS owns one of the largest pharmacy chains in the country and also operates MinuteClinic walk-in clinics.

Shares of the retail pharmacy titan have lagged behind the broader market over the past year. CVS stock has declined 2.6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.6%. However, CVS has made a strong comeback in 2025, with its stock soaring 33.7% year-to-date, significantly outpacing the S&P 500’s 8.3% gain over the same period.

Zooming in, CVS’ stock has outperformed the iShares U.S. Healthcare Providers ETF (IHF), which has declined 25.4% over the past year and 12.6% on a YTD basis.

On July 23, CVS Health shares soared 1.3% after the company announced the opening of its new Workforce Innovation and Talent Center (WITC) in Columbus, located at the Rosewind Community Center. In partnership with local organizations, the WITC offers free workforce training and health services, aiming to support careers in pharmacy, customer service, and retail.

For the current fiscal year, ending in December 2025, analysts project CVS’ EPS to grow 12.9% annually to $6.12 on a diluted basis. The company has a good track record of outperforming expectations, having surpassed the consensus estimate in each of the last four quarters.

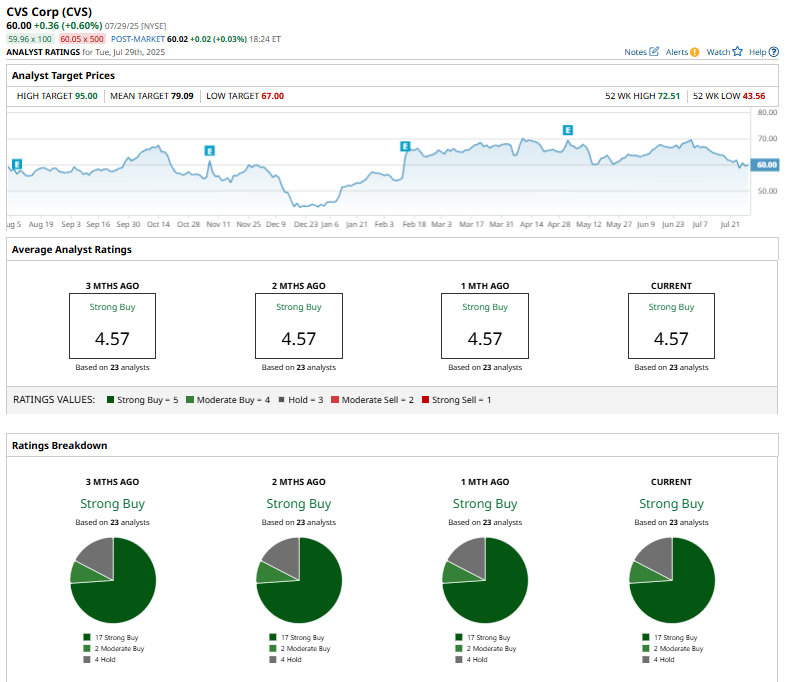

Among the 23 analysts covering CVS stock, the consensus rating is a “Strong Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” and four “Holds.”

This configuration has been consistent over the past months.

On Jul. 22, UBS Group AG (UBS) lowered its price target on CVS Health from $71 to $67 while keeping a “Neutral” rating, citing increased cost pressures in the Health Insurance Exchange and Medicaid segments. Despite these challenges, CVS maintains solid financial health and is considered undervalued, with potential offsets from cost-saving initiatives and acquisitions.

The mean price target of $79.09 represents a 31.8% premium to CVS’ current price levels. The Street-high price target of $95 suggests an upside potential of 58.3%.