/Corning%2C%20Inc_%20logo%20and%20website-by%20T_Schneoder%20via%20Shutterstock.jpg)

Corning Incorporated (GLW) is a leading innovator specializing in glass and ceramics, with operations divided into five core business segments: Display Technologies, Optical Communications, Environmental Technologies, Specialty Materials, and Life Sciences.

The company develops products for markets such as electronics, telecom networks, automotive filtration, advanced optics, and biomedical research, leveraging expertise in materials science and manufacturing to address evolving customer needs worldwide. It has a market capitalization of $74.95 billion.

Strong market sentiments for advanced materials and tech-centric manufacturing have kept Corning’s stock on an upward trend. Over the past 52 weeks, the stock has gained 81.2%, while it is up 86.2% over the past six months. Following its Q3 earnings release on Oct. 28, Corning’s shares reached a 52-week high of $92.57 on Oct. 31, but have since declined about 8% from that level.

Corning’s stock has broadly outperformed the S&P 500 Index ($SPX), which has gained 18.5% over the past 52 weeks and 19.1% over the past six months. Turning our focus to the company’s own tech sector, we see that this electronic components stock has outperformed here as well, while the Technology Select Sector SPDR Fund (XLK) is up 31.4% over the past 52 weeks and 35.7% over the past six months.

On Oct. 28, Corning reported its third-quarter results for fiscal 2025. The company’s net sales increased by 21% year-over-year (YOY) to $4.10 billion. This roughly aligned with the Wall Street analysts’ estimate. Its core sales increased 14% from the prior year’s period to $4.27 billion. Its core EPS growth for the quarter was 24% YOY to $0.67, modestly topping the analyst estimate of $0.66.

Corning also approaches the second anniversary of its “Springboard” growth plan. The company highlighted that, in line with the plan, it has added $4 billion to its annualized sales run rate and now expects to reach its operating margin target of 20% a year ahead in the fourth quarter. For Q4, Corning now expects core sales of about $4.35 billion and core EPS in the range of $0.68 to $0.72.

For the fiscal year 2025, which ends in December 2025, Wall Street analysts expect Corning’s EPS to grow 27.6% YOY to $2.50 on a diluted basis. Moreover, EPS is expected to increase 19.6% annually to $2.99 in fiscal 2026. The company has a solid history of surpassing consensus estimates, topping them in all four trailing quarters.

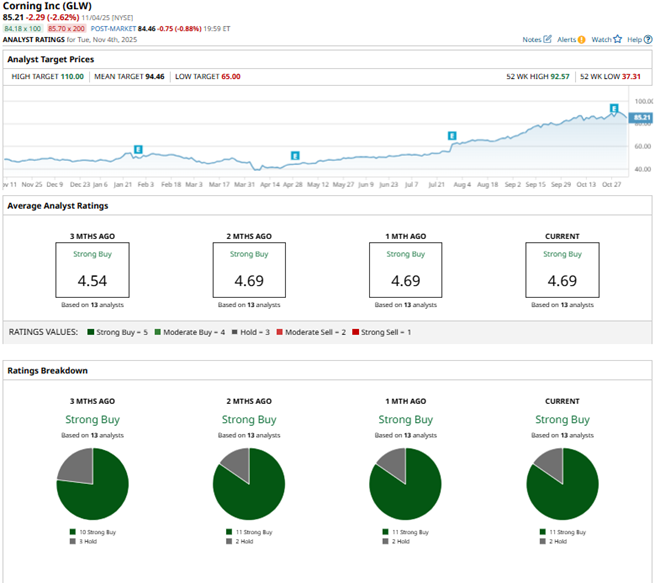

Among the 13 Wall Street analysts covering Corning’s stock, the consensus is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings and two “Holds.” The ratings configuration is more bullish than it was three months ago, with 11 “Strong Buy” ratings now, up from the previous 10.

Last month, analysts at Susquehanna raised the price target on Corning’s stock from $75 to $100, while maintaining a “Positive” rating on its shares, citing increased revenue from Polysilicon, with continued growth in the Fiber business. Reflecting bullish sentiments, JP Morgan analyst Samik Chatterjee raised the price target from $85 to $100, while keeping an “Overweight” rating.

Corning’s mean price target of $94.46 indicates a 10.9% upside over current market prices. The Street-high price target of $110 implies a potential upside of 29.1%.